Women's representation on India's board has been mere tokenism with regulations bringing about a change by force.

“Women hold up half of the sky”- Mao Zedong

Another Women's Day is in the offing, yet gender equality continues to remain a question.

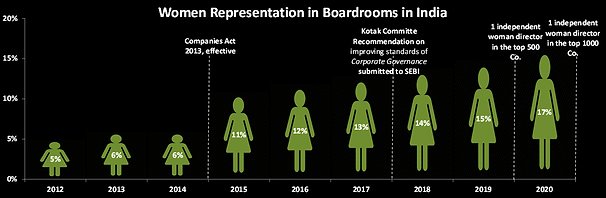

The Companies Act, 2013 and the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 accepted the Kotak Committee's recommendation on diversity to have at least one woman director on the board of directors of every listed entity in 2019.

Yet, women are still struggling to break through the glass ceilings that keep them out of the boardroom.

Even before the regulatory changes to improve gender diversity, be it in leadership roles, on the boards of companies or in the labour force, women's representation in India was mere tokenism. Going back to 2010, the number of women directors was just 5.5%. [1]

Data Source: IiAS Research, NSE info base (Corporate Information Database, nseinfobase.com), Quantum Research, 2021

A deeper analysis shows that most of the companies (~60% in Nifty 500 Index) have only one woman in the board of directors in 2020 [1]. Certainly the gender quota isn't considered as a long pending need yet.

Interestingly, companies with women managing directors have equal gender representation. However, such companies can be counted on the fingers of one hand.

The disparity in women representation is yawningly large across sectors. Sectors such as healthcare, telecom, consumer goods, and construction have a relatively larger share of women directors while mining, metals, banking and finance have a relatively smaller share of women directors. Furthermore, when it comes to making it to the corner office, the number is extremely low.

Globally, the picture is not strikingly different. The average share of women directors in developed countries in 2019 was 27.4% while that in the developing countries, the share was 15.1%. The mandatory requirement has become an advantage for India to stand out among other developed Asian countries. [2]

An extensive research studies suggest that women representation can be financially rewarding. Even the International Monetary Fund study stated that larger share of women in higher positions leads to significantly higher return on asset, as much as 8-11 basis point incremental addition. [3]

The regulations bring about the change by force. However, to go beyond companies just ticking the box, it is necessary to have a mind-set and cultural change. Across countries with or without gender quota, the importance of gender diversity is only recognised by the companies when prodded by legislation and rarely on their own.

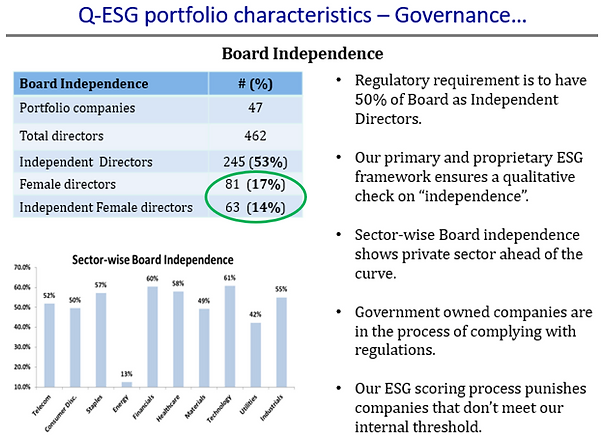

ESG investing is an avenue to evaluate and allocate to companies who are proactively trying to make an attempt towards improving board independence. Quantum's offering on ESG incorporates qualitative check to ensure independence at board level and women participation in true sense and not just a tick mark.

Source: Quantum Advisors

- Source: NSE info base (Corporate Information Database, nseinfobase.com)

- OECD Gender Data Portal

- International Monetary Fund Report -“Gender Diversity in the Executive Board - Draft Report of the Executive Board to the Board of Governors”, 2016