US corporations are increasingly investing in India, but their corporate pension funds have not followed suit. With over $6 trillion in assets, US corporate pensions should increase India allocations to match their CEOs' long-term bets on India's growth story.

A CNBC report from January 2024 headlines as ‘China is ‘risky’ for supply chains and India a favored destination for U.S. firms’. It was quoting from a recent survey of 500 executive level US managers done by India Index, which stated that:

61% would pick India over China if both could manufacture the same materials.

56% preferred India to serve their supply chain needs within the next five years over China

59% of the respondents found it “somewhat risky” or “very risky” to source materials from China, compared with 39% for India

A quarter of these respondents said they do not import from either China or India yet. So, one has to be wary of these survey design and questions. However, the general mood and the recent data suggest that the trend of global corporations, especially US corporations moving away from China and looking for other investment and sourcing destinations is well and truly in place.

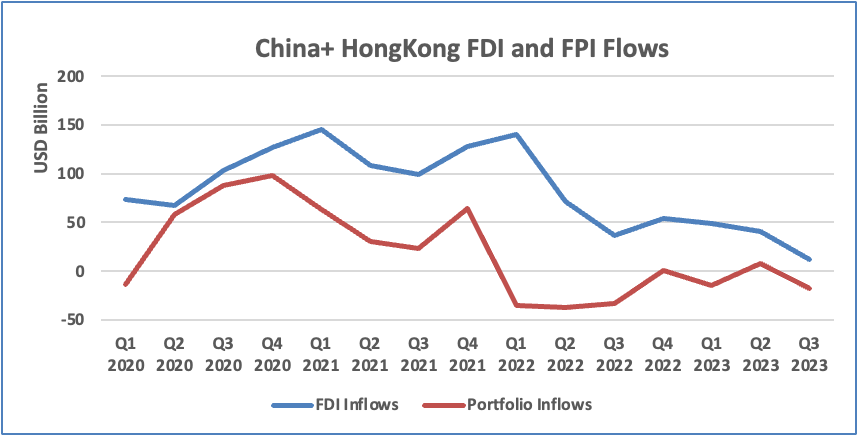

Chart 1: China falls off the global investment radar….

(Source: IMF Balance of Payments, Quantum Advisors, Data till December 2023,)

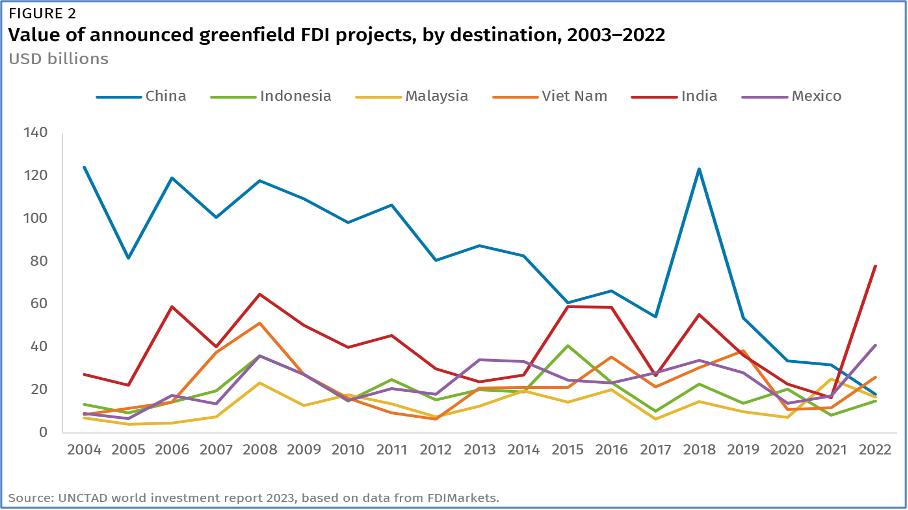

Chart 2: …and India gets the attention it deserves

Although, actual FDI Inflows into India has tapered in 2023 after the large Global PE/VC led increase of 2021/2022 but FDI intentions as seen from the above chart are visible.

