We are not jumping on the tables and celebrating the slam dunk of GST. We need to see the data points evolve.

The GST was an idea born out of a policy group set up by the previous Congress-ruled coalition government in 2011. The BJP, then in the Opposition, opposed it vehemently. By 2014, after the BJP won the general elections, the BJP furiously waved the flag for launching GST, a unified tax structure for all goods which would allow for the free movement of goods within the borders of India.

From our perspective, it deserves further analysis to see whether GST frees India or enslaves its states and - by extension - the people living in the states. There are two parts to the GST: (i) the free movement of goods, and (ii) a uniform, standardized sales or service tax for every product/service sold/provided anywhere in the country.

We think the first objective of ensuring free movement of goods is fantastic. For decades, goods moving between states were met by uniformed, government employees at wooden border check-points with grease on their palms and a wicked smile in their eyes. This dreaded “octroi tax” is gone - not only will it erase “black” money but it will also dramatically reduce the time it takes for a truck to complete a journey to deliver goods. By some estimates, a truck plowing between Bombay and New Delhi will see the travel time reduced from 3 days to 1 day.

It is the second part of the one-tax rate for any product across the country that may pose a problem. India, with over 1.2 billion people living in 29 states and 7 Union Territories, is divided into 709 districts each of which is headed by a District Officer. Rather than giving more powers to the states and to the local district officers, the GST gives the power of taxation on 50% of the consumption basket to a federal agency. It reinforces the (misguided) view that New Delhi knows best. It reinforces India's path to a “mediocre” real rate of growth in GDP to the 6.5% per annum level that we have assumed in our long term scenario of India. A break out to the much-awaited BRIC-era and Modi Mania 8% to 10% has been deferred. And, therein, lies the problem: investors assume that GST will add to GDP. We are not sure. It may reduce the ability of each state to maximize its potential.

Consider this. Every state in diverse India has its own natural resources and advantages. Goa has great beaches and could easily evolve into a leading global destination as opposed to a hippy place to hang out for 30,000 young Israeli men looking to inhale intoxicants after a 3-year bout in the stressful Israeli army or destination for retired British burping out the last days of the Raj on cheap beer.

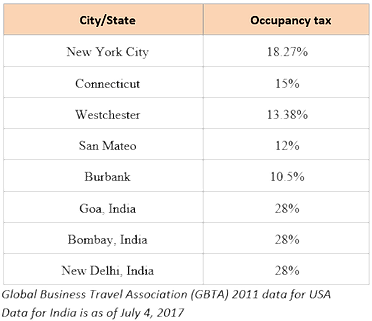

Under GST, Goa will have no flexibility on trying to figure out its economic future. In the US, every state or county can charge whatever tax they wish to on a hotel room. In India, that will not be possible. One Nation; One Tax feels more like a “One Nation; One Race; One Food” cleansing of any independent thinking, independent choice of meals, or independent pursuit of economic interest.

No, we are not jumping on the tables and celebrating the slam dunk of GST. We need to see the data points evolve.

Goa is beached with no choice

If Burbank wishes to position itself as a better destination to tourists than, say, New York, it can decide to reduce the occupancy tax rate on a room to build volume and attract more visitors. Goa has lost flexibility to build its business plan and P&L as a state and will have to hope that the wise men of the GST Council got their thought process correct and that, somehow, the dynamics that drive tourism to Goa are the same that drive visitors to other parts of India.

In addition to this conceptual argument over the ability of any state to pursue its own economic path to development and prosperity, the dark (and unknown) side of GST is the e-paper work. While the physical highway has been removed, the digital speedbumps have increased. Quantum Advisors will now have 29 filings in a year compared to 3 filings earlier: we need to file in every state where we do business. Press articles suggest there will be 3.5 billion filings every month! The software for the GST is being rolled out in tranches by GST Network and glitches are expected. However, the software services provider indicated these will be ironed out over time.

The problem with “ironing out over time” is the inconvenience to people and disruption to the economy. The Indian economy is still suffering from the impact of the demonetization initiated by the Modi regime on November 8, 2016. Modi’s plea to the people to wait patiently for 50 days was a shallow ploy aimed at nationalism and a “hit the rich” mentality.