"China and India are fellow travellers sharing weal and woe in a common journey." Mahatma Gandhi

India became independent in 1947, Mahatma Gandhi was assassinated in 1948 and in 1949 the Communist People’s Republic of China was proclaimed.

The Mahatma never visited China but his famous quote above noted the contemporary similarities between these two geographically huge, populous and poor countries. He felt both were embarked on a similar journey, punctuated sometimes by triumph and sometimes by tragedy.

Well in reality China did not follow the same democratic path as India. Though economic, social and other developmental metrics were more or less similar for the three decades after their mutual rebirth, China’s reforms under Deng Xiao Ping in the 1980s catapulted its transformation into the global powerhouse it is today, a pivotal economic and geopolitical player in the World. India’s own reforms, which started a decade later, have also transformed its economy but it is still far off being a powerhouse, never mind an aspiring superpower.

China became the late 20th and early 21st Century’s ‘factory of the world’ absorbing and assimilating the best of global technologies in manufacturing for exports, while also building domestic physical infrastructure in an unparalleled economic expansion. For example, the rolling out of the most extensive network of high speed rail, powered by trains which were faster than the Japanese and European equivalents on whose knowhow they were based.

China is now the world’s largest economy on a Purchasing Power Parity (PPP) basis though still 30% behind the US in nominal GDP. It is also the largest contributor to global growth. India has recently overtaken its erstwhile colonial power the UK in nominal GDP to take the fifth spot but is still only a quarter of China’s size despite their similar populations.

It is therefore no surprise China has attracted substantial foreign investment and its capital markets, which simply did not exist in their current form in the 1980s, have become so important. These markets are now truly distinguished from many other Emerging Markets in liquidity, sophistication and depth. It is both a producer and consumer of commodities and a price giver rather than price taker, unlike many other developing countries.

So it also fitting that it should be increasingly recognized by the World’s Institutional Investors as a standalone asset class alongside the USA, Europe and Japan. China is already the largest proportion of key emerging market indices – 35% of MSCI EM while India is at 11% - but it is increasingly being given its own weighting while also figuring heavily in global indices, augmented further by Chinese companies listed overseas.

And then there was ESG...

Source: Bloomberg

Environmental, Social and Governance (ESG) parameters have become increasingly important over the past few years in the face of climate change concerns and the increasing desire of savers in the rich world to know their money is not being spent in ways they do not like.

This year it became clear that, like China’s high speed trains, Chinese policymakers run on their own tracks and choose their own direction of travel. The control room, and the controller, are in Beijing Central. For example, the recently announced but apparently unexpected reforms of its education sector knocked billions off the value of companies servicing the huge market for home tutoring and Education Technology, some of which had listed on the once welcoming but increasingly China-unfriendly US markets.

Similarly, despite global opprobrium, China’s internal security measures have become increasingly stringent in recent years as evidenced in Xinjiang and Hong Kong. The ramp up of its surveillance technology has also undermined faith in China’s cutting edge telecom hardware exports as countries scramble to find other 5G makers, fearing embedded spyware. A perceived lack of transparency and openness in delving the origins of the globally disastrous Covid 19 virus in the Central Chinese city of Wuhan has become another serious cause of concern.

Then there is the vexed issue of carbon emissions and China’s continued reliance on Coal and Oil to fuel its growth, albeit alongside substantial investments in renewables and a stated commitment to reduce its huge carbon footprint. For ESG investors there is a real conundrum, exemplified in the supply chain for many of the world’s solar panels which starts in factories in Xinjiang province. How do you square the circle of investment opportunity when the E and the S are structurally misaligned and the G is opaque at the very least?

So if China has somewhat shocked the World and rocked its investment boat, is it now time to get more on board with India, perhaps seeing it also set sail as a standalone asset class for the world’s investors.

Well India has its own set of issues too. For one, the economy has been badly impacted by Covid and the badly handled lockdowns and medical response across the country. There have been various policy own goals in India too – including a retrospective tax law that caught a number of multinationals with big bills to pay on their India investments – but some, like the tax law, have been modified after international pressures.

Unlike China though its stock markets have been around since 1875 and its legal system, while slow and ponderous, is much more transparent. India’s stock markets have been roaring ahead recently in spite of the economic challenges, creating stretched valuations for many of India’s leading companies. This demand for shares – from domestic and foreign investors alike – has also fuelled a boom in IPOs that recently saw food delivery app Zomato oversubscribed 35x valuing the company at around $12bn. The recent earnings season has been disappointing, perhaps unsurprisingly, but this did not seem to matter for Zomato which has yet to turn a profit.

