By avoiding companies failing our strict Integrity Screen, we manage to navigate the risks of investing in India and enhance sustainable long-term returns. Keeping governance and transparency as priorities has proven crucial, even as some high-flying stocks periodically try to test our resolve.

In 1996, stung by experience, we initiated what we called the ‘Integrity Screen’ as a filter for our investments.

A conscious decision to avoid investing in companies with suspect corporate governance. No matter how large they were. No matter what products and services they built. No matter how much weight they had in the index. No matter how much important they were.

We called it “shake the hands and count your fingers back” – a test of treatment of minority shareholders.

If they did not pass this test, we will avoid investing in those names.

If they did not pass this test, we will avoid investing in those names.

However, Investors, especially foreign investors, increase their risk profile when they invest in Indian equities.

This risk then is not just standard deviation. The risks do not always get captured by a mathematical or a statistical number.

Quantum’s research and investment process is built on the principles of avoiding and managing three inherent risks in India : a) Liquidity – not only of the underlying for entry and exit; but also of the scalability of the strategy; b) Governance – avoiding India’s myriad crony capitalists and managing reputation and headline risk for our investors and c) Valuation – buying India’s ‘growth’ with margin of safety

Our job as an investment management firm is to assess, manage and control that risk. Not enhance it.

In this thematic, we look at the risks from governance. And detail what we mean when we say – ‘Shake Hands and invest only with those managements where you get your five fingers back.

In a country like India, where the representatives of Indian industry are fondly referred to as “corporate honchos”, “leading industrialists”, “captains of industry”, “the face of new India”, or just plain “filthy rich” – you inherently know that you need to be very careful while investing.

With some of them, forget fingers you might lose your ‘entire arm and a leg’.

Investors who do not care about governance , reputation and headline risks, can of course ‘roll the dice’ by investing in the Indian indices and managers and brave their share of Enron, Worldcom, Yukos, Wirecards.. that exist in India.

For those who care, it might be worthwhile to understand how we think of Indian companies, their businesses and the integrity of the managements.

We Avoid or We Engage. We talk about the integrity screen and the engagements with a few examples. It shows how we have learnt and refined the integrity screen over the years and also detail some of our engagements with corporates on their behavior and treatment of minority investors. Some with success (for eg- our efforts and engagements with ICICI Bank ) and some with failure leading us to exit those companies (eg; Ranbaxy, L&T).

In this piece, we look at one another way of trying to figure out suspect managements.

We believe that market prices also tell you some stories. Stories, not only about, the businesses and the opportunity but also about the character of the management. It can also tell you how close or dependent the company is to government policy action and/or favors.

Difference in governance is visible in market valuation for instance. In some cases, the market loves a particular management style in bull markets, but when the tide turns, as Warren Buffet reminded us ‘ ….you learn who has been swimming naked’.

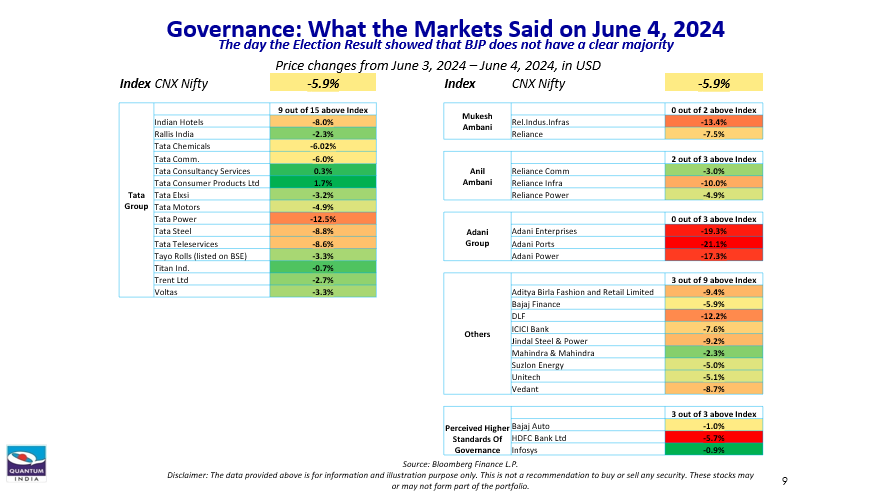

We also see a clear pattern of market reaction on key events and dates. Scroll through the slides below to see ‘Governance in Action’ – how market price movements reflects markets reading of different managements. And why sometimes it is not that hard to avoid suspect managements.

