Market expectations for the new government offers new realities and challenges to value investors.

From a stock market perspective, the Modi fever continues unabated. Ever since the historic win in the recent elections, the markets have valiantly reached successive peaks driven less by factual actions and more by Great Expectations.

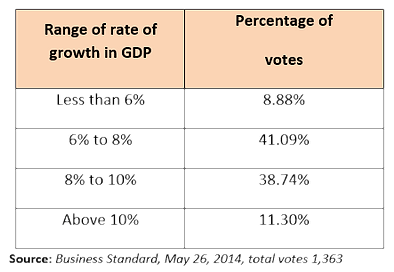

An online survey (Table) suggests that 50.04%, a tantalising slim majority but a majority nonetheless, expect Prime Minister Modi's economic policies to result in India achieving >8% real rate of growth in GDP over the next 4 years. Given that India is at a sub-5% level of growth - and the global environment is what it is - that is indeed a lofty (but not impossible) expectation.

Table: What will the GDP growth rate be during 5 years of Modi’s rule?

A new reality

These are certainly testing times for a disciplined value manager. On one hand there is the reality of a poor operating environment in which the companies in the portfolio are currently operating in. On the other there is the expectation that this operating environment will improve dramatically with - as the covers of The Economist, a magazine, indicate - some pretty strong expectations.

And while all equity investors by definition have optimistic expectations, our challenge is that the prevailing expectations of Ram Rajya (a goldilocks sort of environment sprinkled with some spirituality) is something we have not been able to digest as an “expected given”.

Needless to say, there is the not-so-subtle question of what sort of managements are likely to do well in this new Ram Rajya: will it be an India powered by meritocracy or will it be an India powered by the hypocrisy of crony capitalism? The kind we had under the mis-rule of an intellectually bankrupt Congress.

As investment managers with an “integrity screen”, that matters a lot. If the operating environment favours the well-connected as opposed to the entrepreneurial, it could lead to lower cash levels (we may be buying the declining shares of the entrepreneurial) but with a risk of “under-performance”

.webp)