Oil prices above $100/brl driven by war premium, a global increase in food inflation and a hawkish US FED – a scenario of a ‘perfect storm’ wherein you would have expected Indian asset markets to be under pressure.

However, Indian Equity and Currency markets have shown remarkable resilience. Indian bond yields though have followed the global rise to a large extent, but even that has been from record lows.

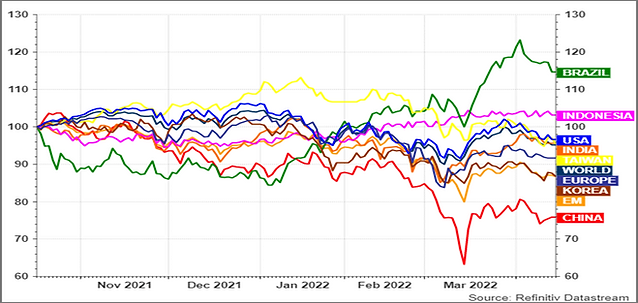

Chart 1: Indian Equities is holding out well

(Source: Refinitiv Datastream, MSCI Indices, in USD, rebased to 100 for a six month period ending 14th April 2022)

As Chart 1 shows, if we look at six month data from October 2021 till April 2022, India has performed relatively well against other markets. This period from October is important from a global context. The US Federal Reserve signaled its move away from the ‘inflation is transitory’ stance. Global Bond yields, especially in the developed world, started rising pricing in a removal of accommodation and higher policy rates.

In the last six months, we have also seen a steep rise in many commodities, both hard (metals, fossils..) and soft (food items). Most importantly, has been the rise in Oil prices. India imports more than 85% of its oil and high oil prices remain India’s biggest short term bug-bear.

This background of rising commodity prices fueling consumer inflation and a hawkish global monetary policy announcement further received a supply shock with the war in Ukraine.

As we remarked in our ‘India Non-Aligned But Not De-Coupled’ insight piece, India may have decided to not side with anyone in the conflict but the Indian economy and its markets will get impacted from global events.

We would normally associate such a period with falling equity markets, a weaker currency and higher interest rates. All that has happened, but at a much smaller scale than expected.

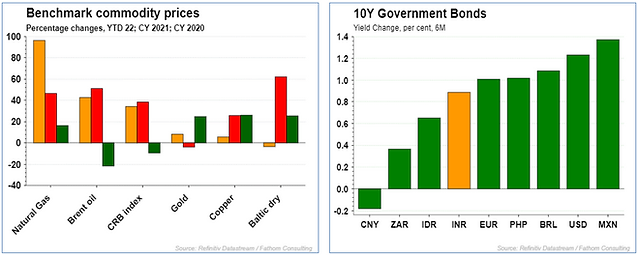

Commodity prices have been on a tear and have been so since it bottomed in 2020 post the first wave of COVID. Of course, Central Bankers have been late in reacting to the threat of inflation. Bond yields are only now reacting to the surge in inflation and increase in input prices.

Chart 2 and 3: Higher Commodity prices are forcing central bankers to tighten monetary policy

(Source: Refinitiv Data Stream; Data till 14th April 2022; Chart 2: Orange = YTD 2022; Red = CY 2021 and Green = CY 2020)

Indian Bond yields have risen substantially, almost in line with global bond markets. We would though argue that a part of the rise is the pricing in for RBI’s eventual monetary policy normalization from the current crisis level policy rates. Also, the higher fiscal deficit and the relative absence of the RBI in bond purchases, has also led to some rise in yields at the longer end.

