India has established a goal of becoming carbon-neutral by 2070, as well as four other medium-term targets for 2030, including 50 percent renewable energy, a 45 percent reduction in carbon intensity, and a 1 billion-tonne reduction in anticipated total carbon emissions. In addition, the country released a seven-point plan for low-carbon development. However, in order to achieve its objectives, it is estimated that India will need to invest a staggering $10.1 trillion.

Although India has so far been self-reliant for its funding on environmental activities, this staggering amount will undoubtedly have to be externally funded to a large extent. To showcase its seriousness, the Indian government has placed a major emphasis on sustainability, renewable energy, and the environment in its Union Budget 2023, the amount though increasing every year remains far short of its ambition. Government will have to set a high bar on environmental regulation to create the right environment for believing India's transition to a low carbon future and mandating stringent ESG data is an initial step towards that. The Securities and Exchange Board of India (SEBI), India's capital market regulator, has mandated Business Responsibility and Sustainability Reporting for the top 1,000 corporations, which is a granular reporting framework on E,S, G parameters by Indian corporates, filling the data gap that exists today.

Furthermore, there are advantages for both international institutional investors and domestic corporations to collaborate in a country which is "ground-zero" for climate change while being amongst the fastest growing economies providing investors to participate in "sustainable growth" in a real sense. It is critical that Indian enterprises follow best practises when teaming on sustainable investing with international investors.

We keep hearing the argument that India in its current state of development can only do so much. But to attract global capital, we need to adopt the global best practices and to do so we need capital and technology. We shouldn't let this "catch 22" situation hamper the sustainability agenda, we should gear up to not only meeting the global best practices but surpass them and make it easier for investors to allocate to India. We need to understand that the global institutions need to meet certain minimum standards which if not met, it will be difficult for them to allocate. So embrace the best practices before you are forced to do so.

The same is true even for asset managers. If they want to channelise external ESG capital from institutional investors, we need to facilitate disclosures mandated overseas which may be over and above prescribed by the local regulator. We need to create the right framework for sustainable investing and reporting to facilitate the ease of decision making.

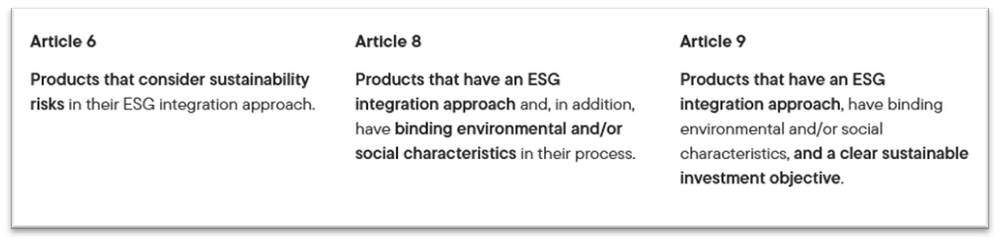

The Sustainable Finance Disclosure Regulation (SFDR), which is widely regarded as the best and perhaps most up-to-date practise for ESG disclosures, all funds are required to disclose their ESG considerations, including sustainability risks, principal adverse impacts (PAI), and accurate sustainability claims. It also establishes three investment product classifications (Article 6, 8 and 9) to assist investors in understanding different types of sustainable investing.

Classification of Products

Source: Official Journal of the European Union (link)

SFDR compliance - The first blue tick

Quantum has always been the torch bearer to bring in global best practises to the Indian markets. Quantum India Responsible Returns Strategy' officially classified itself as an Article 8 fund under SFDR regulations. Quantum Advisors initiated process to integrate with EU's Sustainable Finance Disclosure Regulation in 2022.

What really helped us to claim compliance under the remits of SFDR so quickly and easily, is our overall approach to sustainable investing. Quantum's ESG policy emphasis on identifying the principal adverse sustainability impacts at every stage of the investment process. For Quantum's Responsible Returns portfolio, a dedicated ESG team will continuously track the mandatory and voluntary PAI indicators listed below employing our proprietary research approach.

To evaluate the double materiality of various ESG variables have on a company's operations, Quantum has put in place a stringent screening procedure. Our ESG analysis is built on the concept of materiality identification and mapping. The company research includes better due diligence on ESG risks that are relevant to the investee company as well as taking into account how companies handle the identified ESG risks.

