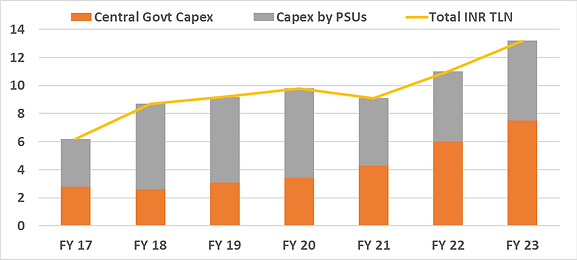

The government has stuck to its priority to boost growth over fiscal consolidation. In the Union Budget announcement made on February 1st, 2022, the increase in the Capital Expenditure spending from INR 5.5 trillion budgeted for Fy 22 to INR 7.5 trillion for FY 23 is substantial (see Chart 1).

If the central, the state governments and the Public Sector companies can implement and spend those amounts in a timely and efficient manner, it could lead to a multiplier effect in the economy. This should enable the continued economic recovery and sustain the economic growth over the next 2-3 years.

Chart 1: Government steps up on Capital expenditure

(Source: indiabudget.gov.in; Quantum Analysis), FY 23- budget estimates, FY22- revised estimates)

We had noted earlier that there are several tailwinds to the Indian economy and we may be on the cusp of a sustained economic revival :

- Government focus on reviving growth with higher spending

- Improvement in India Inc balance sheets with lower debt and higher profits

- Banks have lower NPAs and higher capital adequacy and are better positioned to lend

- Indian exports have surged on the back of global growth, which can spur corporate capex activity

- Residential real estate activity, which has a large multiplier, is witnessing a positive turnaround

Availability of capital flows across FDI, FPI, Private equity and venture capital, real estate and infrastructure as global investors allocate away from China .

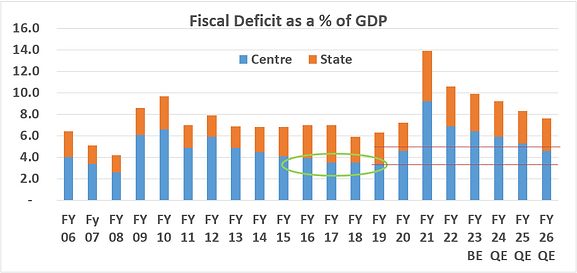

The economy crippled by the pandemic and hampered by the pre-pandemic growth level, forced the government to shed its fiscal conservatism . The government set out a long path and committed to bring the fiscal deficit below 4.5% of GDP only by Fiscal year 2026. For FY 22 (March 2022), the fiscal deficit is estimated at 6.9% of GDP. In FY 23, the fiscal deficit will be cut only by 0.5% to 6.4% of GDP. On a growing nominal GDP, this slow pace of fiscal consolidation provides the government enough spending power.

Chart 2: PM Modi sheds his fiscal conservatism

(Source: CMIE Economic Outlook; BE= budget estimates, QE= Quantum Estimates)

As chart 1 above showed, the government has also increased its spending on capital expenditure – building roads, investing in power, enhancing and improving the railway network, boosting education and health infrastructure, investing in water and sanitation etc..

This increase in government capex spending, across sectors, should be able to revive private capex activity. IN the absence of investment activity by corporates and households, it is imperative that the government spend and revive the investment sentiment. We would hope that supported by the increase in exports, the government capex spending will help increase private investment.

We have seen from before that a period of investments and growth does lead to broad based corporate earnings growth. This budget is supportive of that trend.This bodes well for Indian equities over the medium term.

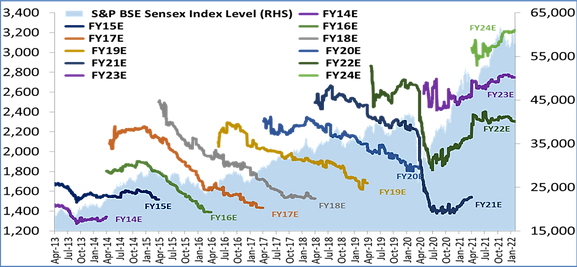

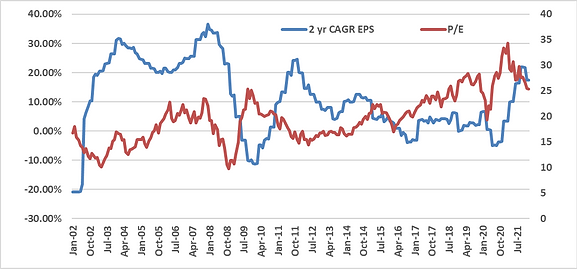

Multi-year strong earnings cycle

If the tailwinds that we highlighted above play out and we are indeed in the 2003-2007 global growth cycle, then Indian equities and Indian corporate earnings have a long way to go. For the first time in over 5 years, we are seeing consensus earnings estimates being upgraded (see lines for FY22/FY23 on chart 3). Since 2014, as the nominal GDP growth slowed down, we would see analysts cut their year end EPS targets. For about 4 years, the BSE-30 sensex earnings was flat. However, in 2020 and 2021, companies are beating sell-side estimates making them upgrade their estimates. The optimism is extending into 2023/24 with a ~ 18% increase in projected earnings.

