Faced with uncertainty, risk aversion grips banks, corporations, investors and individuals.

Risk Aversion, is defined in Psychology, as “A preference for a sure outcome over a gamble with a higher or equal expected value.”

A risk averse investor is, therefore, someone who when faced with uncertainty, will attempt to lower that uncertainty.

We often come across investors who will accept the lower but a guaranteed return from a fixed deposit, over the uncertain returns from investing in stock markets.

Without going in to the merits of that investment decision, the key aspect to note is that investors cherish certainty. Or the prospect of certainty. When faced with uncertainty, the investor is most likely to choose the option which is perceived to be less risky.

This is an individual example. What if we find similar risk-averse behaviour at the level of a national economy?

What if economic agents – banks, corporations, investors and individuals – are also making risk-averse investment decisions?

It may mean that the economic environment is uncertain and hence is preventing risk taking activity.

Or that past investment decisions have turned sour and hence the ‘risk appetite’ for investments is now a lot lower.

India seems to be in a situation of such a spate of risk aversion. The worrying aspect, as the below charts will show, is that most of this uncertainty and risk aversion isn’t related only to or has begun with COVID-19 but the added uncertainty of jobs, income and health emerging from the COVID-19 crisis is only going to worsen this issue of risk aversion.

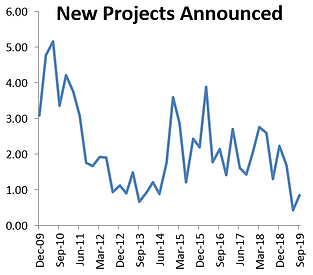

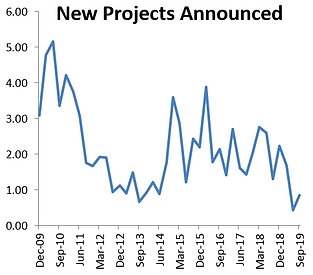

Fig-1&2: Crony Capitalism gets Busted and Drives Risk Aversion

Source: RBI, % yoy

Source: CMIE, INR Trillion, Data for Private Corporates

Explaining Graphs -1&2: PSU Banks make dodgy loans to fund India Inc’s over-estimated expansion. Too much debt, sales below expectation, regulatory uncertainty and change in global environment leads India Inc to default on the loans to PSU Banks. PSU bankers saddled with bad loans now neither have the appetite nor the capital to take on more risk. India Inc cannot take the risk of new investments without the support of the friendly PSU banker.

New credit and new investments drive growth. Falling investments and lower credit growth leads to a slowing economy.

The economy was not choked completely off credit as the space vacated by the risk-averse PSU bank in lending to corporate India and company promoters was earnestly taken over by private banks, NBFCs (Non-Banking Financial Companies) and mutual funds.

Especially so post Demonetization, which brought in cheap money and deposits into the banking system. This increased cheap liquidity found its way into a higher risk taking by private banks, NBFCs and mutual funds.

Just as the PSU bank lending boom went bust in 2012-2013, this spate of reckless lending started to unravel in September 2018 when IL&FS defaulted on its loan and bond obligations; starting a wave of risk aversion in the system.

Since then, a large private bank has had to be bailed out, a large NBFC defaulted and many mutual fund schemes which invest in bonds issued by weak corporates have seen their NAVs suffer steep declines.

Investor sentiment has taken a big knock. The market is constantly looking out for the next weak bank, the next NBFC to default and the next credit risk fund to redeem. Investment portfolios have seen a flight to safety.

In the given charts, it is clear that the risk aversion in the Indian financial system has been slowly building up. Multiple shocks to the system like demonetization and the hastily done GST along with social tensions have added to the uncertainty and stress over time. The Indian economy, its rural markets, casual labour and informal enterprises never fully recovered from these shocks.

