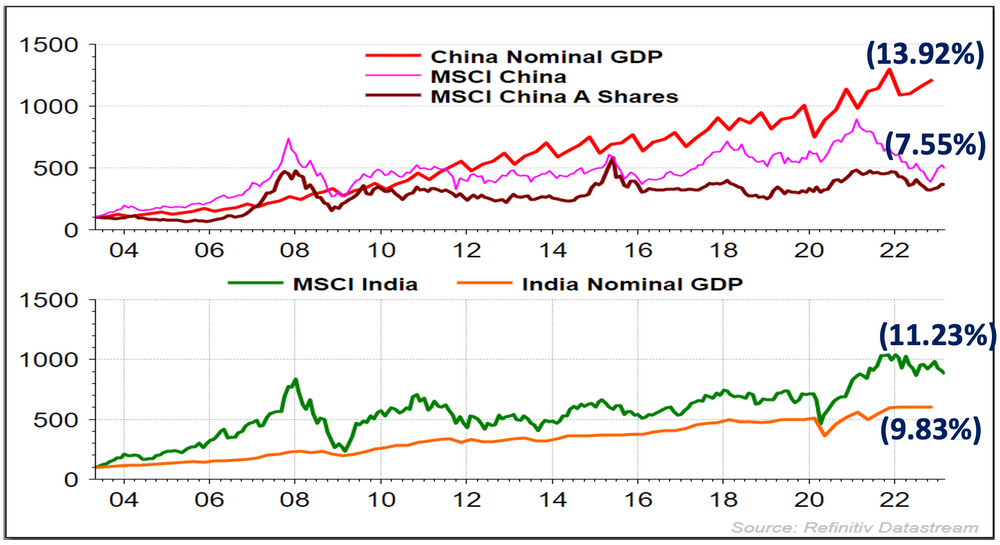

Mesmerized by the Chinese dragon many investors have been comfortable leaving India in a generalist “emerging market” bucket in their allocation. The allocation was usually GEM + China with a few venturing to invest in other single countries. Given the large and growing size of the Indian economy and the opportunities it provides for investment, one would have expected investors to seriously look at a dedicated India allocation. Moreover, India has a historical track record of growth in GDP translating in returns in stock markets (Chart 1). However, the crackdown on businesses in China, particularly in the technology sector erased significant chunk from their market value and have again led investors to shy away from single country mandates. Consultants advising Global investors after facing the music from clients for the China exposure are also reluctant to recommend another single country like India. This is a lazy view and is doing injustice to their clients.

Chart 1: India GDP Growth Reflected In Equity Markets

Source: Refinitiv DataStream, All data in USD, GDP data is quarterly till Sep 2022, Index data is monthly till April 2023

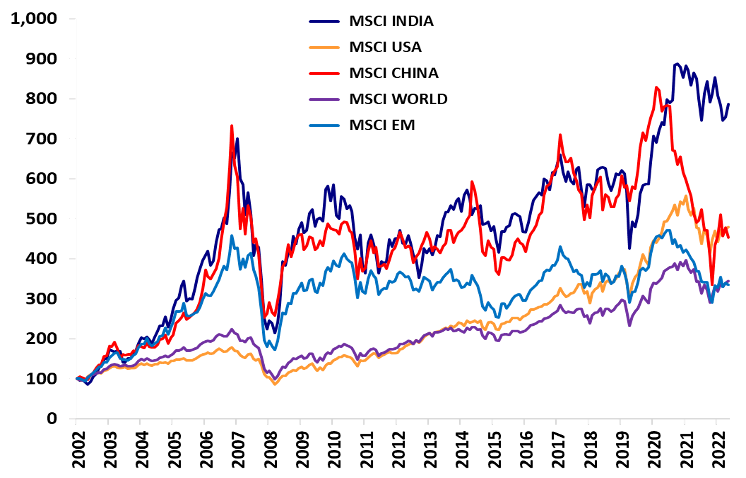

Chart 2: Under Allocation To India Has Hurt Investors

Source: MSCI Indices, 20-year data; rebased to 100 from December 2002 till April 2023

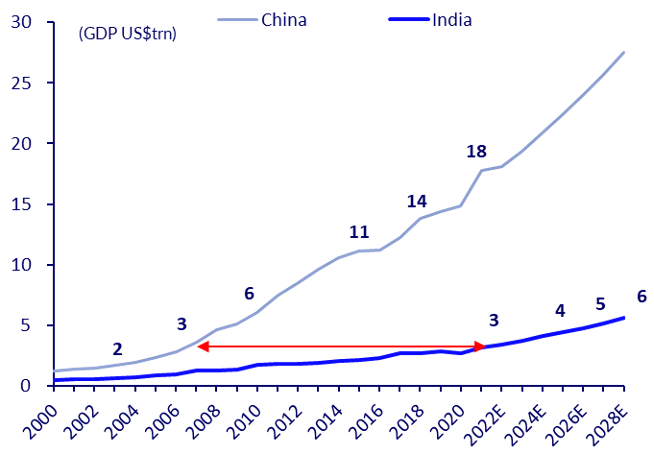

India, with a GDP of US $ 3.5 Tn is where China was in 2006 (Chart 3). With a young population of median age 28 vs 39 in China, India not only has the potential to grow at 6.0%-6.5% in real GDP terms over next two or three decades but is also poised to be a large consumption market.

