Demographic Dividend is defined as the economic growth potential that can accrue from changes to population structure and fertility rates. An increase in the working age population and a fall in fertility rate, are two measures which suggests that an economy is entering into such a phase.

For eg: When the share of the working age population (commonly used as age 15-64) to the total population crosses above 50%. As that happens, more of the population is in the workforce and a lesser share of people (ages 0-15 and 64 and above) are dependent on the work force for livelihood support.

Similarly, when the Total Fertility Rate (TFR - live births per women) starts falling, women have more free time to join the workforce as compared to spending time on raising the children and looking after the family. Lower TFR, for instance, below 2, would also mean that the births and death rates are almost equal and the population no longer grows.

Source: World Bank; Age Dependency Ratio = % of population of ages 0-14 and above 64 / % of population of ages 15-64; TFR = live berths per women; Mortality = infant deaths in the first year per 1000 live births

Economies which undergo this phase of rising share of working age population, falling fertility rates, lower mortality, and rising life expectancy tend to see an improvement in labour output. As the health and education levels improve, you tend to see an increase in productivity. This combines to add to economic growth. The economy thus sees a sustained rise in income, investment, and savings. A Demographic Dividend.

Almost all countries go through this phase. We have seen this much before in the 1500/1600, where India, China had large populations and commanded a large share of Global GDP. Over time, as its relative share of population and human development was upstaged by other regions, its share of global growth fell. In the 20th and 21st century, we are again seeing the rise of China and India, due, a lot to demographic developments.

We have also seen a similar phase with Korea, Japan and other east Asian Tigers which grew on the back of demographic and productivity enhancing changes. However, the sheer size and scale of China and India, has large economic, social, political, and geo-political impact.

This Demographic Dividend though does not last for eternity. Given it is bound by age profile, a country on an average has about 35-40 years of extremely favorable demographics in which it would like to grow from a low-income country to a medium/high income nation. All countries get this demographic profile, however very few take advantage of it structurally.

(Source: Worldbank, Economic Times Article)

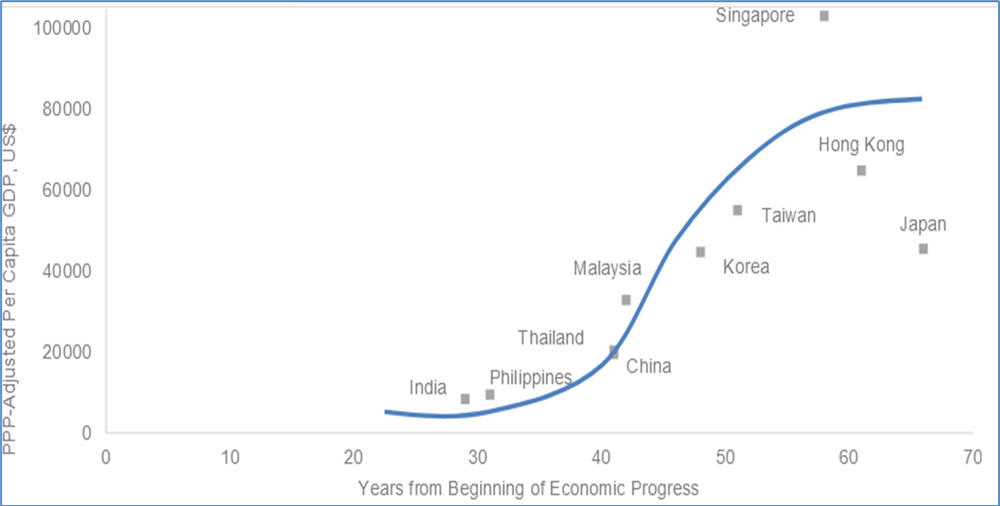

The Asian economies by and large have managed to create the policies, build the infrastructure, improve the health and education levels, attract investment and thus have moved their societies from a low income to a high income.

India will hope to ride along the 'S' curve

(Source: MorganStanley Research)

The Dividend: A Large consumer Market Beckons

India is a Billion+ people now, but a large part of its population has low incomes. India yet thus does not have the consuming, saving and investing power.

Over the next 25 years though, It has the potential to become a country with a Billion plus Consumer, Saver and Investor.

Source: ICE360, Middle Class Brochure, 2022; Quantum Assumptions and Estimates on number of households and share of income in households

In the next 10 years, assuming normal growth and employment, India may have 26 million households (~107 million people) with an annual total income of above ~USD 37,500. That is equivalent to a Japan of today. That will be the size of the rich class alone. There will be ~800 million belonging to households with income of above USD 6,250. This is remarkable size and scale.

As India moves towards this size and scale, many global businesses will be willing to set up, invest and produce in India to serve the domestic market.

For instance, Apple has decided to manufacture iPhone14 from India. Apple makes about 220 million handsets every year. They have decided to manufacture about 5% of its iPhone 14 in India to begin with and may take it to 25%. Although, it will be supplied globally, what it also suggests is that the Indian market will also be large enough to be able to absorb some of that local production.

Many more segments of the economy will keep hitting critcal size over time which will encourage more domestic production and which we hope will spur investment and employment.

Well, that is critical, as we haven't seen the kind of investment that India deserves to meet its growing consumption and employment needs.

The Disaster: Where are the Jobs? - This is India's only long-term risk!

