On 15th August 2022, India celebrated 75 years of being a free country since ending British colonial rule in 1947. Though India boasts a civilization with recorded history of over 5,000 years, India, as a modern nation state, is very young.

Despite rumours of its impending death over the past 75 years, India is humming along. It has handled the pulls and pressures of diversity in culture, religion, language, and political thought to remain a vibrant democracy.

While much is to be done, its steadily growing economy has helped bring millions out of poverty. The next decade will determine the success of India’s social challenges of strengthening the democratic institutions, raising the quality of education and health, improving the standard of life for the bottom 20% of its people by providing opportunities for job and income creation.

Unlike its immediate neighbor’s and much of the ‘emerging markets’ India (currently the world’s largest democracy and fifth largest economy) is on course for a real rate of growth of > 6.0% p.a. in GDP and a nominal growth of 11% to 12% p.a. - for at least another decade. This should make India to being the third largest economy behind China and the USA.

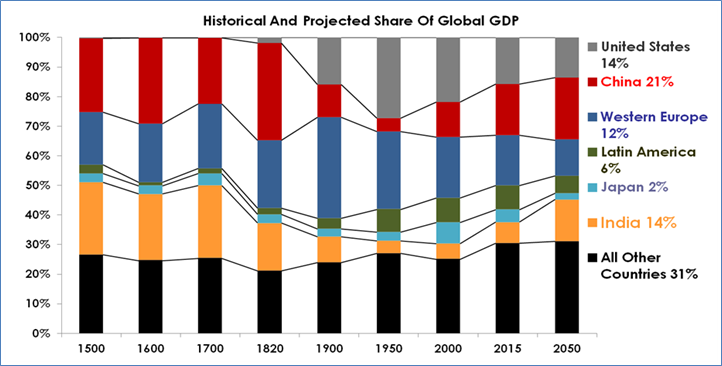

Chart 1: India will take its rightful place in the World

(Source: Angus Maddison, University of Groningen, Quantum Advisors)