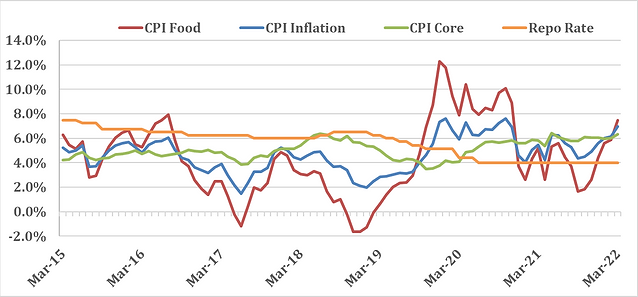

Despite, the commodity price rises, India yet does not have a run-away inflation problem. India’s Consumer Price Inflation (CPI) is only now threatening to breach and sustain above the upper limit of 6%. This has forced the RBI to pivot its focus from Growth to Inflation.

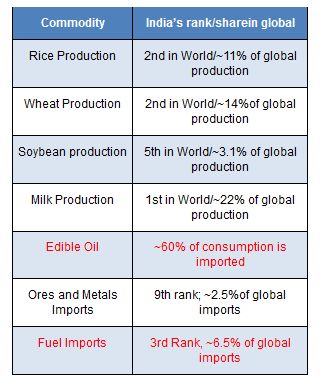

India has self sufficiency in some key agricultural commodities like staples (Rice Wheat, Millets); Sugar; Milk. In fact, India is exporting large quantities of Rice and Wheat this year. The government also has enough buffer stocks to feed the population. If India has a good monsoon this year, staple food related inflation can be managed. India will face problems on edible oil especially palm oil and the only way to manage that is by cutting import duties. (See Table 1 below).

India’s bug bear remains fuel – crude oil and Gas. These are imported and its prices keep India vulnerable to supply side inflation.

Chart 4 and Table 1: Global prices seeping through but food self sufficiency is a boon

(Source: Chart: MOSPI, Quantum Data, / Table: Refinitiv Datastream, FAO)

India’s ability to manage food prices is probably why the Central Bank has appeared complacent about the evolving prices pressures and had retained its accommodative stance. This is also a big reason as to why the market, especially the currency markets have not panicked as yet.

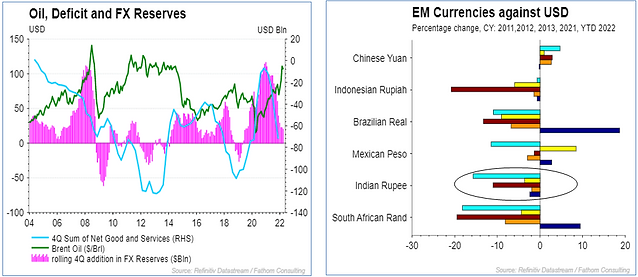

Everyone seems sure that India is not Fragile anymore. That this is unlike the 2011-2013 situation. Though, Oil prices are at similar levels and global commodity prices are showing similar impulse, the situation is unlike 2011-2013.

However, domestic demand conditions are much weaker and unlike 2008-2012, there is very little demand driven inflation. Wealth effects (apart from equity markets, private equity and ESOPs) from land, deposits and gold haven’t been all that high in recent years. The pre pandemic slowdown and post pandemic recovery has meant that labor force remains in excess and wage pressures (barring in the IT sector) are muted.

The RBI's decision to gobble up dollar inflows when the sentiments were upbeat and current account was near surplus has meant that it technically has excess foreign exchange reserves to give up and stave off any sharp depreciation.

Indian exports, of both goods and IT services, have been on a trend upswing in both value and volume terms, thus buffering the current account from the impact of high oil imports.

Chart 5 and Chart 6: Oil above $100/brl but INR not fragile anymore

(Source: Refinitiv Data Stream; Data till 14th April 2022; Chart 6: teal=Cy 2011; yellow = CY 2012; Maroon=CY 2013; Orange = CY 2021; blue =YTD 2022)

The Indian rupee has weakened more than other EM commodity exporter countries. However, the extent of depreciation is nowhere as compared to what we saw during the 2011-2013 scenario (See chart 6 above).

