On 30th July, Donald Trump slapped a 25% tariff on Indian exports to US, effective from August 7th, citing unhappiness over the trade negotiations and warned of a penalty rate for India’s continued purchase of Russian crude oil. 1

On 6th August, he threatened to make it 50% by August 27th if India does not cease its Russian oil purchases. 1

And on August 27th, 9:31am India Standard Time (IST), Indian goods exports, unless those exempted under (Sec 232 of the US Trade Expansion Act of 1962), will face a 50% tariff rate at the US customs border.

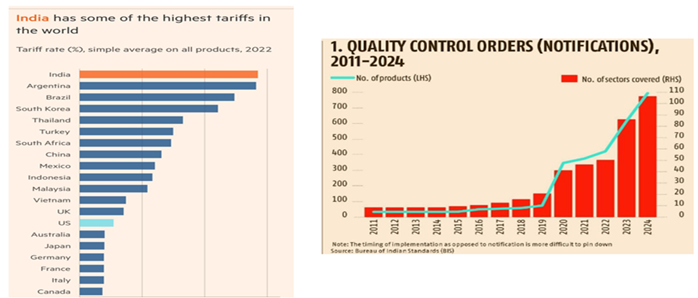

It is difficult to see how we reached a situation where India now has amongst the highest tariff rates (25% tariff + penalty).

There were reports in mid-July suggesting that the trade negotiations were going great and that India may walk out with a 15% tariff rate. 2

In our view, this should be deeply disappointing for the government, the trade negotiators and the foreign policy officials to have ended up in this situation.

Especially, given our starting conditions going into the trade negotiation.

When Donald Trump won the US elections in November 2024, we wrote in an insight piece, ‘Will India be Trumped’ by the America First policies that were being propounded.

We had noted that other competing countries were vulnerable to Trump’s stated policies, whereas the Indian state and Indian Corporates did not have:

- Commodity like oil, where the US seeks to control prices. Eg: Saudi, Russia

- High technology industry, such as chips or AI, where the US seeks dominance. Eg: China/ Taiwan/ EU

- Large trade surplus with the US that could invite tariffs. Eg: Mexico, Vietnam, China

- Dependence on US foreign policy for regional conflicts. Eg: Israel, Middle East, Ukraine

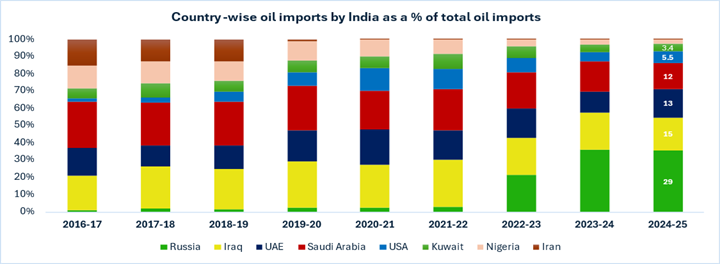

We believe this would offer India some leverage to try and enter a bilateral trade on favorable terms. India could also potentially offer to buy US shale oil and Gas and wean away its purchases from Russia. (See chart 1 in the annexure)

More importantly, we hoped for Trump, to be a ‘messiah’ for Indian trade and investment.

Image 1: Will Trump force India to give up its protectionism?

(Source: Image on tariff comparison from a Financial Times article and chart image on Quality Control Orders (QCOs) from a business standard article) Products refer to goods imported and exported

India has indeed increased import duties over the last few years in its quest of ‘Atma Nirbharta’ – self dependence and to promote ‘Make in India’.

Apart from duties, true to India’s bureaucratic licensing and permit raj system, it also notified many more products to meet the Quality Control Order (QCOs) – a means to curb imports.

Our hope was as India enters bilateral trade negotiations with the US, we would have to reduce duties and dismantle the quota systems to get favourable treatment and access to US markets.

And once you do that for US, India can replicate and do the same for other high income, developed world countries like the EU, UK, Japan, Canada, Australia etc.

This is why we termed Trump a ‘messiah’.

Someone who would force India to open up again to global trade and investment.

Since the 1990s, this is what helped India attract global capital from corporations and investors. It is what helped Indian industry to compete and succeed in global markets. This is what boosted our growth rate. 3

But here we are, as of now.

Forget about favours and a trade deal.

We have a potential 50% tariff rate on goods exports to US.

At the 25% tariff level, we could have yet competed, as other similar competing trade nations also have tariffs around the 15%-25% level. So, not ideal but manageable. (see table below)

However, if the tariff rate remains at 50%, very close to China’s tariff rate, we believe, a large share of the Indian exports to the US will be uncompetitive.