As we wrote in the our insight piece, US should Embrace India, the detailed joint statement post PM Modi’s meeting with US President Joe Biden in June 2023 did raise the expectations. A 58 paragraph, detailed and meticulous layout of a comprehensive US and India strategic relationship straddling across economic, scientific, technology, diaspora and geo-politics. There were mentions of various US corporations and their intentions to invest in India and increase trade across sectors from the likes of Apple, Google, Amazon to new ones like Micron, and the usual GE, Boeing in the jet engines.

Amazon is investing in its cloud infrastructure in India. Apple has of course led the manufacturing course with recent news reports suggesting it would source ~25% of iPhones from India by 2025. In February 20243, Walmart committed to source made in India products worth USD 10 billion annually by 2027. Walmart had famously paid USD 18 billion in 2018 to buy Flipkart (e-commerce retailer). Micron, the chip manufacturer, is using the generous Indian government capital subsidy to set up a semi-conductor packaging line.

In Services, India has moved from being the application software and back office of the world to become the leading global capability center (GCC) for the world. There are about 1600 GCCs with ~USD 46 billion in export revenues. 45% of these GCCs are set up by US corporations.

Many of the large US corporations are present in India. Those who are not, have plans to enter India. We should expect an increased level of activity by US corporations and for that matter global corporations in their activity in India.

However, if we look at data on US Public and Corporate Pensions Investment activity, we do not see the same level of participation or excitement. For instance, based on P&I data, the Top 1000 US pension funds (State, University and Corporate) total to about USD 12 trillion in Assets Under Management (AuM). If I consider only US Corporate pension plans, as per our data analysis, just above 750 of them with assets of ~USD 6 trillion.

Less than 100 of these entities have a direct registration to invest in Indian markets. India requires investors who want to invest on their own account to register as Foreign Portfolio Investor (FPI). This is of course mandatory only if they invest in the public markets. Investors who invest in India through global/EM/Asia or India Dedicated funds either in public and/or private markets need not have their own license.

However, large investors, seldom invest in commingled funds. They prefer to invest directly or they offer segregated mandates to asset managers.

The top 100 US pension plans have a total AuM of ~USD 7 trillion with an average AuM of USD 70 billion. The top 100 US Corporate pension plans have a total AuM ~USD 2.7 trillion, with an average AuM of ~USD 33 billion. These are significant enough for them to offer segregated mandates.

For sure, we see many of the Top 100 US pensions do have a India FPI registration. Majority of those are by US public Pension plans and a substantial number of that is opened for their India allocation as part of a global or a Emerging Market or International mandate. We do not yet see large India dedicated allocations by these pension plans.

For US corporate Pension plans, the list is even smaller. Very few of the ~700 large US corporate pension plans have an India registration. Less than a handful would have direct investment or India dedicated mandates in public equities. They may have allocation through funds or may have investments in private equity / venture capital or real assets. However, the amounts are unlikely to be large.

This is in contrast to what the large US corporations, their CEOs and their management boards are likely to do. As we have shown, many have made direct investments in India and many are likely to come on board as they pivot away from China.

Given the large assets under management (AuM) of US public pension funds, Corporate Pension Funds, university endowments, foundations and asset management companies, we should see the India allocation to increase over time across all spheres. However, the most logical aspect would be to see corporate pension CIOs following the path of their corporate CEOs in making the long-term India bet.

Appendix:

India Public Equities is the most sensible way to participate in the long-term India story.

Foreign investors have allocated 2X more capital to India private assets like Private Equity, venture Capital, Infrastructure and Real Estate than Public Equities. Again, a large part of is driven by investments by US domiciled global Private asset managers.