India also has a mixed record on Corporate Governance. Some of its most prominent industrial groups have not always prioritized minority shareholders nor fully fulfilled their environmental or social obligations. An increasingly comprehensive regulatory regime is forcing change, however, and corporate Boards where, for just one example, the independent Directors are not genuinely independent are increasingly called out by analysts and investors. There are also many examples of companies which have always had high ESG standards, including some of the biggest names in India’s world leading IT service companies.

On the Environment, India faces the same problem as China on replacing coal and, legitimately, reminds the World it is inequitable to expect poorer countries to shoulder the same burden of carbon capture. After all they are starting from a much lower per capita base in Greenhouse Gas (GHG) emissions and are entitled to aspire to growth in the same fashion as Developed countries. It also has big problems with pollution and water scarcity, remaining reliant on an increasingly erratic Monsoon just as the World warms up.

The question is whether India can take advantage of its twin dividends of Demography and Democracy. The Indian population is young, while China’s is aging – one of the reasons for another policy reversal there with the recent abandonment of the one child policy. The democracy is established, providing outlets for voter choice and free expression – though some may argue this gear is in neutral at the moment if not sliding into reverse.

Significantly, as the Zomato IPO demonstrates, it is seen to be on the cusp of an IT enabled ecommerce revolution. This at a time when the Government has committed to significant and much needed investment in physical infrastructure too as well as labour and land reforms designed to make manufacturing in India much more attractive. India should stand to benefit from diversification in global supply chains away from China which in turn could create more job opportunities for its growing young population and give another leg up to its established middle class. It has many world class companies, large and small, in both the old and new economies.

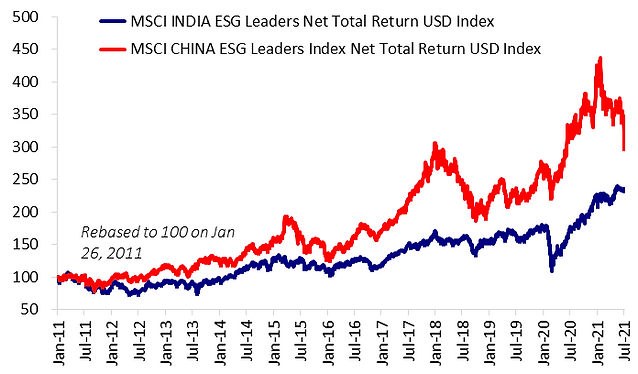

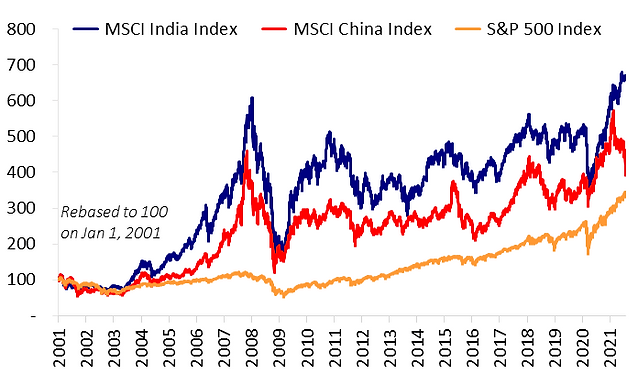

By way of illustrating both the journey for both countries’ investors since the start of the 2000s for the whole market (chart below) and since 2011 for ESG (see the chart above). In spite of the headlines, and a sharp drop for Covid, India is ahead over China and, perhaps surprisingly, the S&P 500 too, over the last 20 years. On ESG – and recognizing no choice of index is perfect – it is behind but look at the directions of travel.

Source: Bloomberg

Returning to Mahatma Gandhi’s original quote perhaps it is more prophetic than it at first appears. Both countries may well be on a similar journey, just on a different timescale. Indian trains may not move as quickly as Chinese ones, but they still get there in the end. Finally, it is not China or India but China and India. Both markets should be seen as standalone asset classes and both examined closely for the veracity of their ESG credentials.

Important Disclosures & disclaimers

1. The stocks/securities discussed in this article have been featured purely for illustration purposes. This is not a recommendation to buy or sell any stock.

2. All information provided in this article are updated as of July 31, 2021, unless otherwise stated.