What is hard is to have the courage to stay away from them and deal with likely periodic underperformances that you suffer.

This is why it is important to build these kinds of ‘integrity screen’ into the investment process as a rule and not as an exception.

We use 8 event dates to show how select stocks responded to the events.

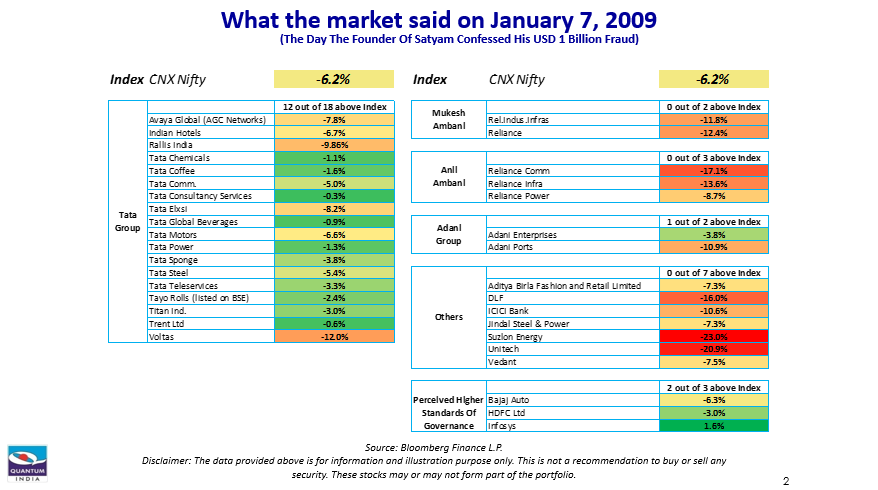

- January 7, 2009 – The day the Satyam Computers Founder wrote to the stock exchanges admitting the fraud stating, “it was like riding a tiger not knowing how to get off without being eaten” – markets were sort of telling us, who they think is the next Satyam

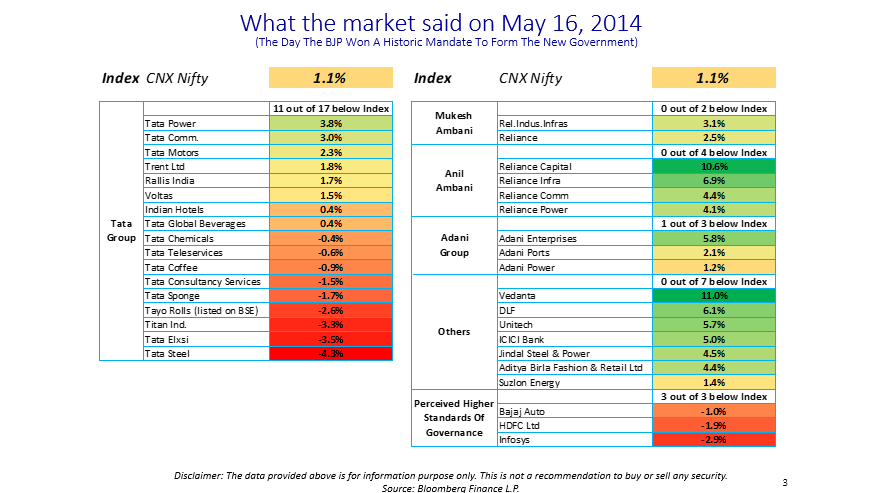

- May 16, 2014 – the Day BJP and Modi won the general elections – market perceived him to be ‘pro-capitalists’ and stocks of crony capitalists did well