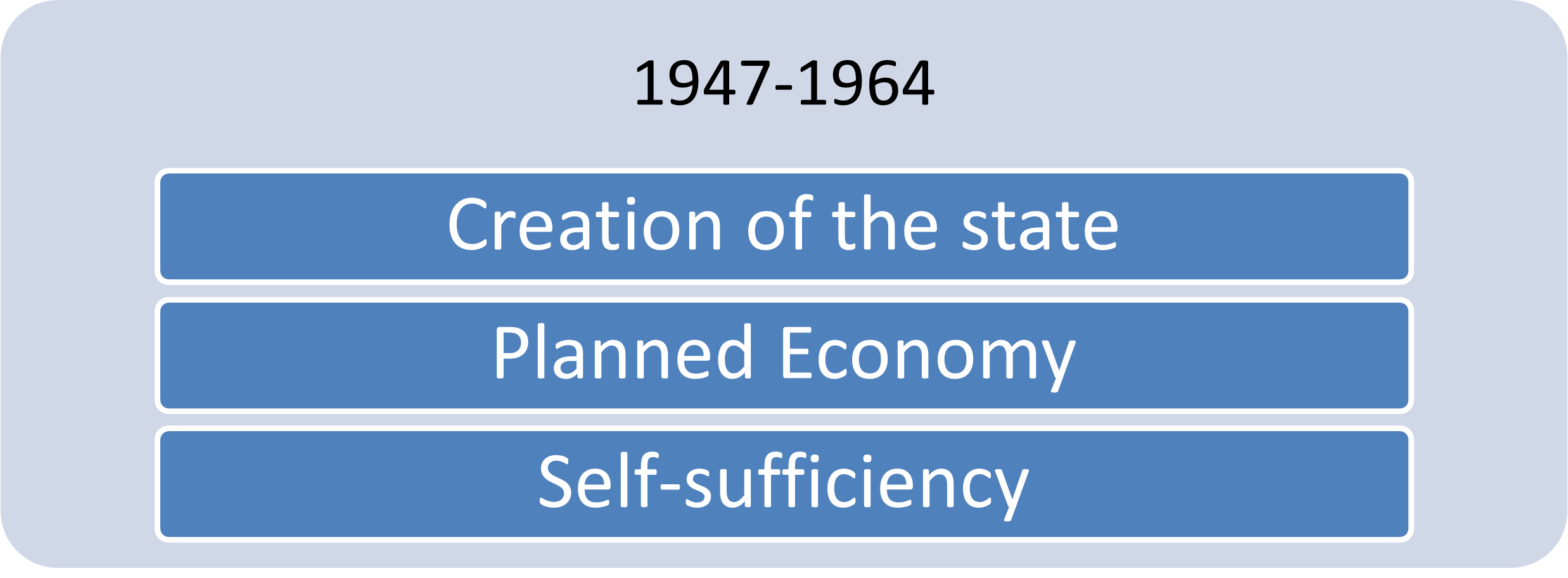

1947-1964: The Role of the Founding Fathers

India has had long history of fighting the British rule before it got independence. However, the second world war and the destruction it left in Europe meant that the British could no longer afford to rule over its colonies and had to retreat. The war and the famine left India in shambles. Britain had de-industrialized the economy, incomes were low, and the economy had stagnated.

The founding fathers prioritized political freedom for its population by enacting a liberal, democratic constitution in 1950. Economic freedom though remained elusive for many decades. India adopted what was then known as ‘mixed-economy’ with the public sector undertakings (PSUs) playing a large role. India’s first prime minister, Jawaharlal Nehru, called the setting up of the large ‘national champions’ in the public sector as ‘Temples of modern India’ and wanted them to seize the ‘commanding heights’ of the economy.

India also adopted the Russian style ‘five-year plans’ to manage and control resources, production, and consumption. Although, many institutes and corporations of immense importance across science, technology, engineering, and education were created and India held much promise in the years to come, but economic and geo-political situations meant that India withered away.

Wars with Pakistan and China in the early 60s drained its resources, drought and famines and the dependence on imports for food consumption dealt it a severe blow.