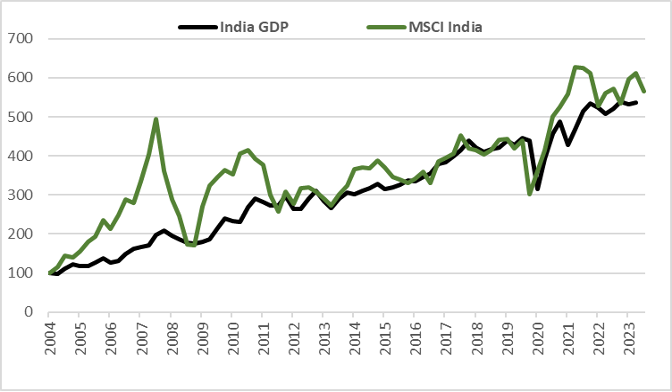

However, as this chart shows, India Public Equity is the best way to play the India long-term story.

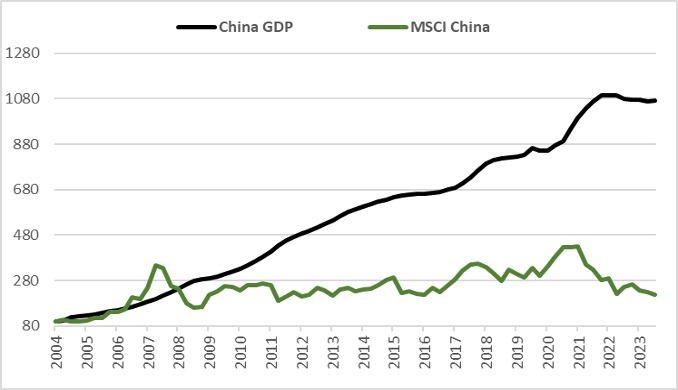

Chart 3 and 4: India GDP Growth Reflected In Equity Markets

Source: Bloomberg, All data in USD, GDP data is quarterly till Sep 2023, Index data is monthly till December 29, 2023

The table below details the nature of flow into the Indian public equity markets.

Global Fund allocations account for more than 50% of the total foreign investments

Of that a substantial portion is through passive allocations, especially given the rise in India’s weight in the MSCI EM and global Indices.

Passive is about the worst way to invest in India as Indian indices are very ‘actively’ constructed; they do not sift for governance; and the capital gains on trading leads to large tracking error of the ETF against the benchmark. Just chart on your Bloomberg, the i-shares MSCI India Index and the ETF performance

India Dedicated Fund allocations are growing but are still small in global AuM context

Investors remain constrained by their asset allocation mandates and their constraints to benchmark against global indices.

See chart 5 below on how global investors miss out on India returns by not having dedicated mandates

Global AuM of asset owners like SWFs, Pension Funds, Endowments are close to ~USD 60 trillion. Of that less than USD 200 billion is invested in Indian equities. Again, a substantial portion is invested through global allocations and not through India dedicated mandates.

In public markets (equities and fixed income), US investors are by far the largest investors in India as a reported destination. As of December 2023, of the ~USD 770 billion in market value investments in equities, US investors account for ~40% of those investments. That amount though is only USD 300 billion. Small change as compared to the overall AuM and wealth in the US.