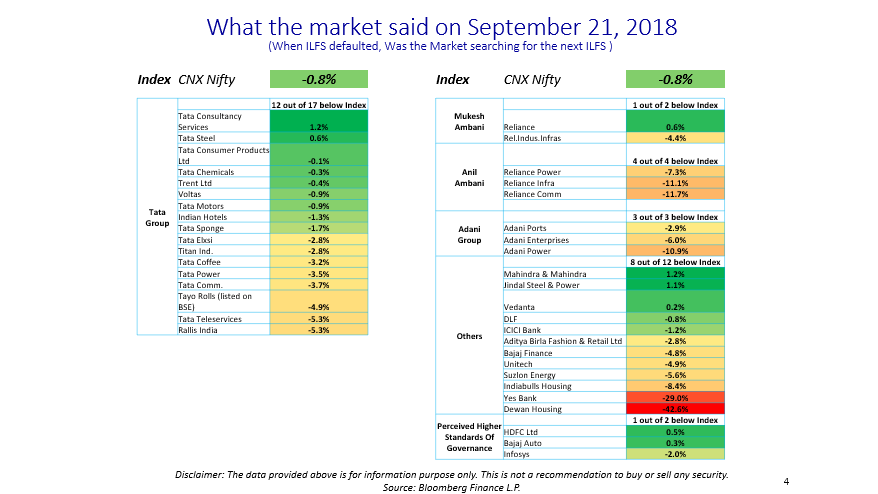

- September 21, 2018 – The day when ILFS defaulted and market price response suggested they were questioning the balance sheets of some other financiers

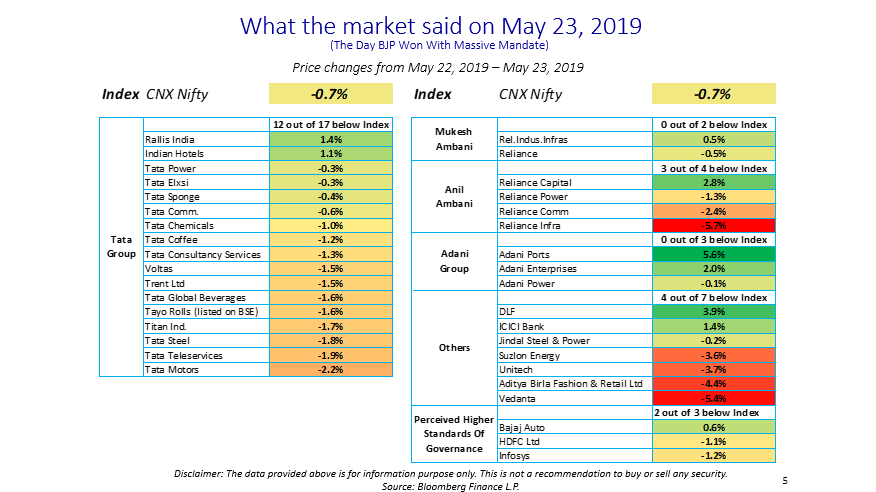

- May 23, 2019 – PM Modi re-election in 2019 – a stronger mandate.

