As stewards of long term capital we expect Indian corporates to lead India's transition to a low carbon future.

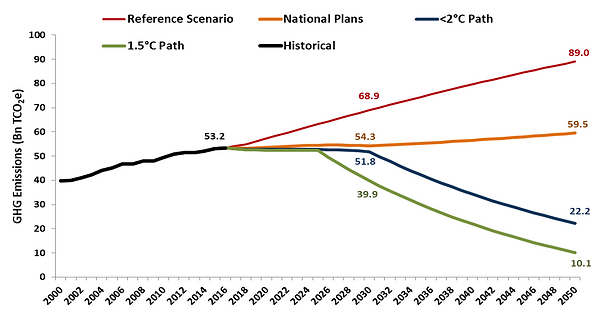

The Paris Agreement in 2015 saw 195 countries commit to limit global warming to well below 2 °C (1). The Agreement’s long-term goal is to limit global average temperature rise to below 2 ° C (above pre-industrial levels) and to pursue efforts to limit the increase to 1.5 ° C. Based on the analysis of each country’s NDCs (National Plans), global GHG (Green House Gases) emissions are expected to remain within the 55 billion tonnes to 60 billion tonnes range from 2030 to 2050. However, the more ambitious outcomes that require global warming to be within the 1.5 ° C to 2 ° C range require steeper declines in emissions from current levels of ~ 55 gigatons to a maximum of 22 gigations by 2050. Achieving the above targets will require significant reductions in absolute and per capita GHG emissions from the current levels.

Source: [Opens Excel Spreadsheet]

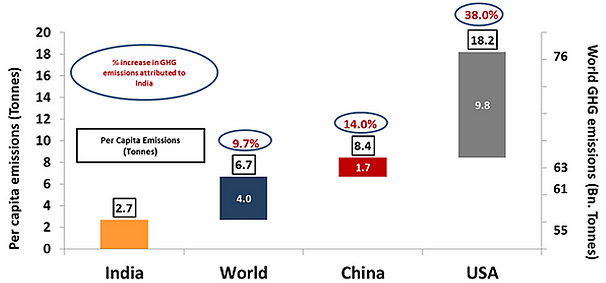

For a country like India, which is still in the developing stage, the challenge is twofold. In addition to providing its large population with access to affordable energy, the focus is also on transitioning to “cleaner” sources of energy. Assuming other countries can achieve their NDC’s by the year 2030, the chart below estimates India’s contribution to total GHG emissions at per capita levels equal to that of the World (6.7 tCO2e), China (8.4 tCO2e) and USA (18.2 tCO2e).

Clearly, to meet the GHG challenge, India is too big a country to ignore. While India’s share in total emissions is currently less than 7% and its per capita emissions significantly lower at 2.7 tCO2e, to meet the growth aspirations of millions of its citizens, it is likely to consume a lot higher amount of resources such as steel, cement, electricity, and various sources of energy. If India achieves China’s per capita emission levels, world GHG emissions are expected to be at 63 bn tCO2e in 2030; nearly 8 bn tCO2e higher than the target specified in the NDCs. Without adequate investments in cleaner sources of energy, India is likely to blow a big hole in the 55 billion tons emissions target by 2030.

Source: World Resources Institute, Global Carbon Atlas, Climatescoreboard.org, QASL Estimates

Indian corporations have a crucial role to play to achieve India’s ambitious targets of reducing the GHG emission intensity by 33-35% by 2030 from 2005 levels. Major industrial houses have committed to drive the transition to cleaner energy sources by aligning with various initiatives such as RE100, science-based targets and adopting an internal carbon price to factor climate related risks and opportunities.

As asset managers, it is pertinent to identify whether our investee companies are addressing the climate related risks and opportunities and examine the strategies adopted by them to mitigate their carbon footprint. Generally, most companies first adopt an internal carbon price, establish reporting systems to capture their emissions and then set long term targets on reducing their emissions. These long-term targets can be based on internal aspirations or can be aligned with best practices such as the Science Based Targets Initiative (SBTi) which verifies compliance to the 1.5 ° C or 2.0 ° C pathway, as may be the case. More than 688 companies globally have their targets approved by SBTi. (2)

Arvind Chari, Chief Investment Officer talks to Ajit Dayal, Founder of Quantum Advisors on the urgent action required by global asset allocators and policy makers to meet climate change mitigation goals.

In India, most companies are currently in the first stage of establishing an internal carbon price. However, many have also demonstrated an intent to align their emission targets with the SBTi.

Since there is a major emphasis on transitioning to a low carbon future, we have mapped our investee companies on their commitments to various carbon reduction initiatives.

