India opened up to the western world in the 1980s and 90s. The US-India relations began to change in the Clinton era, benefitting under Bush Jr, and blossoming under the Obama administration.

Now, the Indian Prime Minister seems to have had a very fruitful trip this June to the United States. Not only did he address his now customary ‘Howdy Modi’ event for Non-Resident Indians. He also addressed a joint session of the US Congress. More important though was the statement that followed post his meeting with the US President Joe Biden. A 58 paragraph, detailed and meticulous layout of a comprehensive US and India strategic relationship straddling across economic, scientific, technology, diaspora and geo-politics.

- Technology – Critical technology, space research, semi-conductors, 5G/6G, Quantum computing &AI and Google’s USD 10bn India Digitization Fund;

- Defense and Security – GE and Jet Engine manufacturing, QUAD, Terrorism convergence, Indo-Pacific economic and security arrangements; Nuclear energy co-operation

- Economic growth, bilateral trade (doubling to USD 190bn in 2022 from 2014) and investment, clean technology investing; acknowledging Air India’s order for 200 Boeing airplanes and Boeing’s MRO set up in India;

There was also an acknowledgement of the soft power, higher incomes and the rising influence of the Indian diaspora, now ~2.7 million in the US, second largest after UAE. Indians are amongst the higher income generating migrants across countries.

A study done in 2022 had found 25 Indian origin CEOs in the S&P 500 higher than that of China. Indians are also visible and present in US political system. We see a similar trend in other large Indian diasporas of UK, Canada and Australia.

About ~200,000 India origin students study in US universities at any time. US Secretary Blinken has recently noted that Indian origin people accounted for close to a third of all immigrant led start-ups in the United states.

India and US thus have many deep connections: cultural, family, economic, defense and the democratic ethos.

However, when we see from a perspective of trade, corporate activity, and investments, there is so much more scope to enmesh India and the US.

On bilateral trade, although the numbers are rising, India is far from being the preferred trading partner of the U.S on the goods front. US is India’s largest export destination. But India is far lower in rank as an importing nation into the US. This is clear opportunity for Indian exporters.

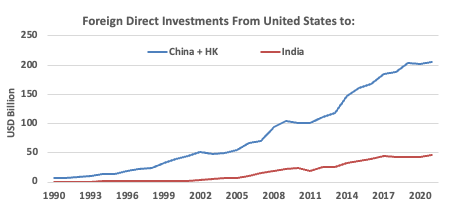

India is also not the largest US FDI destination. China and HK over the years have seen much higher investments by US corporations.

Since 2000, China has received 6X more Capital in Foreign Direct Investment (FDI) and 3X more in Foreign Portfolio Investors (FPI) than India.

US Corporations and Investors have also invested more money into China than India over the last 30 years. India should now be the recipient of these flows as US investors avoid China.

Chart 1: India needs US Corporations to ‘Make in India’

Source: US BEA, Annual Data till 2022

The top manufacturing firms from the US invested a great deal of time, money and management resources into making China a global supply chain.

The US firms invested as greenfield FDI, picked up stakes in Chinese companies, drew up sourcing arrangements and partnered with the local Chinese ecosystem.

We see an opportunity to do the same in India. Many US corporations are already present in India but on a small scale. Few have sourcing arrangements. Few have made standalone FDI investments.

Most are in India to cater to the Indian consumption market. While that is a growing opportunity, however what India would like to see is US corporations manufacturing and sourcing in India to export to the world.

The latest example is Apple. Not only are they looking to sell a portion of their Indian manufacturing within India, they intend to make India their global base for the I-Phone and scale it upto 25% of overall production and export to the world.

India needs Many such Apples to meet its growth, employment and income aspirations. The US may not be interested in a bilateral free trade deal, but as the Indian foreign minister said in a recent interview, ‘there are different ways to skin the cat’.

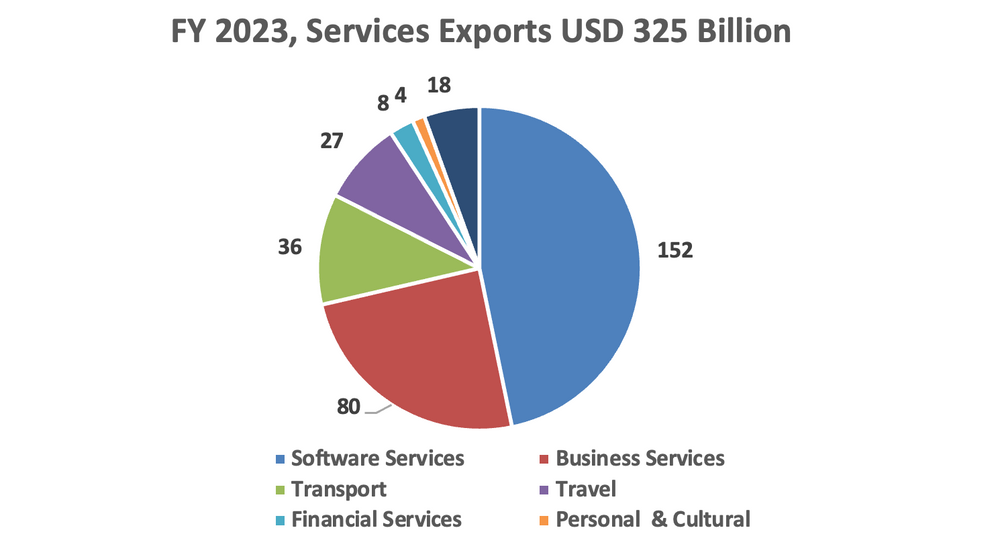

Where India seems to be succeeding for now is in Software Services and Global Capability centres

Chart 2: India exports more Software than Saudi Exports Oil

Source: RBI, Annual Data as at March 2023

India now has a ~11% share of global services trade, as compared to less than 3% of Global merchandise trade. Of course, a large population, educated in English has been a big reason for the success of services over merchandise trade.