Table 1: From a Trade Messiah to a potential Nightmare for India

| Goods Exported to US | CY 2024 (USD Bln) | % of India's Total Goods Exports | % of US Goods imports | India Tariffs * | Key competing country - Tariff | Impact |

|---|---|---|---|---|---|---|

| Electronics | 14 | 3.2% | 3.0% | 0% | China -30%^, Vietnam -0% | Exempt until Sec 232 investigation completes |

| Pharmaceuticals & Chemicals | 12.5 | 2.8% | 6.0% | 0% | Ireland -15%, Switzerland - 39% | Exempt until Sec 232 investigation completes |

| Gems & Jewellery | 11.6 | 2.6% | 13.0% | 50% | Turkey -15%, Vietnam- 20% | Impacted - Customers will look at alternatives |

| Machinery | 6.8 | 1.5% | 1.0% | 50% | China -30%, Mexico - 0% | Impacted - Customers will look at alternatives |

| Textiles & Garments | 7.7 | 1.7% | 8.0% | 50% | Vietnam - 20%, Bangladesh -20% | Impacted - Customers will look at alternatives |

| Iron & Steel | 3.1 | 0.7% | 4.0% | 50% | China -30%, Canada 35% | Impacted - Customers will look at alternatives |

| Others- (Motor vehicles, Marine, Platic and carpets etc) | 31.6 | 7.1% | - | 50% | China -30%, Vietnam -20% | Impacted - Customers will look at alternatives |

| Total | 87.3 | 19.7% | 2.0% |

Source: USITC.GOV (*- potential tariff rate effective August 27th if India does not act to reduce oil imports from Russia, effective August 7th apart from exempted, the tariff rate is 25%) (^ - China’s announced tariff rate is 54%); (Sec 232 of the US Trade Expansion Act of 1962); India Export Data is from CMIE Economic Outlook, The data in the table on tariff rates is based on Internal Research

Economists estimate that the total impact on India’s GDP if a significant part of US exports is lost would be ~0.5% of GDP. The indirect impact would be larger. 4

That might not sound a lot, but the way to look at this, is what would have been possible if India actually got a ~15% tariff deal2 and a preferred country status.

Imagine the boost to India trade and the likely increase in investments to support the increased trade.

Trump, as we have noted above, presented India the opportunity to scale up on global value chain and boost India’s global trade, investment and growth.

Can and should India remedy this? These are the reasons in our view which were put forward for the dramatic turn of events:

- India did not agree to US demands on opening up India’s farm trade and defence purchases

- Trump wants to solve the Russia-Ukraine problem and sees India’s purchases of Russian oil as a big aspect of funding Putin’s war efforts and hence the penal rate (see chart 2 in annexure)

- Trump did not like the fact that India kept refuting his insistence that he solved the India-Pakistan conflict

We should remedy, given US’s importance in the global economy, trade and investment. India and US are connected in many ways.

India goods export of ~USD 86 billion to the US is ~20% of our total goods exports (see table) India’s services exports (USD 387 billion), of which especially IT and business services (USD 290 billion, a major share of that is to the US. 5

Many US corporations have their global capability centres (GCC) in India (see Annexure, Image 2) Most of the corporations would also look to expand their sourcing and presence in India. For instance, Apple in mobile phones and Micron/Intel in Semi-conductor’s are recent examples of US corporations shifting investments and production to India. 6

US residents and institutions are large investors into the Indian equity and bond market. The US Federal reserve data shows ~ USD 350 billion of US resident money invested in Indian capital markets. 7

Similarly, US institutional investors have investments in private equity, venture capital, real estate and infrastructure assets in India.

India received USD 32 billion from its diaspora in the US as remittances out of the total remittances of ~USD 130 billion in 2024. 8

The India diaspora in the US now is over 5 million with a lower median age, higher education and more than twice the median incomes as compared to other immigrants. 9

India must ensure that such situations does not make India ‘un-investable’ from a geo-political risk perspective.

Whether we can remedy, depends on the concessions, sacrifices and compromises we are willing to make for demands which India deems unjust and inappropriate.

And with Trump, we do not know what is coming next.

India should always retain its sovereignty and not bow down to threats and intimidation; however, we should find ways to placate the situation as there is lot to gain for India in having a favourable relationship with the US, which it has worked on to improve since 1990s.

