After a challenging year for ESG investing in 2022, marked by setbacks and declining interest, the focus now shifts to 2023. The recent wave of extreme weather events serves as a powerful reminder of the climate crisis, spurring a renewed emphasis on sustainability and driving course corrections in ESG strategies for the year ahead.

The world's commitment to sustainability and climate action underwent significant change in 2022. The momentum that had been building over the previous few years, accelerated by COP26 quickly waned in response to the impending energy crisis. Although that was reasonable, climate sceptics took advantage of the situation to oppose environmental rules, ESG investments, and the global warming agenda. However, the recent extreme weather events serve as a powerful reminder of the climate crisis we continue to face; 2023 may possibly be the year when sustainability driven by piling climate evidence influences sensible decision-making.

Let's examine some ESG trends of 2022 and see what course corrections can be made in 2023.

2022 ESG Trends:

ESG took a back seat

The post-Cold War era came to an end in 2022, geopolitics returned, the forced energy transition to net zero had its first energy crisis, and environmental, social, and governance (ESG) investing got out of favour. All these events marked the end of an era of illusions.

Investor attitudes post the COVID-19 outbreak was influenced by ESG concerns and perhaps, falling energy prices. Attitudes changed as the price of energy or natural resources started to rise again. This merely serves to demonstrate that when an investor's portfolio underperforms, their concern for societal and environmental issues takes a backseat. Investors seem to have a short-term focus and are not committed to resolving the climatic challenges, leaving their portfolios vulnerable to shocks in the long run.

Large withdrawals, a market drop and reclassification of funds

The global sustainable finance market has grown over the past five years from being a niche product to more than 1.5 trillion dollars in assets under management last year.

Additionally, hundreds of billions of dollars have been invested in equity and debt exchange-traded funds with an ESG focus. Until last year, the market for sustainable financing was one that was expanding.

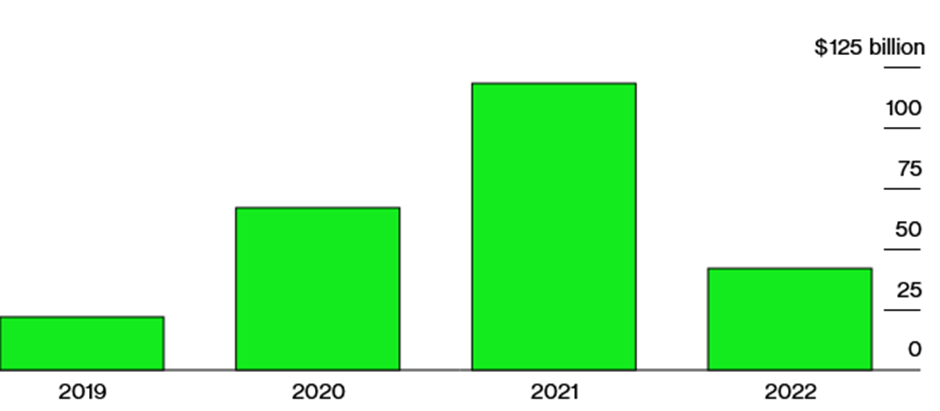

More than $ 330 billion [1] assets under management in ESG funds, around $130 billion capital was poured into exchange-traded funds with an emphasis on environmental, social, and governance in 2021, a five-fold increase over the inflows of just two years prior. The number of new investments in 2022 may be less than $50 billion, which is significantly lower than both 2020 and 2021.

Chart 1: Inflows into ESG exchange-traded funds, January through November, by year

ESG-focused exchange-traded funds have experienced outflows as a result of ongoing efforts to stigmatise ESG, particularly from US activist investors, regulators and politicians focusing on large asset managers.

Currently, not even the largest asset manager in the world is immune, and a key global alliance for climate finance (Glasgow Financial Alliance for Net Zero) is being left behind by a near-peer. In response to political and rhetorical pressure, others might follow suit.

European initiatives to quantify ESG and sustainable investing standards have forced realignment of sustainability tags to reflect fund strategy. According to a Morningstar Inc. assessment, the downgrading of Article 8 funds may potentially have an impact on $4 trillion worth of assets and result in the loss of the ability to brand a product as ESG or sustainable. In the Q3 CY 2022[2], 280 funds changed the SFDR status, of which 41 funds were downgraded from Article 9 to Article 8 and more are expected to follow t suit. Although this stringency was necessary, this may lessen investor interest in additional allocations in the short run.

The so-called 'greenium', or discount to conventional investments, that green investments benefited from has vanished in 2022. In the future, sustainable markets might feel a little frostier, particularly the debt and credit markets.