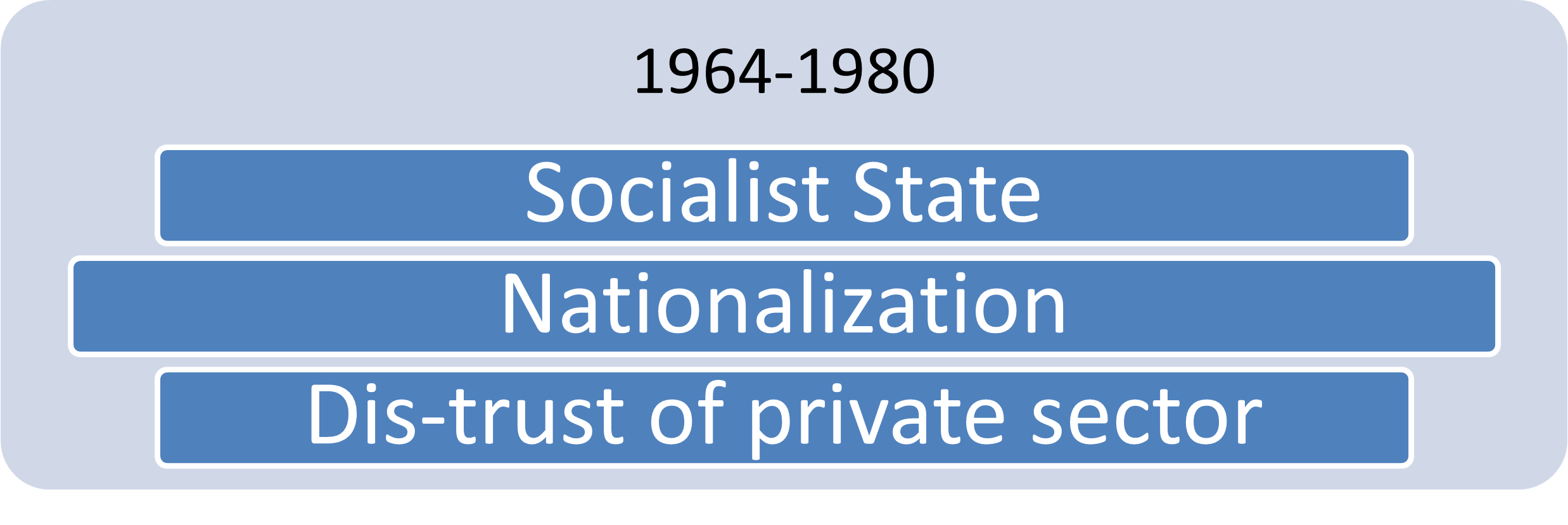

1964-1980: Geo-political choices that shaped India’s destiny

The decades of the 1960s and 70s is generally seen as the period India lost its way. India also lost two of its prime ministers, Jawaharlal Nehru and Lal Bahadur Shastri in quick succession. Although, geo-politically India remained ‘non-aligned’, however India was seen as being part of the Russian orbit as compared to the western axis of US and UK. From an open, socialist state, India became a closed economy.

Successive drought had necessitated imports of wheat from USA in what was known as PL-480 food transfer. The fall in the economy and lack of foreign exchange forced the reserve bank to devalue the rupee sharply in 1966 to boost exports. The US slowed down and then ceased their food exports. India had embarked on its ‘green and white revolution’ to boost its staples and milk production. Today, we are the largest milk producers and in most recent years, face a problem of surplus grains, milk and horticulture. India also nationalized its banking and insurance industry in 1969.

It was the 1971 war with Pakistan to liberate East Pakistan, what is now Bangladesh, which shaped India’s closeness to the Soviets over Americans. The Nixon-Kissinger administration embraced Pakistan in their quest to reach out to China. Naturally, the Americans supported Pakistan over India in the 1971 war. In fact, at the behest of Kissinger, Nixon ordered the US seventh fleet into the Indian shores to thwart India’s fight in the eastern front. India sent an SOS to the Russians who sent its submarines to push back the US and UK navy. India did not choose the Russians. India was denied arms and strategic support by the Americans which gave us no option but to seek help from Russia.

The subsequent increase in oil prices not only increased inflation but also reduced India’s closeness and economic importance to the Middle east as well. In the 60’s, the Indian rupee was the official legal tender in the middle east. The ‘petro-dollars’ generated through higher oil prices meant that the middle-eastern kingdoms gyrated towards America and its markets. To assert its independence, India also tested the nuclear bomb in 1974 inviting further wrath of the western world.

The stagnating growth, rising inflation, a court ruling dismembering her from the parliament and domestic opposition led Mrs. Gandhi to declare a ‘state of emergency’ in June 1975 to hold on to her political power. Elections were held in 1977 in which she was decimated and for the first time a ‘coalition’ of opposition parties came together to form the government. (This form of coalition government will become more of a rule than exception in the next 4 decades. See chart 2)

Although, that government didn’t last long and lost power in 1980 when Mrs. Gandhi came back to power, it did make a major impact on Indian economy and business. The MNCs operating in India then, were basically given three choices – 1) shut down and go back; 2) if they continue, they will have to dilute their stake at a deep discount and list their shares on the Bombay Stock Exchange (BSE) and 3) cut down their operations and work as branch of the parent company. Many MNC’s left, notably, the Coca-Cola company and IBM. However, many stayed, and that sparked a key interest in investors getting the opportunity to own blue-chip MNCs shares at a deep discount. This sparked one of the earlier bull-run at the BSE in what was otherwise a bad decade for India, politically and economically.

However, the long outcome of an independent political democracy with limited economic freedom and adverse geo-political choices, meant that India in first 30 years of its existence did not achieve its potential. Real GDP growth averaged 3.5% and per-capita incomes grew at less than 2%.

1980 till now: many right choices, steady reforms over the last 40 years

The initial set of reforms in the 1980s were all about the government not being hostile to the private sector. They began allowing more freedom to private enterprises to function. Non-resident Indians were also allowed to buy shares on the stock exchanges and to invest in Indian companies. The reforms picked up pace under the Rajiv Gandhi government from 1984-1989, supported by his finance minister V.P.Singh and with the setting up of technology commissions in sectors like – telecom, water, literacy, immunization, dairy and oil seeds. They also cut import duties, tariffs and taxes on high growth sectors.