Annexure:

Table 2: A history of India – US relations

| A history of India – US relations | |

|---|---|

| 1949 | PM Nehru visits US – propagates India’s leadership in the non-alignment movement |

| 1960 | US universities support formation and academic alignment at India Institute of Technology |

| 1962 | US assists India in its war with China |

| 1963 | Norman Borlaug works with Dr Swaminathan on seed varieties to spur Green Revolution |

| 1966 | US slows and stops sale of wheat under PL-480 and food products to India |

| 1971 | US sides with Pakistan, given its role in rapprochement with China. Sends the US seventh fleet, India signals to Russia and wins the war to liberate ‘East Pakistan’ now Bangladesh. |

| 1974 | India conducts its first Nuclear test |

| 1970s | India introduces law forcing foreign companies to cede stake, list or exit. IBM, Coca-cola, Intel famously exit India operations |

| 1978 | Jimmy Carter enacts Non-proliferation Act, India refuses to adhere |

| 1991 | India reforms, several US corporations re/enter India |

| 1998 | India conducts second Nuclear test, inviting sanctions from Clinton administration |

| 2000 | Bill Clinton visits India on a historic trip |

| 2005-2008 | President Bush and PM Manmohan Singh sign several energy and defence agreements leading to the Civil Nuclear deal in 2008 |

| 2008-2014 | Barack Obama – Manmohan Singh advance the partnership |

| 2014 | PM Modi makes his first high profile visit to US; (His Visa was cancelled by US in 2005) |

| 2015-16 | Obama makes his second visit to India; India is elevated to a major defense partner |

| 2017 | ‘QUAD’ solidifies into an Informal Security Dialogue Forum for US, India, Japan and Australia |

| 2019 | Trump ends India’s special trade status India responds by imposing import duties on US exports |

| 2019-2020 | Modi endorses Trump for President at a ‘Howdy Modi’ event in Texas Trump visits India and attends ‘Namaste Trump’ event in Delhi |

| 2023 | Modi makes first ‘State’ visit – addresses a joint session and a meticulous 58 paragraph joint statement with a comprehensive US and India strategic relationship straddling across economic, scientific, technology, diaspora and geo-politics is released |

| 2023 | India hosts G-20 |

| 2024 | Two indictments from US Department of Justice (DOJ) have caused some consternation. The first one of a former Indian government employee being indicted for the assassination of a US national belong to the Sikh community. The other episode was the indictment of a large Indian conglomerate with investments in key national strategic sectors. |

| 2025 | Modi and Trump meet in February and discuss defence, Oil, trade deficits and tariff |

| 2025 | Trump hits India with a 25% tariff, and adds another 25% penalty if India does not cease Russian oil purchase |

(Source: Council of Foreign Relations, Carnegie Endowment, South Asia)

Chart 1: India can shift its Oil purchases from Russia to the US as a trade truce

Source: CMIE, Internal Research. Annual Data as of March 2025

Image 2: India is the Global Capability Centre (GCC) of the World

-of-the-World.png)

(Source: Times of India Article, August 2024)

Notes to the Article:

- Trump Tariff puts strain – Chatham House Article, August 12, 2025

- Missed Signals, Lost Deals - Reuters News Report, August 6, 2025

- The 1991 Project website

- US Tariffs could knock off 50 bps - Indian Express Article, August 13, 2025

- No direct hit but braces for impact, Article on Money Control, August 8, 2025

- Tesla, Apple drive US corporate pivot – Article in Nikkei Asia, 2023

- US Federal Reserve Data on Foreign Holdings of Residents

- India Remittances – ET Article, March 2025

- Indian Immigrants in the US – Report on Migration Policy, November 2024

Important Disclosures & Disclaimers

The views expressed herein shall constitute only the opinions and any information contained in this material shall not be deemed to constitute an advice or an offer to sell/purchase or as an invitation or solicitation to invest in any security and further Quantum Advisors Private Limited (QAPL) and its employees/directors shall not be liable for any direct or indirect loss, damage, liability whatsoever arising from the use of this information.

Information sourced from third parties cannot be guaranteed or was not independently verified. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and the views given are fair and reasonable as on date. All the forward-looking statements made in this communication are inherently uncertain and we cannot assure the reader that the results or developments anticipated will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations.

The security/sector discussed in this newsletter are given purely as illustration. This should not be construed as a recommendation to buy or sell any security/sector.

Recipients should exercise due care and caution and if necessary, obtain the professional advice prior to taking any decision based on this information.

Important Notice:

This newsletter contains hyperlinks to websites operated by third parties. These linked websites are not under the control of QAPL and are provided for your convenience only. Clicking on those links or enabling those connections may allow third parties to collect or share data about you. When you click on these links, we encourage you to read the privacy notice of the website you visit. QAPL does not endorse, or guarantee products, services or advice offered by these websites.