ESG indexes are only as good as the underlying data used to construct them and are rightly under increasing investor scrutiny.

The number of sustainability-focused index funds and their AUM has doubled over the past three years, according to a report from Morningstar. As of the end of the second quarter 2020, there were 534 index funds focused on sustainability, overseeing a combined $250 billion. Its not that investors are spoilt for choice, it has increased their complexity considerably. Given the lack of a standard definition for sustainability, it increases investors’ due diligence burden and the risk that a fund will not meet their expectations.

Investors are often faced with two broad challenges:

- The credibility and depth of ESG research - that really defines the investment universe

- Sizing of the index - Is it reflective of the goodness of ESG investing or is there a conscious effort to mirror the conventional indices to show size?

Let’s look at each of these in detail to pinpoint the real issues.

Beauty Lies in the Eyes of the Beholder

The ESG indexes can be as good as the underlying data and how well that is used to construct the Index. Depending on the underlying data set and the level of importance individual providers place on certain ESG aspects, isolated ranking processes often lead to significant differences in ESG ratings. Given the stark polarisation, investors are scrutinizing ESG research for transparency, subjectivity and salience.

Investors are eager to get a strong understanding of the ESG performance, backed by good data that goes beyond an opaque score. Unless one looks closely at the underlying methodology of ESG investment indexes, it’s difficult to know what is being evaluated. ESG scoring by many index providers comes down to the ability of a company to fill out ESG forms. Data compilation is vital to improve the overall quality of the underlying information. Given the incentives on green washing, do you only refer to a company’s self-disclosed information or do you seek other types of inputs? A lot of providers rely too heavily on the former, which is a big problem.

We also have some index providers that rely on third party ESG evaluation of companies to construct an ESG index. In many instances, it is principally down to index providers missing the point about what is really important for companies from an ESG perspective. Company disclosures of CEO and median employee compensation are not the same as assessing whether executive compensation is excessive or not. OR has the company rationalized its employee costs in an orderly and just manner during times of Covid. Also, a company can have a code of conduct regarding employee behavior, but if the code’s standards are not assessed by the ESG process, this tick the box exercise defeats the ESG purpose.

Traditional Index Approach Lack ESG Appreciation

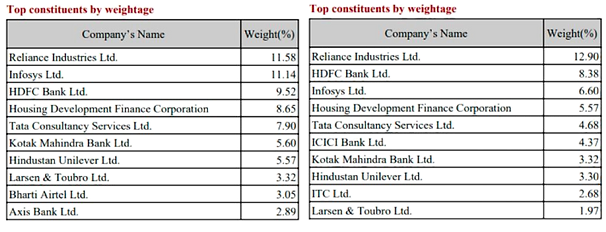

Traditional index construction approaches typically sort a universe of stocks using companies’ ESG scores, eliminating those with the worst rankings, and cap-weighting the remainder. This is due to size, but therein lies the central problem with such indexes: They tend to pick only the largest companies in the world in order to better compare to a conventional index. Some indices have strong tilts towards single stocks, and that pushes the limits of what we define as an index. Investors need to be aware that ESG bets can be concentrated in certain stocks and duplicate existing market holdings. Look at the below given comparison of the top 10 holdings of a conventional cap weighted India Equity index and its ESG counterpart.

For an outsider, it’s difficult to pinpoint which is an ESG mandate. The table on the left is an ESG Index. As seen above, 8 out of 10 top stocks are same with ESG index avoiding a tobacco company. Is that enough a differentiation that investors are looking for? What amazes us is that the Nifty 100 ESG index which is carved out from its cap weighted Nifty 100 Index has 86 out of 100 companies meeting their ESG criteria. We have been working on ESG for last 5 years and have been struggling to get enough data for many of those 86 companies to better evaluate them on ESG and include them in our coverage.

The Way Forward

Mandatory disclosure using clear performance standards is the only true way to develop an accurate understanding of ESG issues across an industry and to make truly informed investment decisions. We believe that ESG indexes need to be true to label and reflect the underlying ESG characteristics because investors are banking on sustainability to drive the long term performance and not on how big or popular the company is. Importantly from an investment standpoint, once the weight of every stock can potentially change as a result of its ESG characteristics, investors are effectively in the active management space. That’s why actively managed ESG funds continue to attract the lion’s share of dollars and represent a much larger portion of the sustainable investing landscape. We believe this will continue for the foreseeable future at least until ESG investing matures.