Declines in ESG Funds Are Happening During the Most Uncertain Time. A case of overpromised and underperformed?

The top ten ESG funds by assets have all experienced double-digit losses, with eight of them suffering declines that were more than the 14.8 percent drop in the S&P 500. The laggards include BlackRock Inc's US $20.7 billion iShares ESG Aware MSCI USA exchange-traded fund (ESGU) and Vanguard Group's US$5.9 billion ESG US Stock ETF (ESGV). More than two-fifth of the assets of most funds are invested in equities of software, semiconductors, and internet services. This year has been particularly difficult for the once-high-flying technology sector due to rising interest rates, worries about inflation, and the potential for a US recession.

Chart 2: ESG Fund's performance versus S & P 500 in 2022

For most ESG funds, there is almost no to low allocation to sectors like oil and gas, power, metals etc which were the positive contributors of the index outperformance. Sectors like Technology, Healthcare where ESG has a higher allocation underperformed. Had it been a broad-based index performance, it would have warranted the criticism of ESG investing that we see today. Given index performance was skewed towards non ESG sectors and growth style suffers from interest rates hardening, ESG will overcome this cyclicality and make a comeback.

A similar macro backdrop impacted performance for the Quantum India Responsible returns strategy which underperformed its benchmark by -4.9% and the Nifty India ESG Index by 0.1% last year. Poor performance in the technology and consumer goods sectors of the economy, which are given more weight in the strategy, was mostly to blame for the underperformance. The performance was further hampered by the outperformance of sectors like oil and gas and utilities, which have a greater environmental impact and have no allocation in the strategy. Despite the underperformance last year, the strategy still stares at an outperformance since its inception basis.