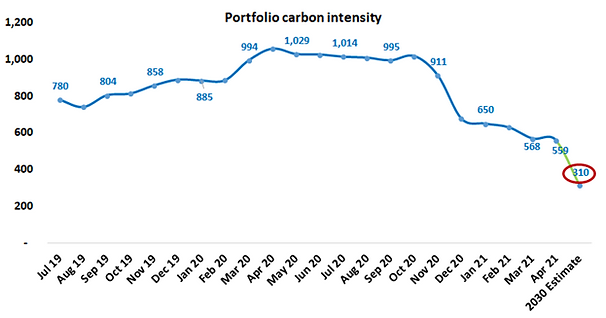

Currently our portfolio carbon intensity stands at ~ 560 tonnes per $ mn of revenues. We assume our investee companies to grow at a real rate of 6% and nominal rate of 10%. Assuming our investee companies reduce their emission intensity in line with their declared targets, we estimate portfolio emission intensity to decline by 1.7% CAGR. At this rate our portfolio emission intensity by 2030 will decline to ~ 310 tonnes per $ mn of revenues.

Source: QASL Research

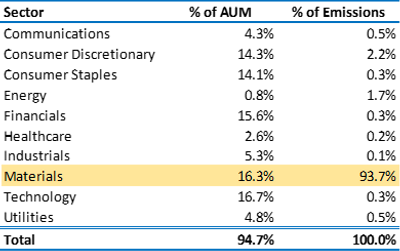

Snapshot of portfolio carbon characteristics

Majority of the emissions are currently contributed by the materials sector. We are reasonably confident that the emission intensity will decline in the medium and long-term. Most of our investee companies and particularly those that belong to the “hard to abate” sectors have aligned themselves to the SBTi and have set internal carbon prices.

Source: The data pertains to the portfolio of Q India ESG Fund

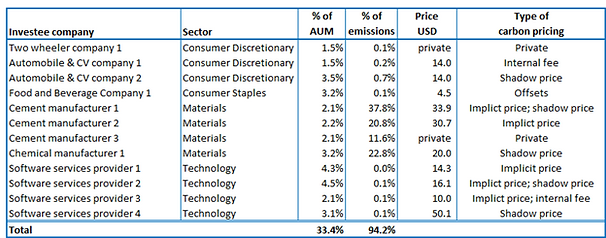

a) 33% of portfolio AUM contributing 94% of total portfolio carbon emissions have established an internal carbon price.

Source: Company sustainability reports and CDP filings

To understand more about the types of carbon pricing, please refer to the link: https://sciencebasedtargets.org/companies-taking-action

While the methodology (3) used may differ, it provides some comfort that these companies are seriously considering the negative externalities associated with their operations. For further information on type of carbon pricing, please refer to the link.

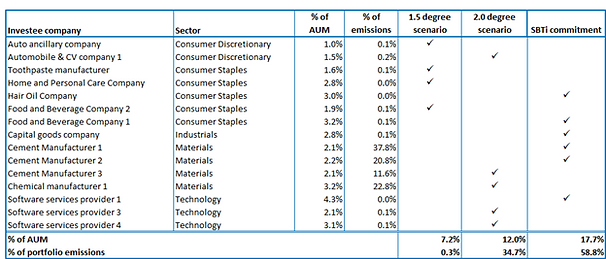

a) 37% of portfolio AUM contributing ~94% of total portfolio carbon emissions have either 1) committed to setting SBTi approved targets or 2) have got their targets approved based on 2 °C pathway or 3) have got their targets approved based on 1.5 °C pathway

Source: https://sciencebasedtargets.org/companies-taking-action

The way forward

Nearly 70% of the portfolio’s current emissions are attributed to our holding in 3 cement manufacturers. The future course of the portfolio emissions intensity will depend to a great extent on how these companies are managing the GHG risks and opportunities related to the low-carbon transition. In our research process, we also pay a lot of attention to management intent. If there is a clear communication of targets, alignment with best practices and a demonstrable intent to improve, we will be willing to stay invested in such companies.

Conclusion

For a developing country like India, the transition to a low carbon future is challenging. Absolute emissions are likely to increase for the foreseeable future despite improvements in emission intensity. While our portfolio emission intensity is expected to decline to 450 tonnes per $ mn of revenue, absolute emissions are still expected to increase by ~50%. It is for this reason that developed countries need to provide technological and financial support to assist developing nations to transition to a sustainable future. As shown above, many Indian corporates are gearing themselves to transition to a low carbon future and as stewards of long-term capital we continue to nudge all our investee companies to align themselves with best practices and are confident of our investee companies meeting their long-term emission targets.

Sources

- https://unfccc.int/process-and-meetings/the-paris-agreement/what-is-the-paris-agreement

- https://sciencebasedtargets.org/companies-taking-action#anchor-link-test

- https://www.wri.org/insights/4-ways-companies-can-price-carbon-lessons-india

- https://www.inrate.com/cm_data/Inrate_Information_Leaflet_EU_Taxonomy_200528.pdf