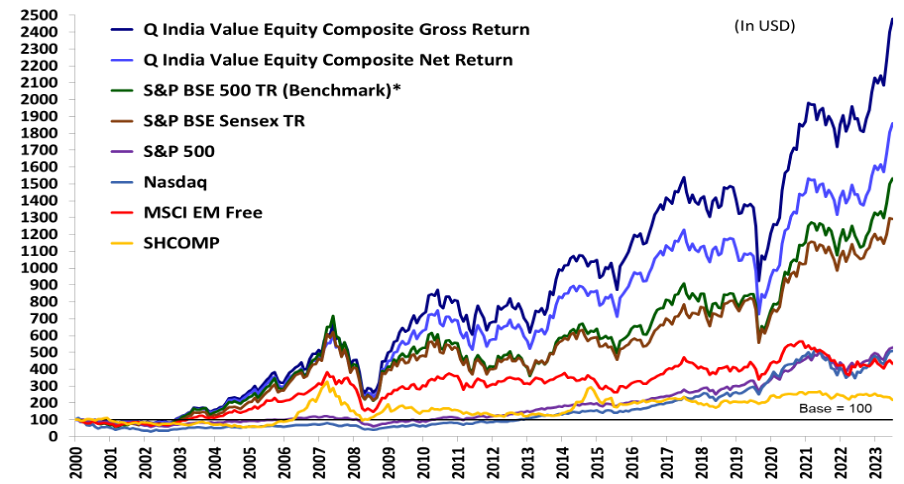

Chart 5: Global Investors are under-invested in India and are missing out on India’s stellar returns

Across 23 Years Of Mood Swings, Quantum India Returns 1.8x > S&P 500.

In 2005 – India was “BRIC” ; In 2013 India Was “Fragile Five” ; In 2015 India Was “TINA”

Since 2021 India is “China + 1”

Source: Quantum Advisors, Data as at January 2024, rebased to 100 in August 2000

The performance shown above does not guarantee future results and future performance may be lower or higher than the data quoted. Please refer Disclosure Statement for important performance related disclosures and disclaimers. The Quantum India Value Equity Composite’s (QIVEC) inception date is considered as August 01, 2000 as per our internal performance computation policy and procedures. * Effective April 1, 2023, the Benchmark for QIVEC has been changed to S&P BSE 500 TRI as prescribed by SEBI, India. Note- The return shown above are computed as per Quantum’s internal policy and procedure on performance computation. The returns of QIVEC computed in accordance with SEBI guidelines, as applicable from time to time and the computation methodology prescribed in the SEBI guidelines are given in Annexure 1 at the end of this document."

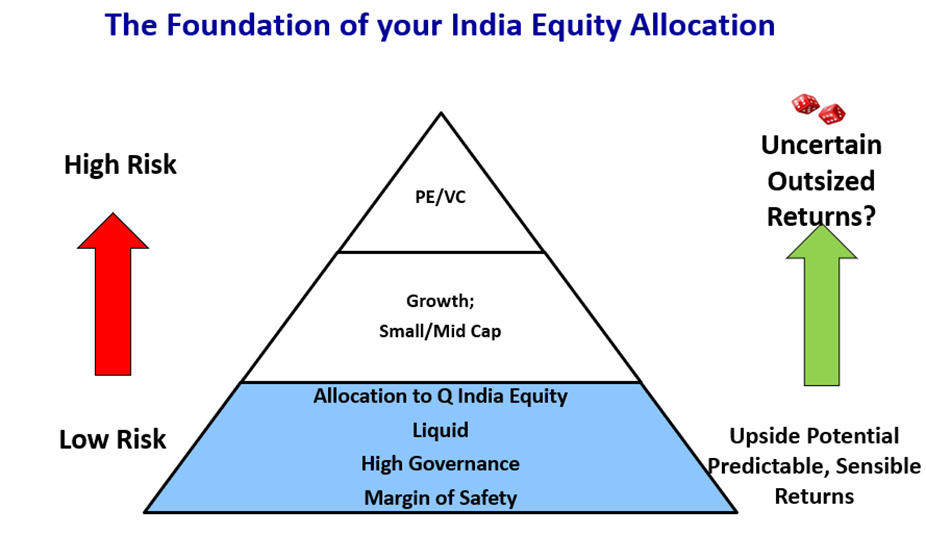

The Quantum India Value Equity Strategy has a track record going back to the year 2000. Its goal is to generate sensible returns in a liquid, scalable, high-governance portfolio, which is built with a margin of safety.

So investors who want to roll the dice and are not bothered about governance and valuations can of course buy the Indian indices and other growth managers. However, if they do care about reputation risks and the risks of valuations in India, Quantum should be their core allocation.

For more information about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Q India (UK), an affiliate of Quantum Advisors India. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 20 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.