Will India be downgraded to Junk? The key rating sensitivity is whether India will reach its growth potential.

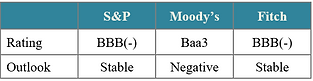

India is 18-24 months away from being downgraded to ‘Junk’. The global credit rating agencies consider a rating of BBB (minus)/ Baa3 and above to be ‘Investment grade’.

All ratings below that are termed as ‘speculative grade’. More commonly in bond market parlance as ‘Junk’ category.

Government and policy makers of an Emerging Market Economy thus strive to be rated at least as an ‘investment grade’ destination.

This demarcation allows an emerging market to become more ‘investable’ in global investment portfolios. It thus drives in foreign inflows into India as well as allows the Indian government and companies to access the global markets in a greater manner.

In 2003, on the back of 5 years of substantial reforms by the NDA government, Moody’s became the first rating agency to upgrade India from Junk to Investment grade. S&P and Fitch, the other two global rating majors, were slow to react but on seeing the strong growth that followed, upgraded their ratings as well in 2007.

Moody’s recent decision to downgrade India back to Baa3 / BBB (minus) with a negative outlook brings India on the throes of being downgraded to below investment grade.

S&P, which has a stable outlook, warned of a negative rating action as well.

Will India be downgraded to Junk?

Source: Rating agency websites, As at May 2020

‘Lest we believe, but this is not due to COVID

The basis of caution of both of the agencies is Growth. India will be downgraded to Junk for lack of growth.

Or Growth, but which is well below potential.

Or Growth, but well below the levels required to be able to justify an investment grade rating.

If you would say this to anyone in 2005, that India will be downgraded to Junk for lack of growth, they would have laughed you away.

India, was at that time, part of ‘BRIC’ – (a great disservice, we believe to all these nations by Jim O’Neill of Goldman Sachs), the wonder economies.

3 years of 9% real GDP growth made everyone extrapolate India to be a sustainable double-digit Real GDP growth economy.

Four forecasts as part of an IMF review paper of 2007 for the long term potential India Real GDP growth had a minimum of 7.3% and a maximum of 9.8% as their range forecast.

The actual average Real GDP growth from FY 08 to FY 20 has been 6.2%. This by the way includes the bewildering high growth prints of FY 15-FY 18.

The 6.2% has yet been lower than Quantum’s own long held (since 2007) long-term Real GDP estimate of 6.5%.

Many called us Pessimists then. The same may now call us optimists.

Growth is key

Business models and Investment decisions in India are based on Nominal GDP growth of 10%-14%.

Rating agencies overlook the ~30% percentage points difference between India’s public debt to GDP and other Emerging market peers with similar rating, as they expect India’s high growth to solve the high debt issue overtime.

We still do not see rating agencies downgrading India just because the general fiscal deficit to GDP will reach +10% of GDP this year.

The key rating sensitivity is whether India will reach its growth potential.

The need for continued reforms in India to boost GDP growth is thus very high.

Moody’s upgraded India in 2017 on the back of the implementation of GST and IBC. However, this downgrade, just 2 years later stating:

The country's policymaking institutions will be challenged in enacting and implementing policies…, which can mitigate the risk of sustained low growth, deterioration in government fiscal position and stress in the financial sector.

It is a damning indictment of the government.

The Nominal GDP growth has been below 10% for the last 2 years and expected to do so for atleast two more years. The banking and financial sector has been in a mess for many years now, COVID-19 was only the straw that broke the camel’s back. Factor reforms of land, labour and capital remain unresolved. The political economy is not keeping pace with the change in times and infact is making India’s institutions weaker. India’s job creation problem is soon turning the demographic dividend into a disaster.

These are indeed growth constraining. No one really talks about 8% Real GDP growth anymore. Many will kindly accept 5-6%.

This is indicative of the extent to which the expectations have been smothered.

6% - Is it Enough?

6% may still be good from a global growth perspective. But, is it good enough for India?

Is it enough to lower our future debt burden? Is it enough to create the demand and hence the jobs that the 10 million Indian graduates will seek every year for the next 10 years? Is it enough to get 300 million Indians out of poverty?

India’s Savings and Investment rate are now below 30% of GDP. India needs continued foreign savings to increase the investment rate to boost GDP growth.

Recent FDI flows have been steady, but portfolio flows both in equity and debt have stalled and/or reversed.

Todays, rating downgrade was expected and may not have too much of a market impact.

However, if our long-term growth does not rise above 6%, then we should expect India’s ratings to be downgraded to ‘Junk’ by all the rating agencies.

Rating changes, as they say, are a lagging indicator. If the move to ‘Junk’ has to happen, markets will price it ahead of the reality.

The impact of it would be seen in the bond market inflows and in the pricing of Indian dollar corporate bonds. Not a good sign, when we are preparing to enter into bond indices.

The impact would be seen in the Indian currency as the market prices in slower/lower inflows into Indian equities, bonds and other asset classes.

As it stands, the government’s economic and fiscal response to the wealth and income destruction due to the imposition of lockdown has been limited.

We at Quantum estimate an income, consumption and investment shock of ~9% of GDP which is likely to derail 2 years of economic activity.

At the start of this decade, India had the potential of becoming a ‘break-out’ nation.

Alas, as the decade ends, India will be fighting to prevent a ‘break-down’.

Arvind Chari is Head Fixed Income & Alternatives at Quantum Advisors Pvt. Ltd (QAPL).

Quantum Advisors is an India Based, India Focused, Investment Management Institution managing money for North American and European Pensions, Sovereign Wealth Funds, Endowments, Wealthy Individuals across Indian Equity, Fixed Income and Real Estate*.

*Real Estate is managed through Primary Real Estate, an Associate of Quantum Advisors.

Disclaimer:

- Quantum Advisors Private Limited is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and as a Restricted Portfolio Manager with the Canadian provinces of British Columbia (BCSC), Ontario (OSC) and Quebec (AMF). Registration with the said authorities does not imply any level of skill and training.. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAS. Any offering will be made only pursuant to an offering memorandum and other relevant documents that will be made available to qualified purchasers under applicable securities laws, and these documents must be carefully reviewed before any investment is made.

- Investing in shares or any asset is a risky proposition and share prices or prices of any assets can increase or decrease in value.

- Investors wishing to ‘double their money’ in one year or having short-term return objectives should not seek the advice of QAS as the research and investment style followed by QAS typically considers a longer-term time horizon.

- All of the forward-looking statements made in this communication are inherently uncertain and QAPL cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will”, “should”, “can”, “may”, “believe”, “expect”, “anticipate”, “intend”, “contemplate”, “estimate”, “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities laws.

- The views expressed here in this document are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Information sourced from third parties cannot be guaranteed or was not independently verified. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date.