The RBI-Government fracas on the institution's independence has long term impact.

An insight into the RBI-Government fracas and its long term impact

Dr. Urjit Patel became only the second Governor in the history of the Reserve Bank of India (RBI), to have resigned from his post. His Press Release mentioned 'personal reasons' for the resignation but markets will assume it to be due to the differences between the RBI and the government on the various issues highlighted in the media.

It indeed seems was an unusual issue which the Governor and the Ministry of Finance hadn't been able to resolve, leading to the Governor choosing the 'nuclear option' of resignation.

This is the second change at the helm of the RBI in this government's 4.5 year term. Raghuram Rajan was not offered an extension; Urjit Patel has resigned midway through his tenure.

The relations between the RBI and Government had started to sour some time ago, but it seems to have reached a breaking point in the last few months. There would have been many issues like RBIs circular on NPA recognition; PSU banks under Prompt Corrective Action; liquidity infusion in the banking system; lending support to MSME sectors etc; but we don't believe these are issues which cannot be resolved through dialogue.

Given the speculation in the media and based on the comments by the finance ministry officials, we see two moot points of disagreement:

- The accountability of the Reserve Bank of India and the role of its board.

- The excess reserves that RBI should transfer to the government (See Table 1 below).

Things seem to have come to a head in the October 23rd Board Meeting of the Central Board of the RBI. In so much that the Dy. Governor of the Reserve Bank of India, Dr. Viral Acharya, gave a public speech on October 26, 2018 on the issue of independence and autonomy of a central bank. He warned the government in no uncertain terms using the phrase “Kiss of Death - inducing the wrath of the markets” that:

“As this dynamic plays out, markets watch keenly, and if uncertainty grows and confidence in central bank independence and credibility erode, then markets rap bond yields and exchange rate on the knuckles!”

The Governor reportedly met PM Modi on November 12, the board of the RBI met again on 19th November in what was an unusually long meeting; Dr. Patel tendered his resignation on December 10th. The government moved quickly and appointed, Mr. Shaktikanta Das, Ex-bureaucrat, with a long stint at the Ministry of Finance, as the 25th Governor of the RBI. In his last major assignment before he retired, he was the government's point person on managing the currency Demonetization process. Indian Bond, Currency and Equity Markets, for now, have rejoiced the resignation and the appointment and instead of a 'rap on the knuckles' it has been a 'two handed handshake'.

Many empathize with the government and have long believed the RBI to be the reason why India is not growing in double digits. Thankfully, there are many more who believe that but for the sanity and the prudence of the RBI, India would have imploded many times over.

Personally and as a firm, we are in the latter camp. But as a research and investment firm, our job is to objectively look at each data and fact without bias and judgement to form our opinions.

Is the RBI carrying excess reserves on its balance sheet?

Let us look at the issue of RBI having excess reserves in its balance sheet which the government is supposedly claiming should be 'rightfully' given back to them to be used for 'public welfare'. Media reports indicate the amount to be INR 1.4 trillion (~USD 20 bln) - INR 3.5 trillion (~USD 50 bln)

As you know, a balance sheet has Liabilities (what you owe) and Assets (what you own). The Liabilities of a central bank are: (i) its capital, (ii) its reserves and (iii) the currency it issues to the public. The Assets are: (i) local and foreign government bonds, (ii) gold, and (iii) other assets.

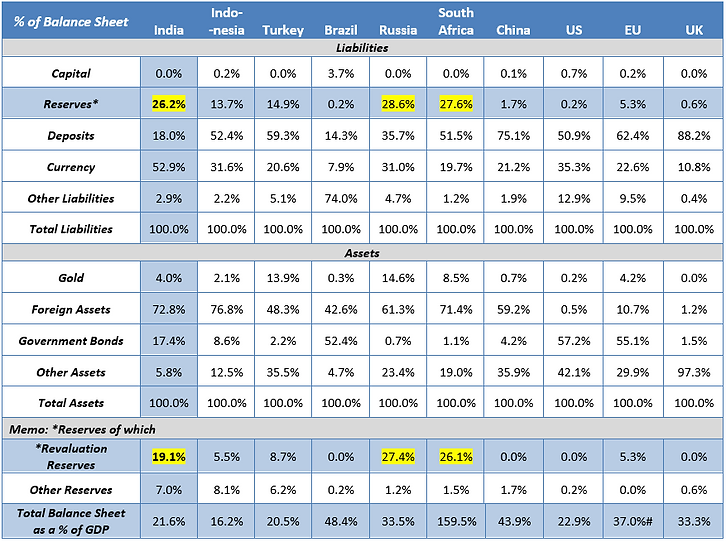

Table 1: RBI does have excess reserves, but those are not cash reserves

(Source: Annual Reports of Central Banks, Classification into items is as per the authors understanding; # Euro GDP is of 19 countries which use the EURO as a Currency; Data for India is as of June 2018; UK is February 2018, rest all is as at December 2017)

The above sample represents the BRIC Countries, the Fragile Five and 3 developed world central bank balance sheets. In 2001, Goldman Sachs made India part of the 'BRIC', countries with the highest growth potential; and in 2013, Morgan Stanley, included India as part of the 'Fragile Five', countries which run current account deficits and were susceptible to higher US interest rates.

It is thus pertinent to compare the RBI's balance sheet with countries which have similar growth potential and/or vulnerabilities. Especially, vulnerabilities, because the size of the RBI's balance sheet, its reserves, its foreign exchange assets are called into question most during periods of stress and crisis. It is quite pointless to compare India's or any other Emerging Market (EM) central bank balance sheet with that of the US or the EU. India and other EMs are dependent on USD and EUR flows for its growth, cannot print them and thus need to own them for stability. The US and EU can print unlimited amounts of USD and EUR as we have seen post 2008.