Chart 3 and 4: Indian Corporates may be entering a strong earnings cycle

(Source: Bloomberg finance L.P for BSE-30 Sensex, EPS and P/E; chart 4 – trailing eps and p/e ; data till January 2022)

We last saw this trend in 2003-2007 period, where companies buoyed by global and domestic demand were reporting strong earnings and consistently beating estimates.

This quality and high earnings growth is also what allows Indian indices a reasonable over-valuation in the EM and BRIC space on a relative basis.

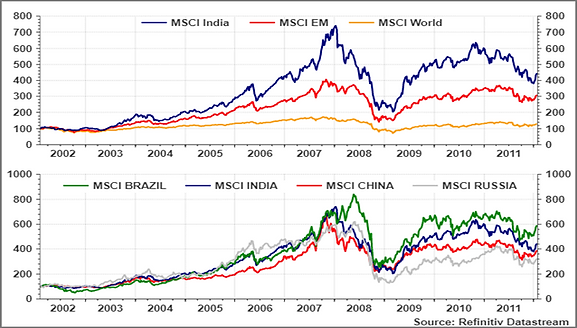

Even in the 2003-2007 period which was a strong period for commodity producer countries, India posted strong performance against many other emerging markets.(see chart 5)

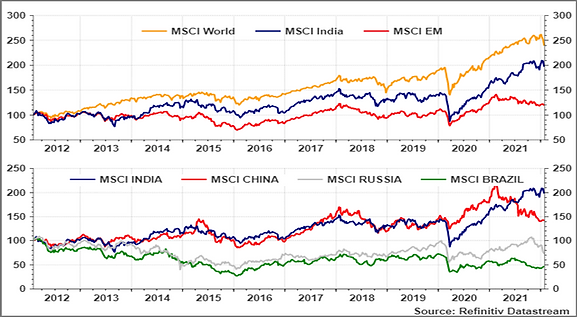

Despite the growth slowdown in the ensuing period, globally and in India, India maintained its outperformance over EM and BRIC. (See chart 6)

Chart 5: India against EM and BRIC – Jan 2002 to Jan 2012

Chart 6: India against EM and BRIC – Jan 2012 to Jan 2022

Indian equities and the economy faces two near term risks:

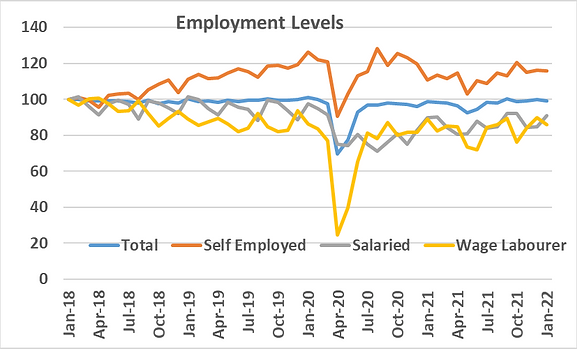

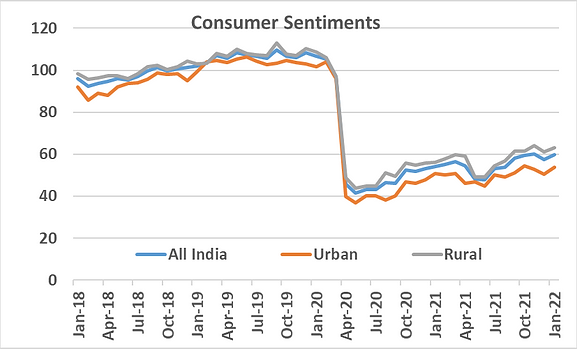

a) lower demand due to loss of jobs, income and livelihoods in the pandemic = policy options available

b) global oil and commodity prices and its impact on current account deficit, fiscal deficit and inflation.

The major disappointment from the government for us continued to remain on the governments’ focus on boosting supply side over demand. We would have loved to see some balance between boosting industry and supporting individuals. We do recognise that higher investment growth will trickle down over time, however there should have been some immediate relief to the economic segments which were impacted by the pandemic.