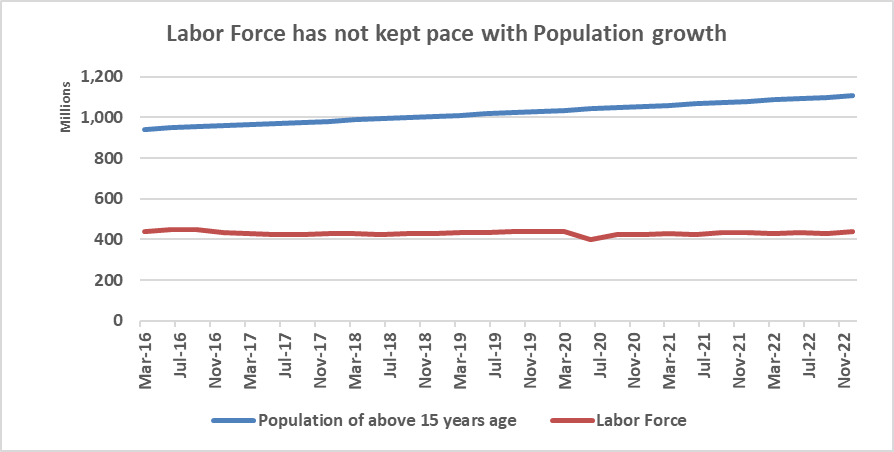

(Source: CMIE Economic Outlook)

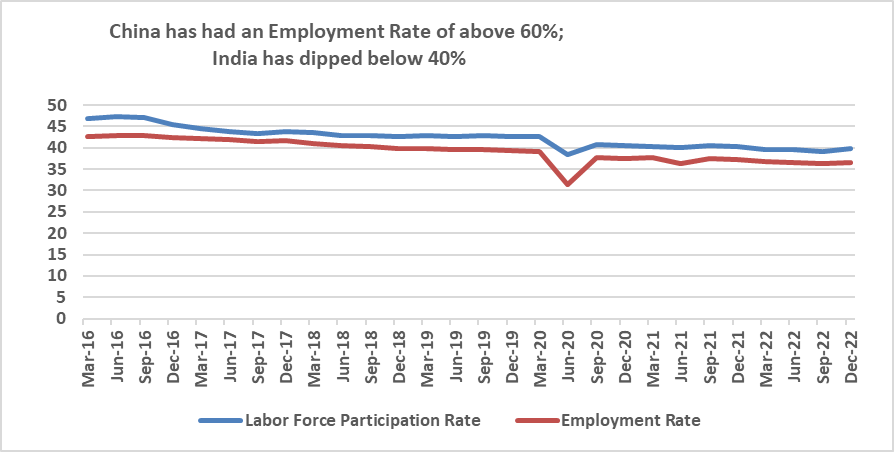

If we look at a comparable long-term chart, we see a decline in the labor force participation rate (LPFR) from 2005. For Males, it dropped from above 80 to 70 in 2021. For Females the drop has been from above 30 to 19.

This is indeed concerning. In a growing economy, a falling LPFR and a falling Employment Rate suggests that the growth is not as fast as workforce growth; the jobs created are not remunerative enough to entice women to join back into the labor force.

Source: CMIE McKinsey-FICCI report; women labor force participation is assumed to increase by 10% in 10 years; worldbank estimates India's current labor force at ~470 million

India's Demographic Nightmare

CMIE employment survey data suggests that India's employed workforce was stagnant/constant over the last six years. World Bank data shows that in the decade of 2000, when growth was by far the best on record, India added ~67 million jobs. The need to add 140 million jobs to take the economy back to a decent employed status over the next 10 years seems challenging. On top of that, there is a need to move jobs away from the farm sector into the non-farm sector. McKinsey, estimates that to be another 30 million jobs. This is a daunting task.

Source: CMIE

In a country with an average age of 28, an increasingly educated and aspirational workforce, not getting enough opportunities is a recipe for social disaster. Imagine, young people on street corners without adequate or appropriate jobs in hand.

All governments in power, be it at the states or at the Federal/Centre, will be fearful. To remain in power, the political administration will have to enable and foster the environment for faster job creation. This will remain the challenge and most politicians, the ruling, and the opposition parties, are well aware of this.

We do see some piecemeal efforts to get it going. For instance, the Centre's Production Linked Incentive (PLI) is an attempt to boost 'Make in India' and help create jobs. Over the next 5 years, the government will spend USD 25 billion in production incentives, and hopes to get an incremental output of ~USD 370 billion and help create ~+6 million jobs. The Apple production, for instancem is part of this PLI scheme. So, in some areas where there is domestic demand, it seems to be working.

India's efforts in financial inclusion and digitalization will foster innovative business at scale and thus should be another large employer. India's IT services, the new age start-ups and the gig economy based on the mobile penetration has large potential. Improvement in road, rail, and air network along with GST should improve throughput and logistics. The biggest multiplier though is in construction. Thus, the need for continuous large scale infrastructure projects. As well as real estate, commercial and residential, which tends to be a large employer.

Every Union Budget announcement; every policy speech, the only big highlight for us is whether these actions will create jobs, spur incomes and improve demand. Until then, we must watch this trend closely. It has socio, economic and political repercussions for the long-term.