RBI has excess reserves, but those are arising from Revaluation of its Assets

On comparing their Balance Sheets, you do notice that the RBI indeed has higher reserves. But if you look at the row under 'Memo' titled Revaluation reserves, bulk of those Reserves are arising out of revaluation of its assets. i.e - over the years as the INR depreciated against the USD, GBP, EUR etc, Gold and Foreign Assets held by the RBI when translated into the current INR value, leads to an increase in its asset value. For eg. 100bln invested in 2010 @ USD/INR of 45, valued today at USD/INR of 70, will show a valuation gain when reported in INR terms.

All such gains are non-cash, notional and are shown as higher asset values and as Revaluation Reserves on the liabilities side. As and when these assets are sold, the gain will be booked and cash realized. The RBI thus does not have very high free cash reserves which it can give back to the government.

How can the RBI then transfer its 'excess' revaluation reserves to the Government?

- Sell the Asset; Raise the Cash and Transfer to Government - Depending on how much the government demands, the RBI will have to sell Foreign bonds in the global market or government bonds in the local market of that amount (USD20 - USD50 bln).

- Selling Government bonds - Domestic bond markets cannot absorb selling of bonds to that extent unless supported in return by an equivalent amount of OMO purchases

- Extinguish the Asset and Reduce the Government Liability - The Government bonds that the RBI owns are a liability of the government. So instead of selling the bonds in the market, the RBI can waive its rights on those bonds, reduce it's holding from asset and reserves and the government can extinguish its liability and reduce its outstanding debt.

- No Cash is transferred - This is a better way of doing it, markets don't get disrupted and government gets a fiscal benefit of lower outstanding debt to that extent.

This second option though may not be palatable to the government. Our view is that the demand from the RBI of its excess reserves is to get a cash bonanza, which the government can then use it for a special handout to citizens as a political benefit before the 2019 general elections.

The RBI has bargained with the government for now to form a committee to look into this matter and determine what should be the level of reserves that the RBI should carry on its books and is governments demand legitimate and if yes, how much can the RBI give away.

Should the RBI be a Board managed Central Bank?

The other major issue was about the decision making of the RBI on macro prudential and policy. The RBI has already transferred the decision making on interest rates to the Monetary Policy Committee which has 3 government nominees, 3 RBI officials with the Governor having the Veto in case of a tie.

The other aspects of central banking in terms of macro prudential, financial stability, regulatory and developmental aspects, the government desires the RBI to be accountable to its Board. The Government, based on the comments made by the finance secretary, seems to suggest a corporate structure with the RBI being a board managed central bank.

This is absurd. The RBI is not a corporate. The Board of the RBI is not strategic. The Board members, all appointed by the government, may be of eminence, but they do not eat, sleep, live and breathe financial stability.

The RBI needs to be run by the Governor, his/her deputies and the management. The RBI management should have freedom to take/reject any decision which it deems is in the interest of macro prudential supervision and financial stability without having to get it approved/directed from the Board.

In a democratic, parliamentary set up, no one expects the RBI to have complete independence; but the importance is always stressed on whether the RBI and its Governor are perceived to be independent. As Dr. Raghuram Rajan had mentioned, it is not the 'de-jure' independence; but the 'de-facto' independence of the RBI that matters.

The RBI has amongst the weakest statutory independence amongst central banks as the government can direct the RBI as it may deem fit under Section 7 of the RBI Act. This Section of the Act, which has never been used till now, was apparently used by the government in the current instance leading to the pushback from the RBI top management.

The government seems to be in a hurry in deciding these issues; with as much as accepting an RBI Governor resignation as its fallout; and their intentions as of now, until we get clarity, should be seen with suspicion.

The government though has to tread carefully here in dealing with this issue as the RBI is a sensitive institution and markets and investors over the long term do accord a great deal of significance to its autonomy and credibility.

Arvind Chari is Head Fixed Income & Alternatives at Quantum Advisors Pvt. Ltd (QAPL).

Quantum Advisors is an India Based, India Focused, Investment Management Institution managing money for North American and European Pensions, Sovereign Wealth Funds, Endowments, Wealthy Individuals across Indian Equity, Fixed Income and Real Estate*.

*Real Estate is managed through Primary Real Estate, an Associate of Quantum Advisors.

Disclaimer:

- Quantum Advisors Private Limited is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and as a Restricted Portfolio Manager with the Canadian provinces of British Columbia (BCSC), Ontario (OSC) and Quebec (AMF). Registration with the said authorities does not imply any level of skill and training.. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAS. Any offering will be made only pursuant to an offering memorandum and other relevant documents that will be made available to qualified purchasers under applicable securities laws, and these documents must be carefully reviewed before any investment is made.

- Investing in shares or any asset is a risky proposition and share prices or prices of any assets can increase or decrease in value.

- Investors wishing to 'double their money' in one year or having short-term return objectives should not seek the advice of QAS as the research and investment style followed by QAS typically considers a longer-term time horizon.

- All of the forward-looking statements made in this communication are inherently uncertain and QAPL cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will”, “should”, “can”, “may”, “believe”, “expect”, “anticipate”, “intend”, “contemplate”, “estimate”, “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities laws.

- The views expressed here in this document are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Information sourced from third parties cannot be guaranteed or was not independently verified. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date.