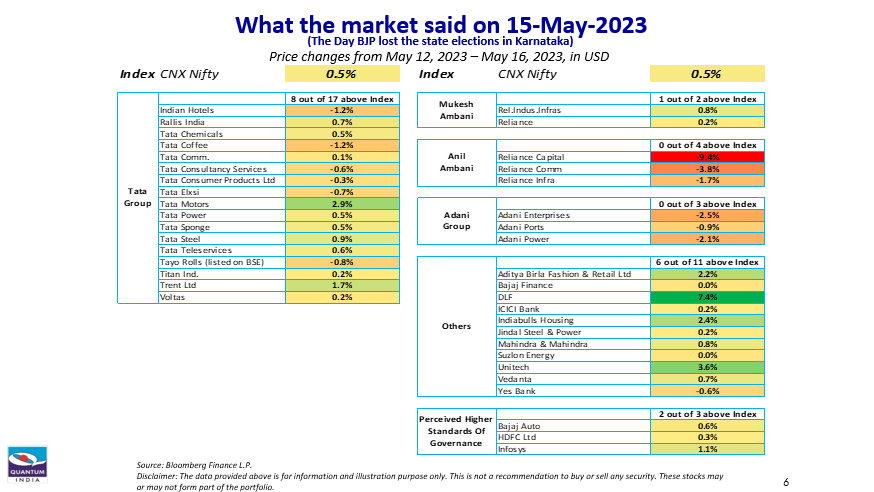

- May 2023 – Loss in Karnataka elections for the BJP – an indication that sectors and businesses linked to government policy and to the party may struggle

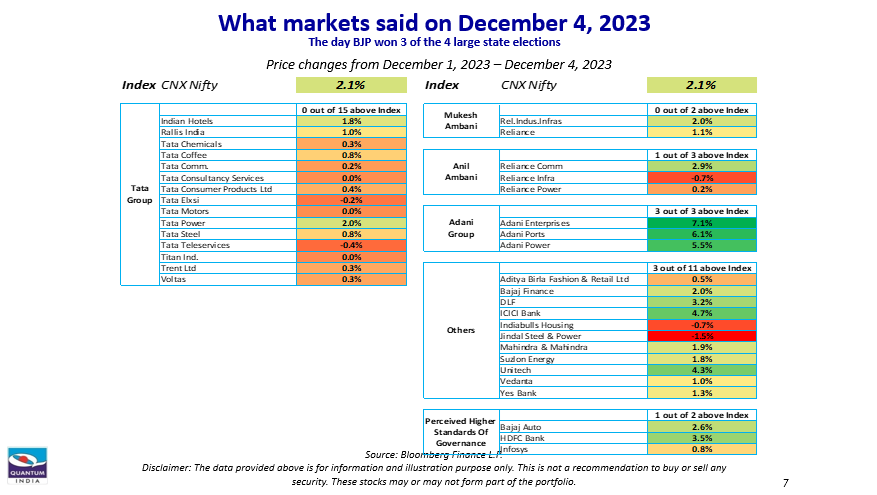

- Dec 4, 2023 – Results of recent state elections with a resounding win for BJP.

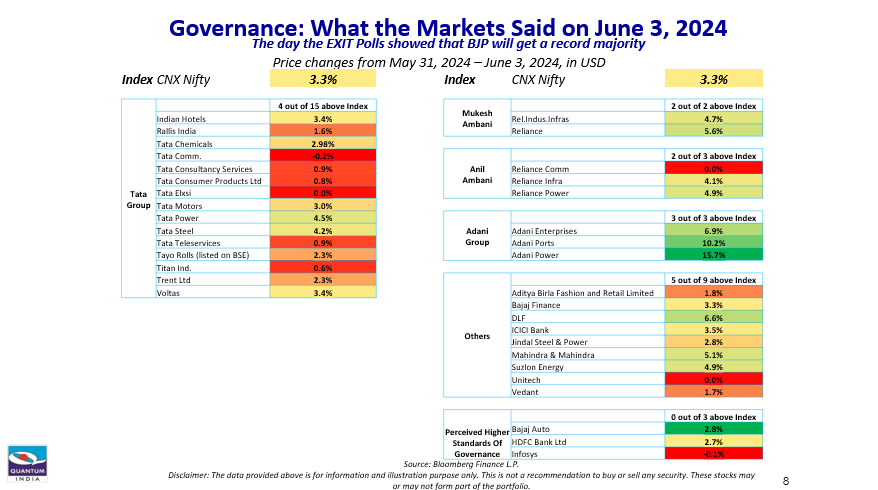

- June 3, 2024 – The day the EXIT Polls showed that BJP will get a record majority

- June 4, 2024 – The day the Election Result showed that BJP does not have a clear majority