We explore the moral hazards and safeguards that accompany the Jalan Committee recommendations.

In our previous article, Government nets a one-time windfall, we wrote about what to make of the INR 1.76 trillion surplus transfer and its impact on the fiscal deficit, bond markets, system liquidity and opined on how the Jalan Committee recommendations provides for a framework for the annual dividend transfer and return of surplus capital to the government if any.

In this piece, we write about whether this large surplus transfer engenders any moral hazard and does the Jalan Committee report provide for any safeguards.

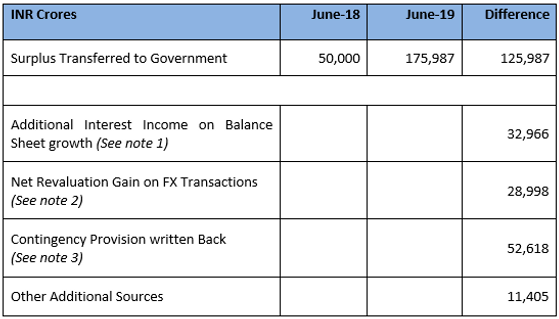

Table 1: What enabled the RBI to transfer a large amount this year

Source: RBI Annual Report ; Quantum Advisors Research

Notes to the Table

- Additional Interest Income - The RBI earns interest income on the Foreign exchange reserves and the government bonds it owns. Between July 2018-June 2019, the RBIs FX reserves went up by USD 21 bln and its holding of government bonds went up as it conducted Open Market Operations (OMO - buying of government bonds to infuse liquidity into the system) to the tune of INR 3.4 trillion (INR 3,40,000 crores). Thus the interest income earned on these increased assets has resulted in an increase in its overall interest income by INR 32,966 crores over the previous year.

- Net Revaluation Gain on Fx - The RBI has changed the accounting policy from this year on what INR/USD rate it uses to recognize gains and losses out of its FX Reserves operations. To be clear, the RBI has accumulated its pile of Forex Reserves over many years by buying dollars from the market at various USD/INR rates ranging from 40/$ to the current 70/$. For e.g, USD 1 bn bought at 40/$ valued at 4,000 crores is currently worth INR 7,000 crores in RBIs balance sheet. The RBI recognizes this 'notional' gain of INR 3,000 crores directly in its Liabilities as 'Revaluation Reserves'. Earlier, when the RBI sold the dollars in the market, it used to use the last weeks closing USD/INR rate to value the sale and hence there were no major profits arising out of the sale. That has changed from this year. The RBI will now use the weighted average rate of its inventory of Dollar holding to determine profit or loss when it sells the dollars in the market. Professor Ananth Narayan of S.P. Jain Institute guesstimates the weighted average rate of RBIs holding of USD at INR 55/$. Which meant, that the Dollar Sales that RBI made last year, at 68/$ and above, allowed them to book some profits which on a net basis amounted to the INR 28,998 crores which it transferred to the government.

- Contingency Provision written back - This follows the recommendation of the Jalan Committee to hold Contingency Reserves at a 5.5%-6.5% of the Balance Sheet. Given that the existing contingency reserves was above the 6.5% level and the Board of the RBI deciding to lower the level for this year to 5.5%; there was an excess reserves of INR 52,618 crores which was written back and paid out to the government.

Are there any moral hazards?

- Monetization: If we add up the Net OMOs; the gain from revaluation reserves and the Contingency provision written back, it amounts to INR 4.2 trillion (4,20,000 crores) of monetization support that the governments average rolling annual fiscal deficit of INR 6.75 trillion (6,75,000 crores) has received from the Reserve Bank of India over the last one year. That forms a substantial accommodation of government's fiscal accounts which a strict monetarist will view as direct monetization and thus carries significant moral hazard.

- FX Revaluation: The new accounting rule of using weighted average FX rate will lead to a situation of Revaluation gains being booked even on a similar amount of Sell/Buy of Dollars. The Sale of Dollars at FX rates higher than the weighted average rate will lead to income being realized and a buy of similar amount of dollars will restore the dollars with a net gain to the RBI and hence to the government. In a year where fiscal challenges abound, there could be a temptation to use this route to generate payout to the government.

- Lower Contingency: Like this year, the RBI may decide to leave the contingency reserve at the lower bound of 5.5% in subsequent years and pay all the excess over that as a surplus to the government. We are presuming the decision to move to the lower bound this year had some amount of fiscal considerations.

Are there any Safeguards? How do we see it panning out next year?