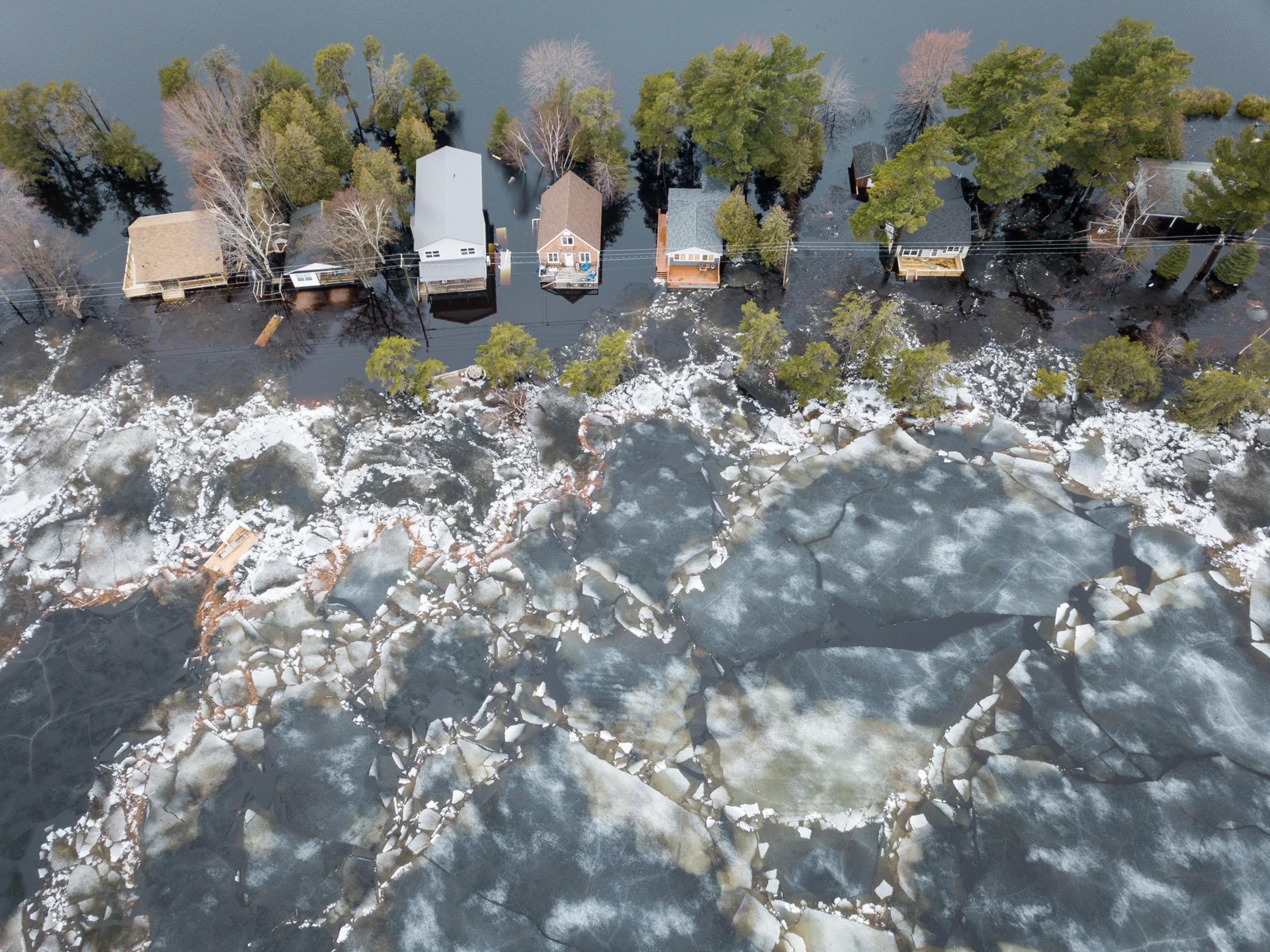

Severe climate events of 2022

As the impact of climate change becomes more catastrophic and dramatic, 2022 was a year in which numerous records for extreme weather events were broken.

Winter storms in the US at the end of December led to loss of lives, property, and assets. And as we write this report, a series of deadly and destructive storms continued to hammer California, as the drought-stricken state grapples with the sudden onslaught of a very wet January.

The year also saw severe flooding that destroyed Pakistan's infrastructure and submerged a third of the country. According to the World Bank, the overall damages were more than $14.9 billion. The longest and most severe drought on record is contributing to a worsening food security problem in Somalia, Kenya, and Ethiopia. Ten million children and over 20 million other people require food and water assistance. In Europe, an untamed fire scorched a record-breaking 700,000 hectares. The combination of heat, dryness, and wind exacerbated Europe's energy crisis by reducing hydropower generation by about a fifth across the continent and preventing some nuclear plants from operating at full capacity to prevent rivers from becoming overheated by the cooling water released by the plants. The list is endless and includes storms in Africa, cyclones in Madagascar and Mauritius, heat waves and storms in the US, typhoons in Japan, drought in the UK, and more. It is obvious that the cost of climate-related disasters remains significant even in the absence or with minimal regulation.

2023 ESG makes a strong resurgence with emphasis on :

Ways to advance common ESG standards,

increased regulations, and transparency,

reviving interest in ESG with more economic stability,

and make biodiversity becomes more embedded

Over the next 30 years, it is predicted that the world will need to invest an average of $3.5 trillion annually to tackle climate crisis. As a result, the demand for ESG investments won't go away, we will as always see a resurgence, perhaps post an environmental shock.

Profit and sustainability are interlinked. The "single materiality" of ESG ratings-the effect of the changing world on a company's profits and losses, not the other way around-underlies the selection of ESG funds. ESG ratings have failed to assess a company's influence on society and the environment. With further evolution like the COP 15 in Montreal discussing biodiversity and standard setters working towards a standardised framework for ESG disclosures, investors and asset managers will be able to assess and contrast the firms based on their impact on the environment and society.

Moving past the misunderstanding and exaggeration surrounding ESG investing that obscures its true potential, numerous public firms in the EU have already been required to measure non-financial factors, and the SEC has recommended making public corporations in the US measure carbon emissions. At the same time, regulation of ESG ratings is likely to result from scrutiny. These are constructive changes that will improve the standard of non-financial inputs to stock valuation.

Since carbon emissions must be reduced at an unprecedented pace (about 7% annually for the foreseeable future), regulatory action must switch from input-based disclosures to outcome-based repercussions. As a result, reduced carbon solutions will attract investment and innovation.

U.S. investment in climate technology is up more than 200 percent year over year between the first half of 2020 and the corresponding period last year, with deal size quadrupling. It will need innovative public-private collaborations that have never been attempted before to transition away from fossil fuels in hard-to-reduce industries like buildings, steel and aluminium production, and air travel. Therefore, it may be a tactical choice to temporarily forego ESG investment during brief periods of inflationary pressure and volatility but doing so permanently is not a wise option.

Despite being oversold, ESG investing is not the "devil incarnate." Let's concentrate on establishing suitable limits for capitalism and allowing the finest market innovators to contribute to the resolution of our global problems and the advancement of planetary welfare.

[1] ESG: 2021 Trends and Expectations for 2022 (link)

[2] Morningstar SFDR Article 8 and Article 9 Funds: Q3 2022 in Review (link)