Times are going to get tougher for India’s external balance of payments situation. If Oil prices average above $100/brl in 2022, we would expect the current account deficit (CAD) to be much above the comfort funding level of 2.5% of GDP level. This will force the RBI to allow some more depreciation of the currency along with a reduction in its foreign exchange reserves.

If we continue to see selling by foreign investors in Indian equity and debt, the RBI might be forced to allow some depreciation to flow through. That might trigger some more selling by foreigners and RBI must be careful and guard against such self-fulfilling prophecies.

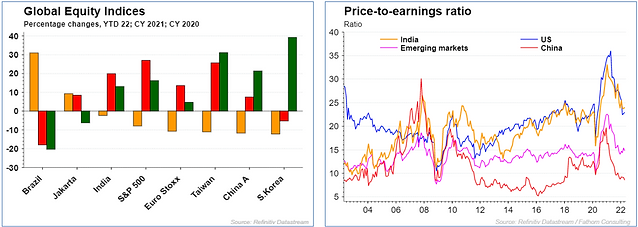

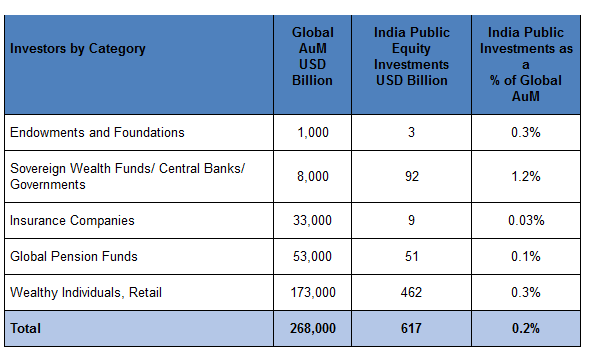

Foreigners now own ~USD 620 billion in Indian public equities as of end March 2022 (~20% of overall market capitalization). Since October 2021, they have net sold ~USD 19 billion in the secondary markets. They had invested ~USD 28 billion in the 12 month period ending September 2021. Thus, some of the recent outflows could be short-term investors who got enamored to India or increased allocation away from China and are now exiting for better relative value in other emerging markets.

Global Emerging Market (GEM) investors also tend to have an overweight position in India as compared to India’s weight in the MSCI EM Index. We are seeing some of that over-weight positions being trimmed given India’s strong return performance and its relative overvaluation.

Chart 7 and Chart 8: India’s strong performance has made it relatively over-valued

(Source: Refinitiv Data Stream; Data till 14th April 2022; Chart 7: Orange = YTD 2022; Red = CY 2021 and Green = CY 2020)

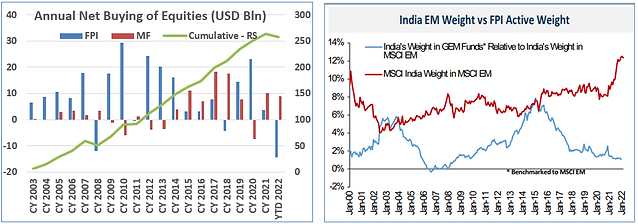

Despite the strong bout of selling by foreign investors, the Indian markets have held up well driven by domestic buying. Since 2014, driven by retail inflows, Indian mutual funds have net bought ~USD 75 billion in Indian equities as compared to ~USD 52 billion of net buying by foreign investors. This trend has reversed the earlier pattern of Indian markets gyrating to global flows. The rising domestic investing pool is growing larger with mutual funds, pension and provident funds, insurance companies all allocating higher proportion to Equities.

Chart 9 and Chart 10: Domestic Investors pile on; How much more can the foreigners sell?