The Jalan committee, we believe, has provided some safeguards on the issue of surplus transfer to the government:

- Any Surplus due to the government can be paid only from retained earnings and not by using the notional revaluation reserves. But with the change in the accounting policy, those notional reserves can be easily crystalized into actual profits.

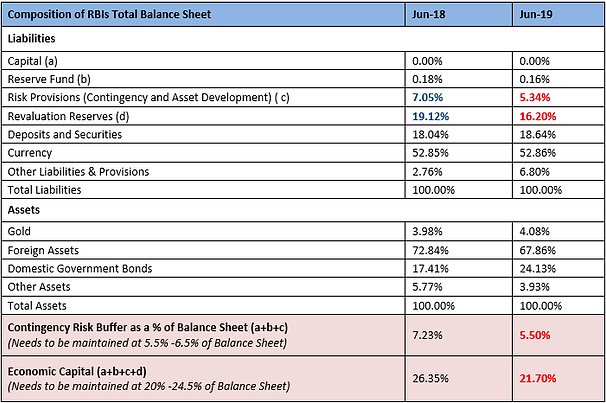

- The Contingent capital buffer has to remain at all times in a band of 5.5% - 6.5% of the RBI's total balance sheet. As the RBI's balance sheet grows by around 10% every year, given that the contingency reserves is at 5.5% of the balance sheet for this year, the RBI will have to provide some money from its profits next year into the contingency reserve to take it at the minimum back to the 5.5% level. We estimate that the RBI will have to add INR 22,500 crores to Contingency Reserve for the year ending June 2020 to keep the Contingent Capital Buffer at 5.5% of Balance Sheet, reducing the overall dividend to the government by that amount. Given that the actual surplus to be transferred this year was already high, the RBI Board should have retained the Contingency Fund at 6.5% of the Balance Sheet. (See Table 2, last 2 rows)

- The total economic capital of the RBI needs to be in the range of 20% - 24.5% of the RBI's total balance sheet for any surplus to be distributed to the government. Since a large part of this includes the Revaluation Reserves, which will fall every time the RBI sells Dollars in the market when Rupee depreciates, the RBI can allow only a INR 10,000 crore flow back from revaluation reserves into the P&L, in order to keep the Economic Capital above the 20% of Balance Sheet level. So there is an inbuilt limit to how much of the Revaluation Reserves can be used as profit in any year and paid out to the government. (See Table 2, last 2 rows)

As the table below and the points above show, the contingent capital buffer will need to be boosted next year and the economic capital itself lies close to the lower threshold. This has now made the entire exercise of capital, dividends and surplus transfer, a matter of wide debate, analysis and speculation in the area of central banking which should have been boring and uneventful.

The RBI is a sensitive institution and markets and investors over the long term do accord a great deal of significance to its autonomy and credibility. Being the monetary authority, most of its actions leads to either creation or withdrawal of money in the economy. That it is doing so in an impartial, autonomous and credible manner is important for citizens and foreign investors to be able to retain its trust in the value of the Rupee.

Table 2: RBI does not have too much excess Economic Capital

Source: RBI Annual Report; Jalan Committee Report and Quantum Advisors Research

Classification into items is as per the authors understanding and do not claim it to be accurate.

Arvind Chari is Head Fixed Income & Alternatives at Quantum Advisors Pvt. Ltd (QAPL).

Quantum Advisors is an India Based, India Focused, Investment Management Institution managing money for North American and European Pensions, Sovereign Wealth Funds, Endowments, Wealthy Individuals across Indian Equity, Fixed Income and Real Estate*.

*Real Estate is managed through Primary Real Estate, an Associate of Quantum Advisors.

Disclaimer:

- Quantum Advisors Private Limited is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and as a Restricted Portfolio Manager with the Canadian provinces of British Columbia (BCSC), Ontario (OSC) and Quebec (AMF). Registration with the said authorities does not imply any level of skill and training.. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAS. Any offering will be made only pursuant to an offering memorandum and other relevant documents that will be made available to qualified purchasers under applicable securities laws, and these documents must be carefully reviewed before any investment is made.

- Investing in shares or any asset is a risky proposition and share prices or prices of any assets can increase or decrease in value.

- Investors wishing to 'double their money' in one year or having short-term return objectives should not seek the advice of QAS as the research and investment style followed by QAS typically considers a longer-term time horizon.

- All of the forward-looking statements made in this communication are inherently uncertain and QAPL cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will”, “should”, “can”, “may”, “believe”, “expect”, “anticipate”, “intend”, “contemplate”, “estimate”, “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities laws.

- The views expressed here in this document are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Information sourced from third parties cannot be guaranteed or was not independently verified. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date.