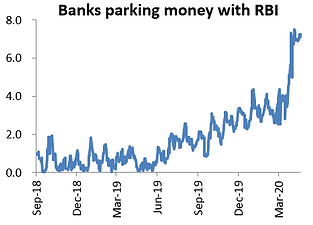

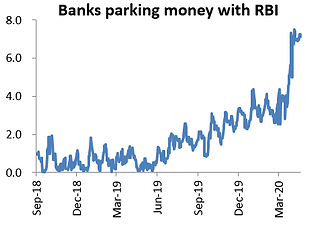

Fig-3&4: Risk Aversion drives Flight to Quality and Safety

Source: Care Ratings, SEBI – INR Trillion

Source: RBI, Daily Reverse Repo Bids, INR Trillion

Since September 2018, the Reserve Bank of India (RBI), has cut the Repo rate by 210 bps (2.1%), added liquidity into the banking system of more than INR 9 trillion, used unconventional never before used measures to get market bond yields lower and has repeatedly said that it stands ready to do “whatever it takes”.

Despite all the actions taken by the RBI, the financial system remains frozen but for government bonds, PSU bonds and strong AAA rated corporates. The rest of the players still find it difficult to access the bond market and that acts as a feedback loop which further increases risk aversion amongst investors.

India encountered COVID-19 at a time when the economy has already slowed down quite dramatically, income generation and the job situation is grim and the financial system is in a mess. The economic impact of COVID-19 is extremely uncertain and hence we will continue to see extreme risk aversion in the financial markets.

Unless, we see strong government action. And that government action though has been lacking.

We would argue that much of the confidence building measures, sentiment boost are dependent on what steps the government takes to stabilize the economy and re-build the trust in the financial markets.

How much money will the government put in the hands of the common man to alleviate their income loss and to drive consumption? How much support will the farmer get in managing the harvest season and sowing for the new season? How well does the government manage the migrant labor issue? Will the government provide risk capital to SMEs, NBFCs, to help them tide over this period? Will the government guarantee and assure bonds of certain financial entities?

The answers to these, we believe, will hold the key to whether the unprecedented actions by the RBI bear fruit in resolving the lack of confidence and lack of certainty that prevents financial market players from taking on more risk.

So as an investor if you are looking to invest in that credit fund for a higher yield as bank fixed deposit rates have gone down. Or you are looking to invest in a small cap fund because valuations are attractive. Be very sure that you are confident that the government would do all of the above and more to support the lost livelihoods, to stabilize and re-start the economy and will create trust and confidence in the economic agents to take risk. Small and weak companies need a period of certainty and high risk appetite to thrive.

If you aren’t that confident, then it may well be prudent for you to be risk-averse in your investment decisions.

In Debt funds, it would be to seek the safety and liquidity of funds which invest in sovereign (government), quasi-sovereign (States, PSUs) and avoid too much of private corporate credit risks

In Equity funds, it may be wise to stick with funds which have a large cap bias as large companies have management teams, product & geographical diversification and balance sheet flexibility to ride out a storm

For many others, an asset allocation fund, which considers the above suggestions and times and balances the allocation within Equity, Debt and Gold, would be ideal at times like these.

Arvind Chari is Head Fixed Income & Alternatives at Quantum Advisors Pvt. Ltd (QAPL).

Quantum Advisors is an India Based, India Focused, Investment Management Institution managing money for North American and European Pensions, Sovereign Wealth Funds, Endowments, Wealthy Individuals across Indian Equity, Fixed Income and Real Estate*.

*Real Estate is managed through Primary Real Estate, an Associate of Quantum Advisors.

Disclaimer:

- Quantum Advisors Private Limited is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and as a Restricted Portfolio Manager with the Canadian provinces of British Columbia (BCSC), Ontario (OSC) and Quebec (AMF). Registration with the said authorities does not imply any level of skill and training.. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAS. Any offering will be made only pursuant to an offering memorandum and other relevant documents that will be made available to qualified purchasers under applicable securities laws, and these documents must be carefully reviewed before any investment is made.

- Investing in shares or any asset is a risky proposition and share prices or prices of any assets can increase or decrease in value.

- Investors wishing to ‘double their money’ in one year or having short-term return objectives should not seek the advice of QAS as the research and investment style followed by QAS typically considers a longer-term time horizon.

- All of the forward-looking statements made in this communication are inherently uncertain and QAPL cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will”, “should”, “can”, “may”, “believe”, “expect”, “anticipate”, “intend”, “contemplate”, “estimate”, “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities laws.

- The views expressed here in this document are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Information sourced from third parties cannot be guaranteed or was not independently verified. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date.