Any company that our team determines to have a significant negative impact across the provided parameters among the companies under active coverage is subject to further scrutiny. The Chief Sustainability Officer, Investor Relations, or any official who can respond to questions about sustainability will then be contacted about the concerns.

The research is not reliant on third party data sources, therefore engagement and exercising stewardship rights are the foundational pillars to validate the data and information. This includes gaining an understanding of the company's sustainability strategy and potential challenges they may face in executing it, as well as their preparedness for upcoming regulatory changes and technological advancements. It also involves researching and visiting manufacturing plants, engaging with suppliers, attending seminars and conferences, and gathering information on the company's supply chain practices. The goal is to gain a deeper understanding of the company's ESG risks and opportunities and their long-term targets and goals.

The regulator must encourage Indian managers to take the SFDR framework's robustness in order to compete with international ESG offerings, this should be the minimum threshold for reporting. This will make it simpler for investors to compare various ESG funds and help them make better investment choices.

Walking the ESG talk - The second Blue tick

While 'S' lies in the center of "ESG" as people are the ones that make execution possible, we find it being given the least priority. But for us, S stands at par to the environment and goes through as much scrutiny in our sustainability assessment. We wanted to bring global best practices to India when it came to appreciating the human capital as well. In a bid to do so, Quantum Advisors became the first signatory from India to UK's Share Action's Work Force Disclosure Initiative (WDI).

Before we mandate disclosures based on the WDI framework, we wanted to understand the aspects surrounding human capital in detail, understand the challenges for improvement and then take that experience to our investee companies to help them become better at their workforce disclosure and practices.

We ourselves, as an organisation, have gone through 3 rounds of WDI submissions. In the first submission in 2020, Quantum scored 61 on the scale of 100 and set concrete objectives and deadlines towards improving its workforce related disclosure and formalise policies wherever it was required and meaningful.

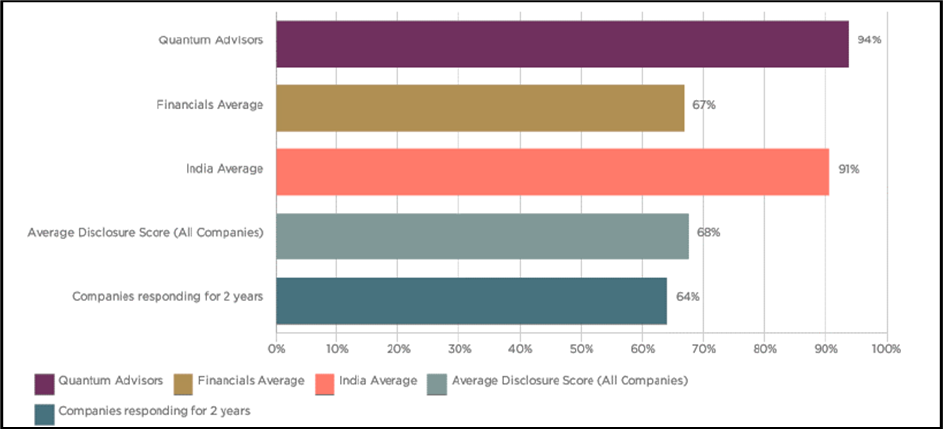

In the 2021, Quantum's score improved significantly to 88 on the scale of 100 as against the sector average of 69% and overall average of 68%. By providing clear, consistent, and transparent data, Quantum was able to improve its score. Furthermore, areas of improvement, for instance, public commitment to Human Right Policy, detailed policy on due diligence of Human Rights, granular data employee related disclosures on diversity, turnover, injuries, and grievances and addressing the supply chain related data gaps, were identified and adopted.

In the 2022 submission, Quantum's scored jumped to 94 on the scale of 100, remarkably higher than the financial sector average of 67% and overall all companies average of 64%. Quantum was also nominated for the "WDI Award" and for the "Contingent workforce data" award as well!

WDI Summary Scorecard

With our continued push for better reporting, transparency, and disclosures on ESG issues, , Quantum is leading by example and actively engaging with its portfolio companies. As a part of our commitment to Workforce Disclosure Initiative, Quantum's focus is on sharing its experience and expectations with the companies on increasing workforce management transparency across its direct operations and supply chains.

By offering the best standards in governance, environmental and Social, workforce equity, and transparency, Quantum wants to undoubtedly make progress toward its goal of fostering growth and boosting investors' confidence in the ESG space.