Chart 3: India Today where China was in 2006

Source: IMF

China caught the tailwind of global exports driving GDP growth which may no longer be an opportunity. India may not match Chinese growth rates. However, India has focussed on developing its domestic consumption market and with many people entering the labour force domestic consumers will be the primary driver of GDP growth which is expected to be far superior over the next few decades versus any large global economy.

The population is not only young, but also digitally savvy making it feasible for India to solve many of the bottlenecks it conventionally faced; Delivery of public goods and services, health care to name a few. It is to cater to this population plus the need to de risk dependence on China that is making large companies such as Apple, Samsung and other MNC’s to tap into Indian market.

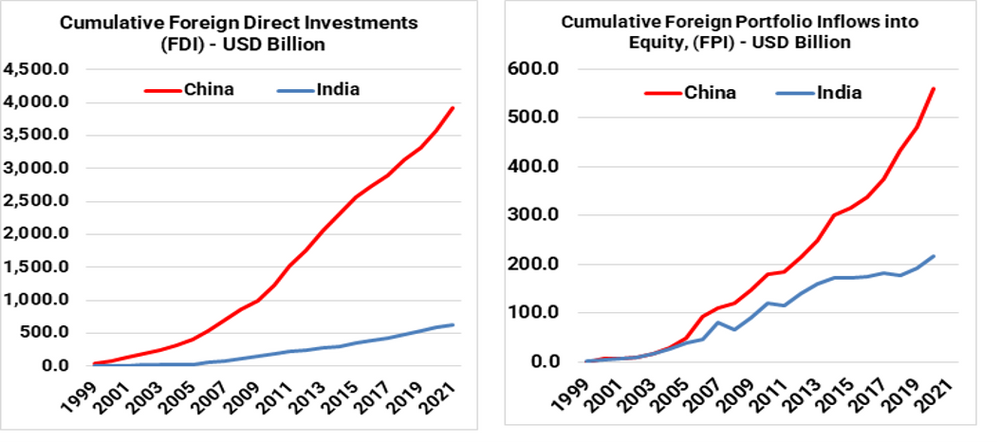

Chart 4: Foreign companies and investors will pour out their love for India

Source: World Bank, Data available till 2021

In addition to attractive demography, and a large market, India offers a superior regulatory framework along with a robust democratic system. Unlike China where the policies are almost decided by an individual and therefore susceptible to his whims and fancies. India remains a messy, unruly democracy with city, state and national objectives not always in sync – much like the US. The Government remains one of the largest litigant but like in most democracies the courts at all levels regularly rule against the government. Administration in India is decentralised: Finances and power are devolved from the Centre to the States and from States to Local governments. The legislators at all levels are democratically elected.

While the Modi Government does show some “Strong Man” tendencies, it is unlikely that India follows the path of China, Russia and Turkey. There are issues of corruption and challenges in education, healthcare, job creation, skilling to name a few – but there are also honest efficient officers, politicians and institutions at various levels that work towards delivering the growth.

India has its fair share of uncertainty for foreign investors who are not familiar with the cronies and their control over policy making. But generally, these are well known names, and a prudent manager should be able to identify and avoid investing with these cronies.

Indian stock exchanges too over time have consistently gained significant depth and settlement systems are world class, making large allocations easy to absorb (Table 1).

Table 1: Evolution of Indian Equity Investing Landscape

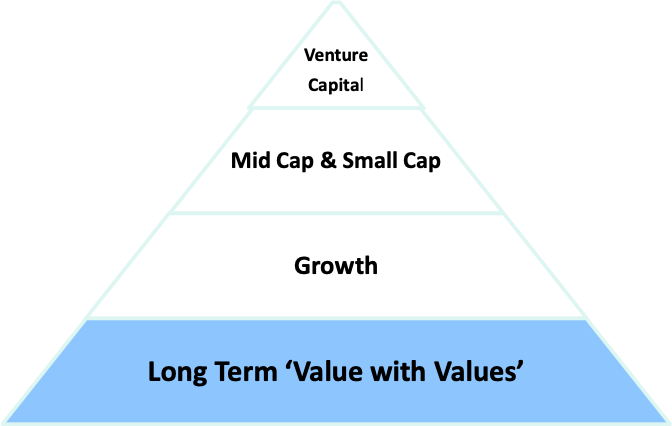

Chart 5: Liquidity, Governance and Valuation should be the base on which to build your India allocation

Source: Quantum Advisors

We thus reemphasise that, just like the multinationals, portfolio investors must have a more balanced “GEM + India” approach to building their long-term investment portfolios. We believe that the next 20 years offers an attractive opportunity for long term strategic allocators to create significant wealth from an India-dedicated mandate in an economy where growth is structural and broad based.