It was though the 1991 reforms which took the large steps to provide economic freedom to India’s citizens, enterprises, and investors. India was on the verge of an external payment default. It desperately needed foreign exchange. It had no option but to ask IMF for a bail-out. The IMF had very clear prescriptions as conditions for the loan. India had no choice but to accept those conditions and thus began its integration with the western world.

Berlin wall falls, Soviet-union collapses, India looks west to provide economic freedom to its citizens

On 24th July, 1991, Manmohan Singh, the then finance minister, ended his budget speech by quoting Victor Hugo, “‘No power on earth can stop an idea whose time has come’. I suggest to this august House that the emergence of India as a major economic power in the world happens to be one such idea. Let the whole world hear it loud and clear. India is now wide awake. We shall prevail. We shall overcome"

The means to achieving that ‘idea’ was not earth shattering. It was simply a move by the government getting out of the way of individuals and private enterprise and allowing them the freedom and choice to invest, produce, consume, import, export. It was also about creating institutions which will allow private enterprise to work freely under a framework of consumer protection and rule of law.

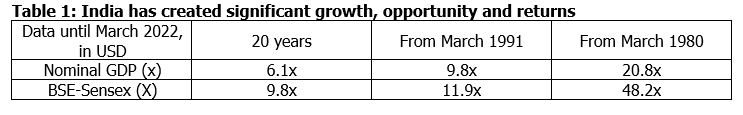

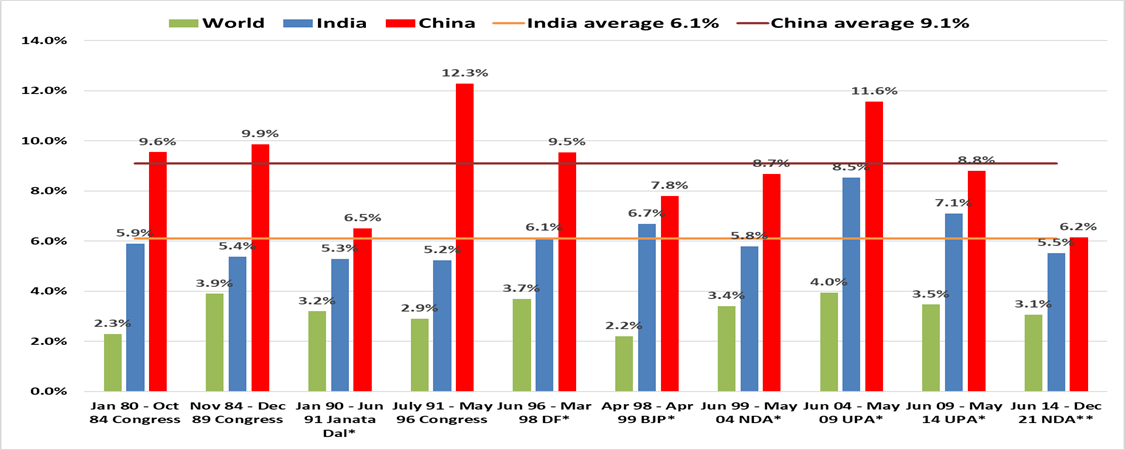

Of course, as with many things with India, it is a work in progress, however, there have been significant achievements. The Indian GDP growth since 1980 - despite coalition governments with left, Centre and right ideology; despite prime ministers being assassinated; despite floods, famines, droughts; despite wars and sanctions; despite financial and geo-political crisis, scams; despite INR devaluations; despite high/low oil, commodity prices and interest rates – has averaged above 6% in real terms and in double digits in nominal terms. The growth has also reflected in stock market returns. (see charts 2 and 5)

Chart 2: Steady reforms across governments has meant India can continue to grow at 6%-6.5%

(Source: worldbank, India loksabha, Data till December 2021)