Think of the sacrifices the Indian consumer has made over the last 2 years. Lost livelihoods, lower incomes, health costs, higher oil and food prices, higher taxes on income and GST. The governments response in terms of some continued income support or a lower tax burden has been missing.

Chart 7 and 8: India needs a Jobs, Income and Sentiment boost

(Source: CMIE Economic Outlook, employment levels are rebased to 100 in January 2018)

The economy faces some short term risks from a higher global and domestic inflation. In this respect, the governments continued increase in import duties to boost domestic manufacturing in the back of improving growth, will lead to a higher cost pressures in the economy. We would have liked to see the government take some measures to manage future cost pressures with duty cuts.

The growing gap between the formal and informal economy, the consumer and the corporate thus seems to be widening. This is good for listed equities but bad for consumption, bad for the overall structure of the economy and bad for the prospect of continued recovery.

The FED and the FISCAL problem for Bond Market

The priority towards growth means that the bond markets will see a slower fiscal consolidation and will have to face a very high level of borrowing both from centre and states. In the 2021 budget announcement, the government announced its intention to prioritise growth and move away from fiscal conservatism.

The RBI thus also does no longer needs to take on the mantle of supporting growth. The RBI should prioritize managing inflation over growth and should begin hiking its policy rates. We would expect atleast 100 bps increase in the repo rate from the current level of 4% in FY 23.

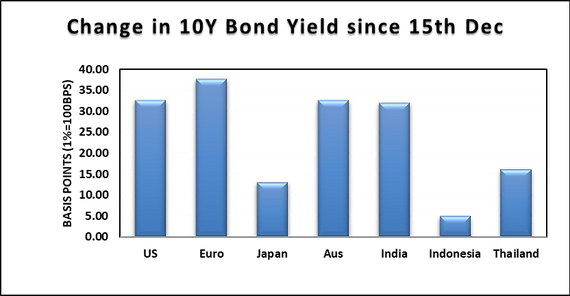

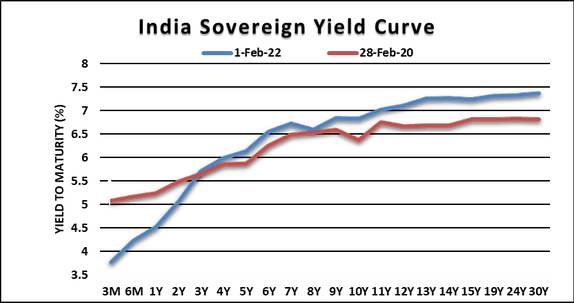

In this backdrop of higher global oil prices, a hawkish US FED and the pressure on the RBI to tighten monetary policy, this higher borrowing will see bond yields rising. Across the medium to longer tenor of the yield curve, over the course of the year, we will expect bond yields to rise by 20-30 bps for now and maybe by more later in the year.

This will be a tough year for medium to longer tenor bonds. It will though be a good year for money markets and short term fixed income as rate hikes will improve returns.

Chart 9 and 10: The FED and the Fiscal spook Indian bond markets

(Source: Bloomberg finance L.P and Refinitiv ; data till 1 February 2022)

The lack of any announcement on the global bond index inclusion or any tax changes to facilitate that was also a disappointment. The bond markets clearly need an external demand source to be able to clear the supply without a major spike in yields. The announcement of issuing a Sovereign Green Bond is interesting. If done through an overseas Masala bond (INR denominated) structure, we would expect it to receive good demand from the ever growing appetite for green and sustainable instruments from institutional investors.

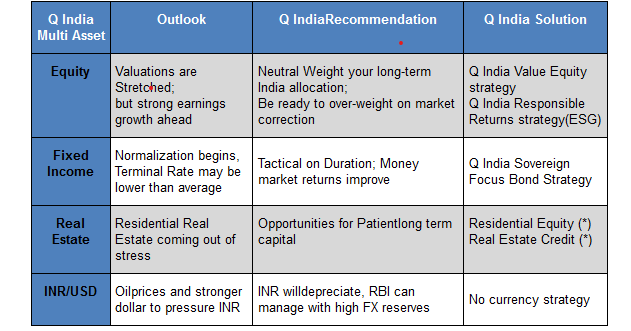

Table 2: Q India Multi Asset Summary

(* - Real Estate is offered by Quantum’s affiliate Primary Real Estate Advisors)

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

Important Disclosures & Disclaimers:

- Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training.

- This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fees, and investment strategies of QAPL.

- This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investment risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 01/02/2022 unless otherwise stated.

- All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition, or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should,” “can,” “may,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume,” “target,” “targeted,” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law.

UK related important disclosures

• The content of this newsletter has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

• The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.