While not in a crisis mode, a fidgety global environment and net imports are not conducive to a stable currency.

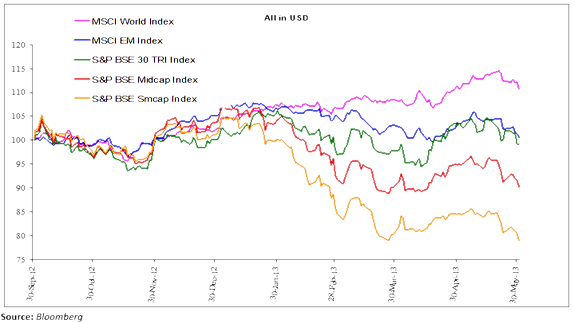

Since our suggestion in the September 30 2012 quarterly update that investors reduce their allocation to India to “50% to 75%” of their long term target (from a “75% to 100%” range), India has underperformed the MSCI World Index and the MSCI Emerging Market Index (Graph).

Graph : The world and EM do better than India (from Sept 30, 2012)

A chunk of the underperformance in the narrower, large cap Indian indices has been due to a weaker INR.

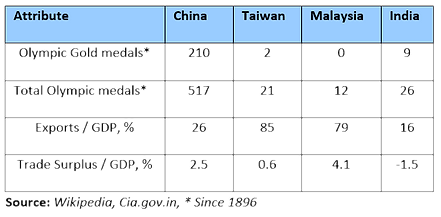

India is the “couch potato” of global trade

The INR continues to be haunted by the fact that India is a net importer of goods. While India should do better in a slowing global economy which results in lower commodity prices, the relatively sticky price of oil has not helped reduce India’s stubbornly high trade deficit. Attempts by the Indian government to reduce the cultural and investment demand for gold have not yet dampened enthusiasm for the “barbaric relic”. While not in a crisis mode, a fidgety global environment is not conducive to a stable currency.

India not in the race.

Culturally, India is the “couch potato” of the global trade business (Table 6). With a large domestic market even a significant investment in infrastructure (don’t hold your breath for this, though!) is not likely to make India anywhere close to a global player.

The plethora of mindless talk shows suggests that the Indian mind is happy to debate, yell, and shout while the Indian business groups prefer to use their remote controls to change policy for a quick profit. To be fair, many Indian business groups have (to their regret) bought companies in Europe and the US, but a lot of that was a market cap play or a leverage play (borrowed in USD) to move into the “big league”. Barring the body-shopping and IT companies, no large Indian group has made their wealth from exports. The large Indian companies have consistently been running a trade deficit.

Given the lethargy within India to build global businesses - and a hostile global trade environment - the INR is likely to be buffeted by portfolio and FDI flows and worries over India’s current account deficit. Any decline in the price of oil will help sentiment towards India.

Forget 9% growth, look for good management

Our view remains that an “India with a 9% growth” story is not the reason to be invested in India. A 6.5% to 7% solid rate of growth in GDP with an even and fair distribution is far better than a 9% skewed, plunder-the-nation rate of growth in GDP that favors the well-connected. Investing in suspect managements is risky.

The macro India news hitting the headlines sometimes excites and sometimes worries investors. The global risk appetite swings between the ecstasy seen when “green shoots” were first spotted in March, 2009 and the fear that was witnessed in the troubled second half of CY 2011 – and now another cycle of infatuation turning into disappointing for many suspect businesses run by suspect managements is playing itself out.

Investors need to throw away those rose-coloured glasses that portrayed India as a Super Power. That 8%, 9%, and 10% rate of growth in GDP is a fiction that will only be achieved in spurts. It may be achieved on a sustainable basis when there is a serious desire to clean the system. Subsidies to the poor are here to stay – you cannot wish away the responsibility of looking after 300 million poor people for the next few decades. With a solid domestic savings rate of over 30%, India has the capital to achieve a 6% plus rate of growth in GDP even in a troubled global environment.

With the macro noise around us, we remain bottom-up stock pickers. As managers with the mandate to look after your capital, we remain disciplined value managers. Our challenges remain:

- to understand and analyze the businesses;

- to decipher the valuations ascribed to these businesses in the stock market;

- to understand the ability of the management to guide these businesses in uncertain times - the unflinching question of leadership is crucial, and

- share the returns fairly with minorities.