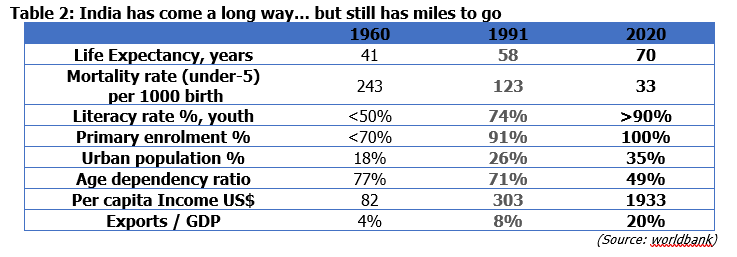

India has also witnessed marked improvements in the standard of living and other parameters important from a human development perspective.

India has been referred to as a flailing state. Good intentions, some successes, but the implementation and the quality at the ground level has its failings. At the same time, if we see the recent COVID vaccination drive of over 2 billion shots; distribution of free food grains reaching ~200 million households; Unique ID (Aadhar) to over 1 billion people or the Jan-Dhan yojana (bank accounts for ~400 million un-banked Indians) does suggest that, if driven well, India does have ‘state capacity’ across Centre, State and Local governments to implement at scale.

Table 2: India has come a long way… but still has miles to go

India: Democracy, Non-aligned, Political Stability, Rule of Law, Open for Business

Democracy provides checks and balances. India is not a geo-political or strategic threat to any other nation. India has had a steady blueprint of reforms carried out by various governments over the last 40 years. It does not matter which government is in power. India’s judicial system may be slow, many compliance and legal rules are archaic, but its institutions, be it the courts, its regulators and its markets follow a stated and somewhat predictable ‘rule of law’. India is welcoming to foreign investors – be it in direct investments or portfolio investors. Public Equity, Private Equity, Venture capital, Infrastructure, Real estate and now even the Bond market is open, investable and are large enough to absorb long-term capital from global corporations and investors.