India’s IT services exports as listed of ~USD 150 billion is India’s largest sunrise success story of the last 3 decades. ~55% of that software exports go to the US. US Corporations, foundations, universities and the government have been the biggest driver of Indian IT services.

Business services, (R&D, consulting, accounting, technical and trade related) have been another large success story. It started off with call centres and today has some centres which are the cutting edge of global technology and innovation.

India now has more than ~1500 global companies who run what is known as ‘Global Capability Centres (GCCs) in various parts of India. It is estimated to account for USD 46 billion in revenues and employs directly over 2 million people. US businesses account for a large portion of these GCCs in India. Many US corporations may no be manufacturing in India, but may have some part of their R&D, services or back office being run out of an Indian location.

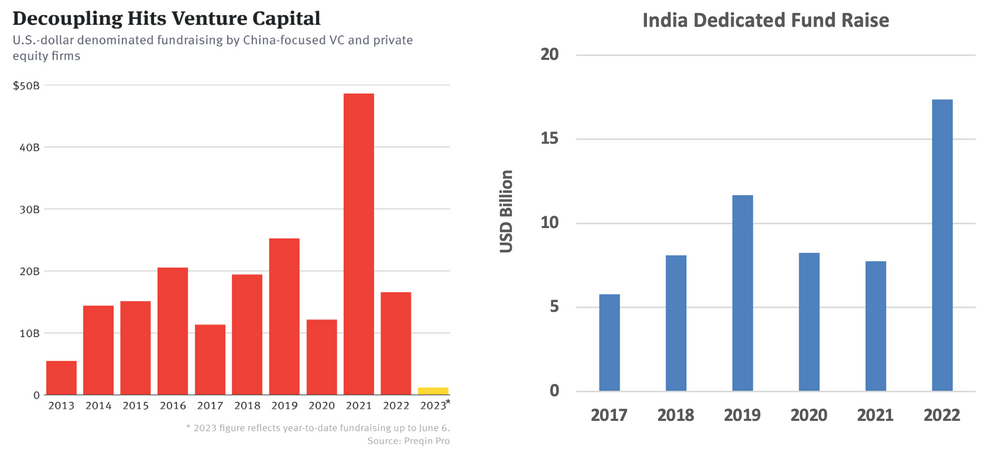

The other success has been in Private Equity and Venture Capital investments.

As we showed in our INDIA to TINA insight piece, US Private Equity and Venture investors have made a dedicated choice to invest into India.

Chart 3 and 4: Silicon Valley has pivoted to India from China

Source: Preqin, Bain capital, IVCA – EY report. Chart 4: Annual Data till 2022

In public markets (equities and fixed income), US investors are by far the largest investors in India as a reported destination. As of July 2023, of the ~USD 700 billion in market value investments, US investors account for 40% of those investments. That amount is only USD 275 billion.

Given the large assets under management (AuM) of US pension funds, university endowments, foundations and asset management companies, we should see the india allocation to increase over time.

As we have been highlighting, that needs investors to have a dedicated India allocation. Just as US corporations begin to think of India as their strategic markets, US investors will also benefit by thinking of India as a strategic long-term allocation with a dedicated weightage to India.

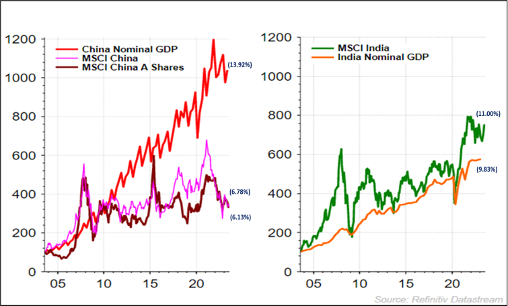

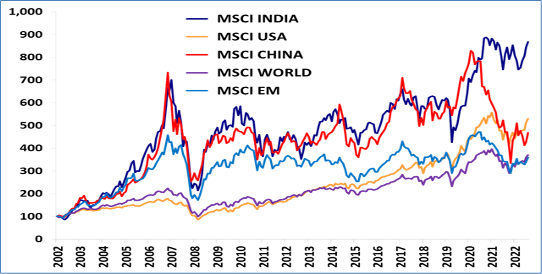

Why Does India perform better than China?

Source: Refinitiv DataStream, All data in USD, GDP data is quarterly till Dec 2022, Index data is monthly till July 2023, GDP data is Quarterly, MSCI Indices is monthly, Data in numbers are %CAGR

- Trust in Indian Institutions like Reserve Bank of India (RBI), Securities Exchange Board of India (SEBI), Stock Exchanges + a supportive Ministry of Finance;

- Stability: Policy-making in India in general, and for capital markets in particular;

- Lower involvement by Government of India in financial markets and economy. No threat in India of an Alibaba like takeover by Chinese Communist Party (CCP);

- Better corporate governance and superior business management skills of Indians and thus of Indian corporations – as reflected in number of India-origin CEOs in Multinational Corporations.

Why are US investors not investing as much capital into India?

- Unnecessary Long-Term Capital Gains Tax on Foreign Portfolio Investors

- Unnecessary Withholding Tax on Interest on Indian Bonds

- Tax Department attitude: Guilty until proven innocent

Annexure: Global Investors are under-invested in India and are missing out on India’s stellar returns

Source: Data in US Dollars, Rebased on Dec 2002; Data till Julu 2023; MSCI Equity Indices