The burdens and benefits of greenflation require closer examination as the world pursues climate transition during times of inflation.

The significant increase in inflation has rekindled the debate around the costs and the benefits of addressing climate change. While inflation is the real concern, “GREENFLATION”- price increases emanating from cost-push inflation and the green transition, is touted to be the number one enemy. Ironically, it seems that the battle to cool down the planet is heating up the economy. Many were quick to establish a potential interconnection between inflation and the climate change actions, it seems to be the fossil fuel industry's spin on high energy prices.

In March this year, Isabel Schnabel, member of the ECB's Executive Board, proposed a new structure that distinguishes between three entangled sources of climate-related inflation:

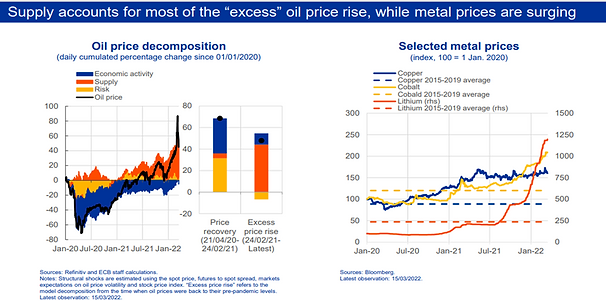

- Fossilflation: Increased inflation caused by a disorderly transition away from fossil fuels: a decrease in fossil fuel supplies (due to reduced investments) unmatched by efforts on demand accentuated by carbon taxes and prices.

- Climateflation: Physical disruptions caused by climate change such as extreme weather events - evident in sectors like agriculture, fisheries, forestry, energy and tourism.

- Greenflation: Inflation caused by increased capital investment in green energy and low carbon technologies - leading to increased demand of critical material like lithium, cobalt, nickel, graphite and manganese causing prices to increase.

These three climate-related phenomena are of different nature, but all have the same consequence: increase in prices. These phenomena are grouped under the misnamed “greenflation”. Broadly speaking, greenflation is real but we should not oversimplify the ongoing reality by using the green transition as a scapegoat for all the pains associated with a broad acceleration of inflation.

Coming to climateflation, Climate change has caused regionally different, but mostly negative, impacts on agriculture, production and marketability of products. Climate change has also led to physical destruction and disruption leading to real losses of property, goods and operations of companies. Climateflation or costs associated with climate change seem inevitable and to reduce its impact, fossilflation and greenflation are necessary.

Fossil fuel inflation of today is as much led by supply disruptions and demand increases as opposed to a result of underinvestments driving the supply crunch. The Covid led supply disruptions, policy making led monetary inflation and the Ukriane war have all led to the imbalance resulting in increase in prices. None of these relate to greenflation.

Source: ECB

However, we will see the effects of fossil fuel related inflation pushing for more investments in less carbon intensive technologies for heating, industries, transportation and electricity. According to International Energy Agency data, the world has dramatically reduced its investment in oil and gas production over the past few years. Climate change is not solely to blame as it is evident that investors are nervous about long-term fossil-fuel demand in a decarbonizing world, and much of the hold back stems from the sectors performance over the past decade. Reduction of fossil fuel dependency would both serve the fight against climate change and against inflation while increasing countries' strategic independence from the shackles of the oil cartels.

Addressing Greenflation

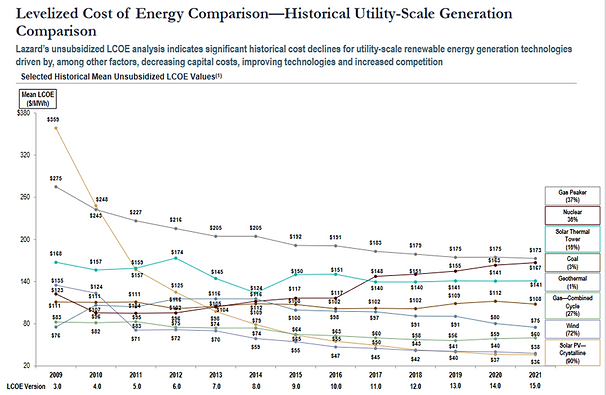

The real way to address greenflation is more greenflation. Higher green investments have led to greenflation and more of that would potentially lead to green-deflation. For more than ten years the clean energy sector has been relentlessly striving to prove its viability and driving costs down, equipment for renewables plant is as much as 10 times cheaper now. Costs of lithium-ion batteries for example, were pushed down last decade thanks to economies of scale and the learning curve.

Many companies are adapting their production processes in an effort to reduce carbon emissions. But most green technologies require significant amounts of metals and minerals, such as copper, lithium and cobalt, especially during the transition period. Electric vehicles, for example, use over six times more minerals than their conventional counterparts. An offshore wind plant requires over seven times the amount of copper compared with a gas-fired plant. No matter which path to decarbonisation we will ultimately follow, green technologies will drive a significant increase in demand for many of these supply constrained metals and minerals in a status quo scenario.

However, as newer technologies develop, innovation would drive down the usage or substitute with commodities that are abundantly available leading to a significant leap in large scale availability at a lower cost. As adoption increases meaningfully, investments and innovation will drive the viability of green technologies.

According to Lazard, the average cost per megawatt hour of solar electricity in United States is $36 and wind is $38. Even before the recent spike in fossil fuel prices, the equivalent cost of energy from coal was $108 and gas was $60. Over the last decade, the solar and Wind generation costs have fallen by 90% and 60% respectively. With technological innovation, learnings translating to experience curves, substitution and efficiency will all drive prices towards affordability. A group of academics at Oxford University have modelled likely future prices of solar on a probability distribution curve, and their central forecast is that they will reach around $10 per MWh by 2050. Moreover, they note that the faster we deploy renewables, the quicker the costs will fall.

We are aware of the darker side of clean technologies. Amongst others, we are bothered about the blind rush towards solar without thinking about the repercussions to dispose the solar modules at the end of life on account of non recyclability. According to the IEA, by 2030, the cumulative value of recoverable raw materials from end-of-life panels globally will be about $450 million, which is equivalent to the cost of raw materials currently needed to produce about 60 million new panels.

The ingenuity of the thrust has made possible to recycle most of the elements of the module to be reused again in panels or be used elsewhere. There are already firms in Europe who claim to have mastered the art to recycle the solar modules using a chemical process. It is estimated that about 8 million metric tons of decommissioned solar panels could accumulate by 2030. Such scale is an opportunity to drive innovation. We are banking on human innovation to derive the expected outcomes as industry achieves scale.

Greenflation is without a shadow of a doubt worth the cost for decarbonization and a net-zero future. It's a premium you pay to protect against climate adversaries.