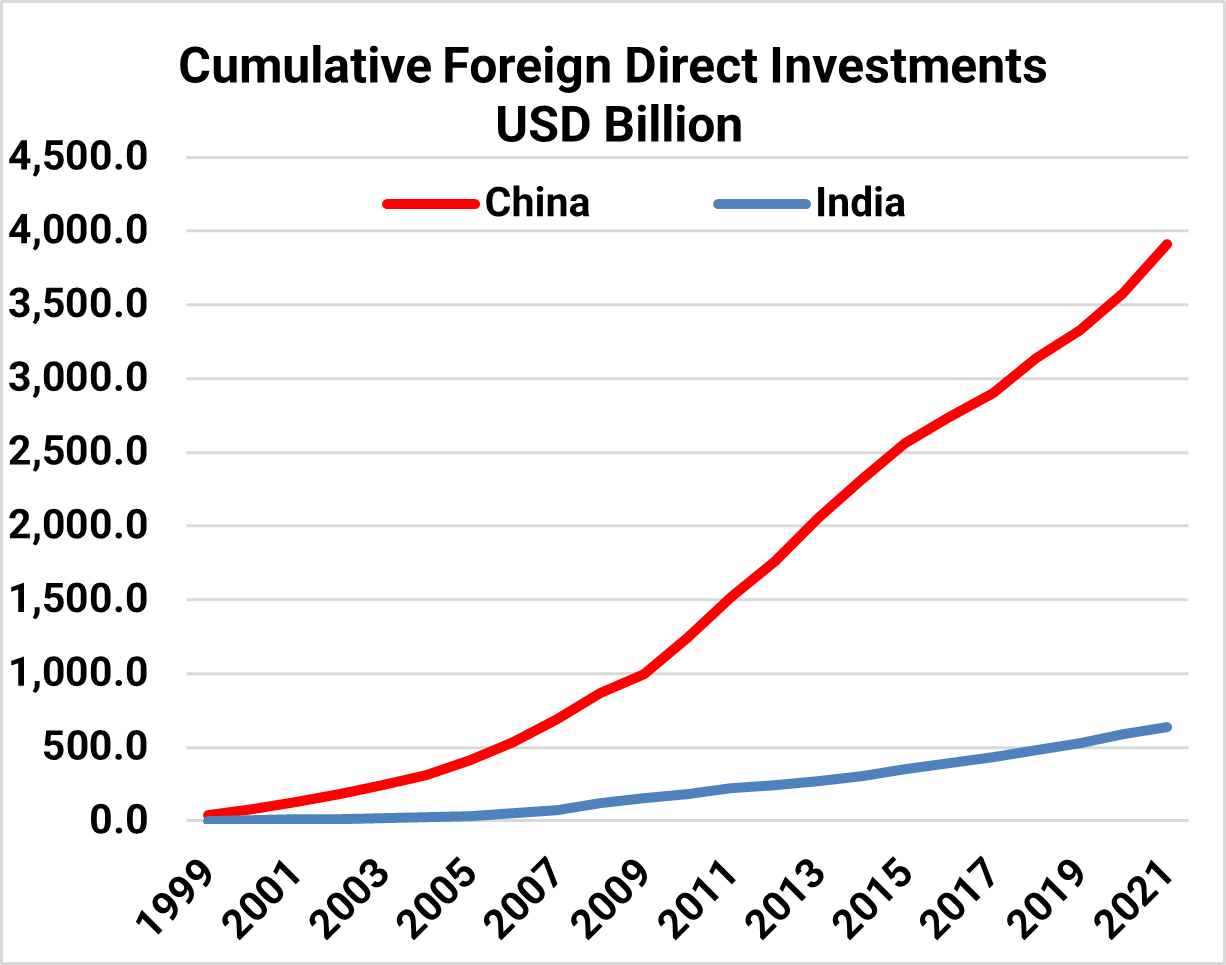

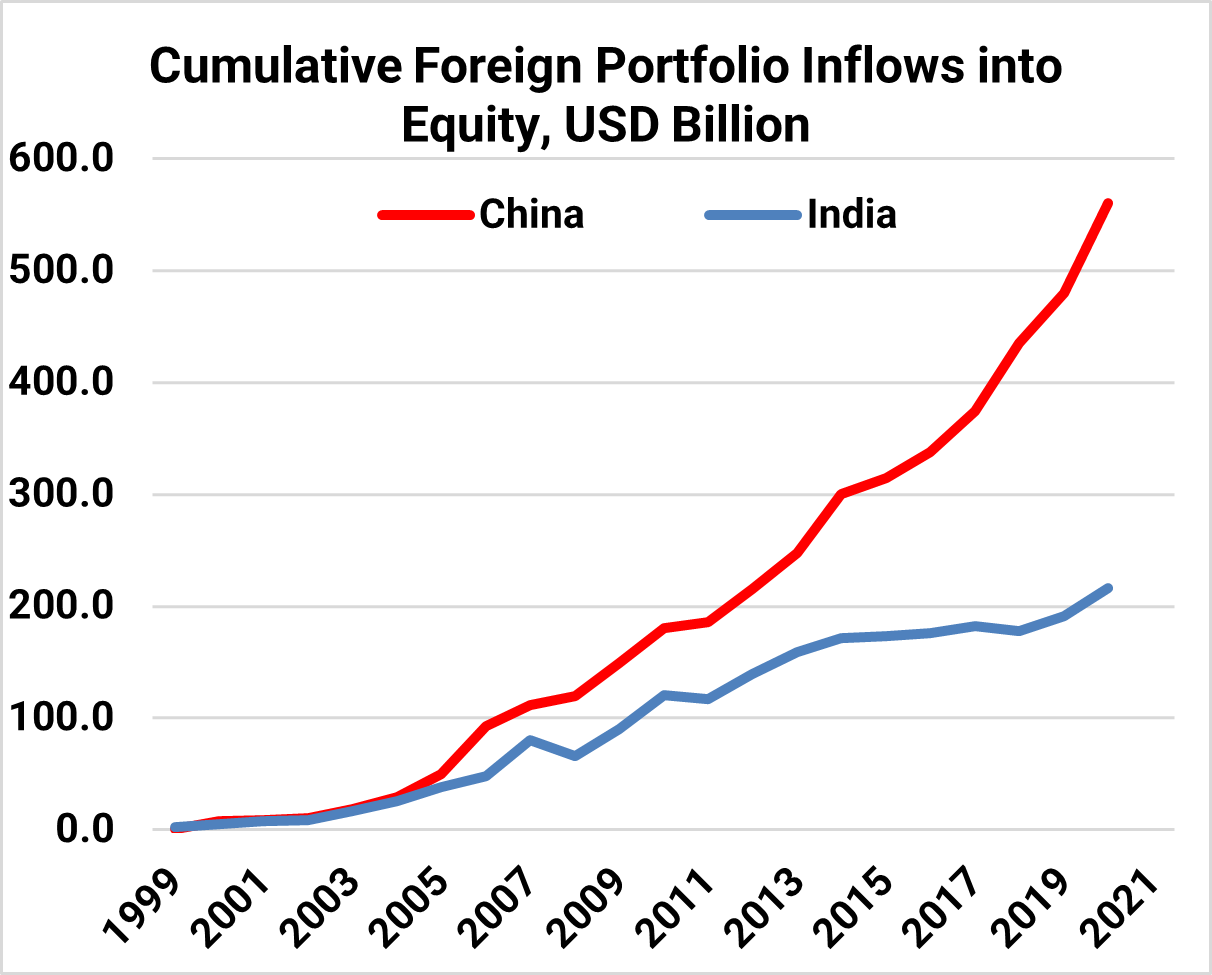

Chart 3 and 4: Will Global Corporations and Investors pour out their love for India as well?

For the last three decades, foreign capital, from the western world, has poured into China. The Chinese growth engine created opportunities and attracted investments from global corporations and investors. There was hope that China, despite being a one-party communist rule, will not only integrate into the western liberal rules-based world order but will also be open to all forms of trade and investment. This has obviously not happened. On the contrary, the relationship has become adversarial. Over the last 5 years, the altercations between Trump and Xi, the recent actions on companies by the Chinese government on sectors which had significant western funding and the on-going tensions with Taiwan, is leading many to question, whether China is investable?

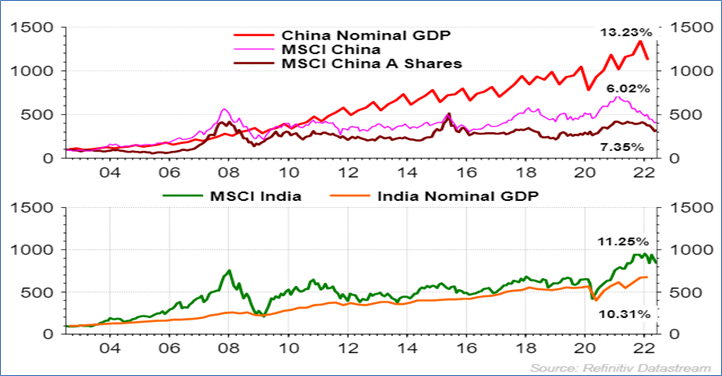

Be that as it may, investments into China have also not been as successful, especially in the public equity markets. The returns from its public equity markets have not been commensurate with the GDP growth that the economy has reported.

Chart 5: India Economic Opportunity is Reflected in Market Returns

Source: Refinitiv DataStream, All data in USD, GDP data is quarterly till March 2022, Index data is monthly till June 2022

The India story always had its dose of opportunity and risk, most of them will remain true over the next decade as well. Over time though, the nation has taken more right steps instead of wrong ones. India may have missed the East Asian growth miracle. India, as we have shown is not China as well, in growth, as well as in geo-political and strategic terms.

However, in today’s risky geo-political environment, reminiscent of the cold war days, India may well be that destination which provides any strategic partner – be it a country, an MNC or a global investor – a framework which runs on a democratic principle, with rule of law and provides the stability in actions necessary in a long-term relationship.

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 21 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

UK related important disclosures

- The content of this presentation has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this presentation for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This prsentation is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this presentaton is only available to these persons or entities and no other person or entity should rely on the contents of this document.

- The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this presentation and any investment activity that may be engaged in as a result of this presenation. The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this presentation would be as specified in the respective client agreements.