(Source: NSDL, SEBI, chart 10 - Morgan Stanley Research)

The continued strength of the flows into domestic mutual funds has surprised most market participants. Domestic Mutual Funds have out invested foreigners in 5 of the last 7 years. The trend of disciplined monthly saving through the Systematic Investment Plan (SIP) has gained popularity amongst the salaried class and now on its own accounts for >USD 1.6 billion of inflows into mutual funds every month, pre-dominantly in equity funds. This trend was tested during COVID wherein it saw some outflows but now has resumed its upward trajectory. The number of mutual fund accounts has risen from 60 million to more than 80 million in the last two years. At the same time, India has seen its own ‘Robinhood revolution’ with direct securities trading accounts rising from 40 million to about 85 million.

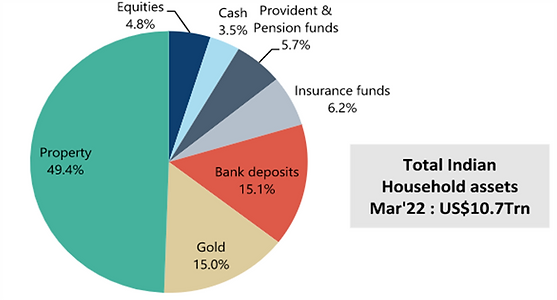

As the chart below shows, Indians are still under-invested in Equities and thus on a secular basis we should expect inflows into equities and into mutual funds to continue to rise as a share of financial savings.

Chart 11 and Table 2: Domestic and Foreign Investors are under-allocated to Indian Equities

(Source: Chart 11: Jefferies Research; Table 2: NSDL Data as of March 2022, Towers Watson, PWC, OECD, Quantum Estimates)

That doesn’t mean we would not see outflows. 1 year rolling returns on the index is falling. If markets continue to correct, 1/2 year returns may turn negative. That would test the resolve of the domestic investor to continue to invest. We also feel that as the residential property markets recover in price and sales, we may see high investors (HNIs) taking money out of equities into residential property.

Given India’s relative over-valuation, we may see some more outflows from foreign investors which can lead to a ~10% sell off in the markets. However, as chart 10 above suggests, we might not see too much selling given how low the allocations have already gone down as compared to India’s weight in the EM Index.

At Quantum, we would welcome any market correction. It will allow us to ask for more capital from our clients and we will be goading potential investors to make their allocation.

We continue to believe in the strong underlying recovery in earnings and corporate profitability. There will be near term impact on corporate earnings as companies battle rising input costs. Assuming that the war is not prolonged, we think the medium term economic outlook for India remains robust given the recovery in business activity and the strong macro economic tail winds. We believe that the Indian economy is at the cusp of a multiyear upcycle with real GDP getting back to its long term growth trend of 6% to 6.5%. Investors are hopeful that over the medium term, corporate earnings will continue to remain stronger and thus support equity markets and valuations.

The Quantum Value Equity team is taking advantage of the market fall to add on to its cyclical tilted value portfolio. As the market corrects further, the portfolio valuations which were already at a discount to the index are getting even more attractive. The potential portfolio upsides are now better than its long-term historical averages.

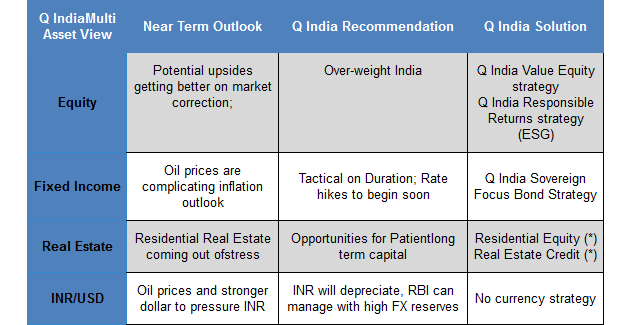

Table 3: Q India Multi Asset Summary

(* - Real Estate related products is offered by Quantum’s affiliate Primary Real Estate Advisors)

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

Important Disclosures & Disclaimers:

1. Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

2. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

3. This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 20/04/2022 unless otherwise stated.

4. All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

UK related important disclosures

• The content of this newsletter has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

• The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter

The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.