The Ukraine crisis is a stark reminder that freedom, peace, and respect can't be taken for granted and puts the S in ESG in sharp attention.

It is an unsettling time for the world as the surreal events play out in Ukraine. With innocent civilian causalities climbing, thousands of people crossing the borders, and heart-breaking videos of barbaric actions flooding media sites, it is imperative to look at this conflict and the humanitarian crisis from an ESG-powered lens.

War should provide a renewed thrust to “Renewables”

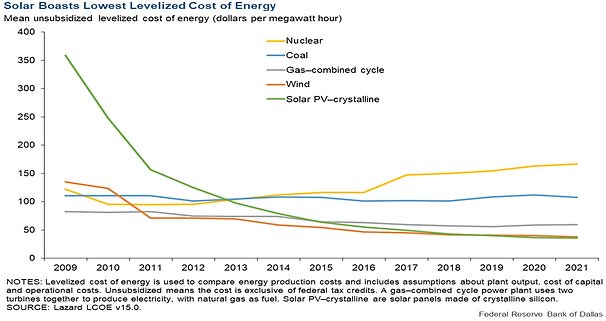

The military invasion has created a new challenge for the business community. Since the COP 26 climate summit in November 2021, ESG has taken center stage. Countries and corporates have begun to vehemently uphold the virtues of ESG. But now, given the economic uncertainty and rising cost of clean energy materials, many are concerned if this would derail the renewables band wagon. Rather, the geopolitics of oil certainly calls for reducing the reliance on fossil fuels and look for alternate sources of energy that aren't at the mercy of irrational dominance. New technologies, efficient materials and new sustainable sources of energy are the need of the hour. This is because the current renewables such as solar and wind, while promising are plagued with their own issues. Also, given the rise in oil prices, the opportunity cost of renewables has gone down considerably, giving a renewed thrust to renewables once again.

Chart 1: The falling cost of renewable energy

The War Led Humanitarian Crisis Brings 'S' in Focus

On the other hand, the humanitarian crisis witnessed in Ukraine calls for courage to act against the serial social and governance violations represented by this invasion. The sanctions and courageous actions taken by some world leaders are indeed worthy of praise. However, the majority of the world still maintains status-quo. One of the key pillars to nurture, uphold and protect sustainability is through freedom and democracy. The Ukraine crisis is a stark reminder that the society collectively has taken freedom, peace, and respect for each other's human rights for granted.

There is a ray of hope. The businesses and the stakeholders have that power to change that by refusing to trade, divesting assets, and denying finance, is one way to put all the talk into action. Like in ESG, there is an exclusion list of “sin” stocks and they stick to the principles for the greater good.

This is certainly not the first time that a crisis has exposed the limitations of narrowly defined ESG investing. The pandemic questioned the long-term sustainability of global supply chains. A few global asset managers and investors did join forces to help stop the humanitarian/livelihood crisis caused due to the Covid outbreak, yet more than 1 million people in the shipping industry were affected. Taliban invasion of Afghanistan shook the foundation of S in ESG, defied equal opportunity, especially women's rights and independence, and yet, the investment industry restricted itself from commenting as they don't or can't invest there.

ESG has to go beyond market impact and returns. It is about factoring in the growing list of global issues that have a potentially long-term implication on the market. Rating agencies downgrading the country's or company's ESG rating after the manifestation of the geopolitical crisis is an antithesis to sustainable investing. Its time ESG moves ahead of the curve and inculcates a forward-looking analysis in their investments. Deny investing in bad ESG actors and appreciate the good ones.

The war has become a defining moment for clarifying the 'S' aspect of ESG.

The social pillar test's the economy's and corporate's ability to provide its population with basic needs and exercise fundamental rights. All this warrants an in-depth assessment of the state of the human capital.

Even for businesses, ignoring the importance of workforce stability, retention of human capital, health, safety, and well-being of employees and suppliers not only will lead to a macroeconomic loss but also raise a serious question about the future stability.

At Quantum Advisors, we engage with the UK's ShareAction's Workforce Disclosure Initiative (WDI) with the aim to improve accountability and responsibility towards Quantum's workforce as well as extend the scope and learnings to our investee companies.

As large-scale migration and forced brain drain are seen in countries in crisis, it is a serious challenge for the corporates too. It triggers instability and leads to weak institutions. In the light of the humanitarian crisis seen over the last couple of years, it is crucial to assess the health and safety of the workforce on a micro-level. Qualitative checks on the workforce will flag off potential red flags and will improve the responsiveness of the investment manager instead of waking up after the crisis hits.

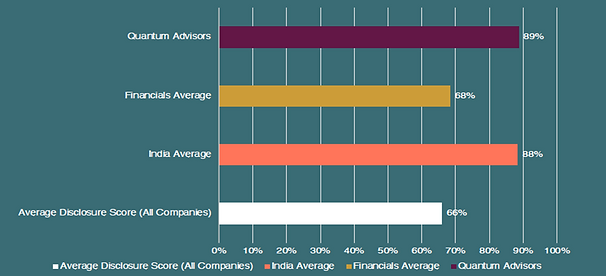

Quantum has always practiced self-assessment before advocating virtues to its prospective investee companies. In a bid to lead by example, the latest assessment of Quantum's Workforce Disclosures of 2021, has seen a sharp jump in scores and global peer ranking. Compared to the global average of 68%, Quantum has scored 89%, a significant improvement in adopting and practising global best work force practices.

Chart 2: Quantum Advisors scored 89% in WDI assessment

Our idea of being a WDI signatory was to add more value in our engagement with our investee companies. We wanted to shine a torch on ourselves, learn from our experience, improve on our disclosures and practices, and then take our experience to the investee companies.

One might question whether there is actually a need for micro assessment of human capital development and rights. It is essential to understand that be it a virus, war, or financial crisis, studies have shown that it is a contagion effect, in a matter of time, it becomes an urgent and pressing crisis with a potential to bring down the strongest of the institutions and economies. Hence, linking micro evidence with potential macro risks materializing in the foreseeable future is a non-negotiable assessment incorporated in Quantum's DNA as well as in the research process.

Using a tick the box approach in ESG investing and reacting after the crisis hits, is just another way of hog washing and seemingly cloaking under the ESG mantle. We will continue to march ahead with adopting the best sustainability practices and hold our companies to the highest standards of governance and ESG scrutiny.