Meet the Team: ESG Governance Strategy

Meet the Team: ESG Governance Strategy

In this interview Chirag Mehta, Senior Fund Manager (ESG & Alternatives) at Quantum Asset Management talks about his experience of managing the ESG offerings at Quantum. The interview covers the ESG research process, portfolio construction, their experience of ESG engagements with portfolio companies and the steep learning curve.

ESG Ratings – Aggregate Confusion

ESG Ratings – Aggregate Confusion

The arbitrary nature of ESG ratings is exemplified by various studies that pinpoint the low correlation in ratings from various agencies.

Our ESG Scoring Process

Our ESG Scoring Process

Our ESG research framework focuses on evaluating corporate disclosures and qualitative performance that are material to operations.

Quantum Leads the Way on ESG in India

Quantum Leads the Way on ESG in India

Backed by decades of building in-house capabilities, Quantum is at the forefront of advancing ESG principles across India.

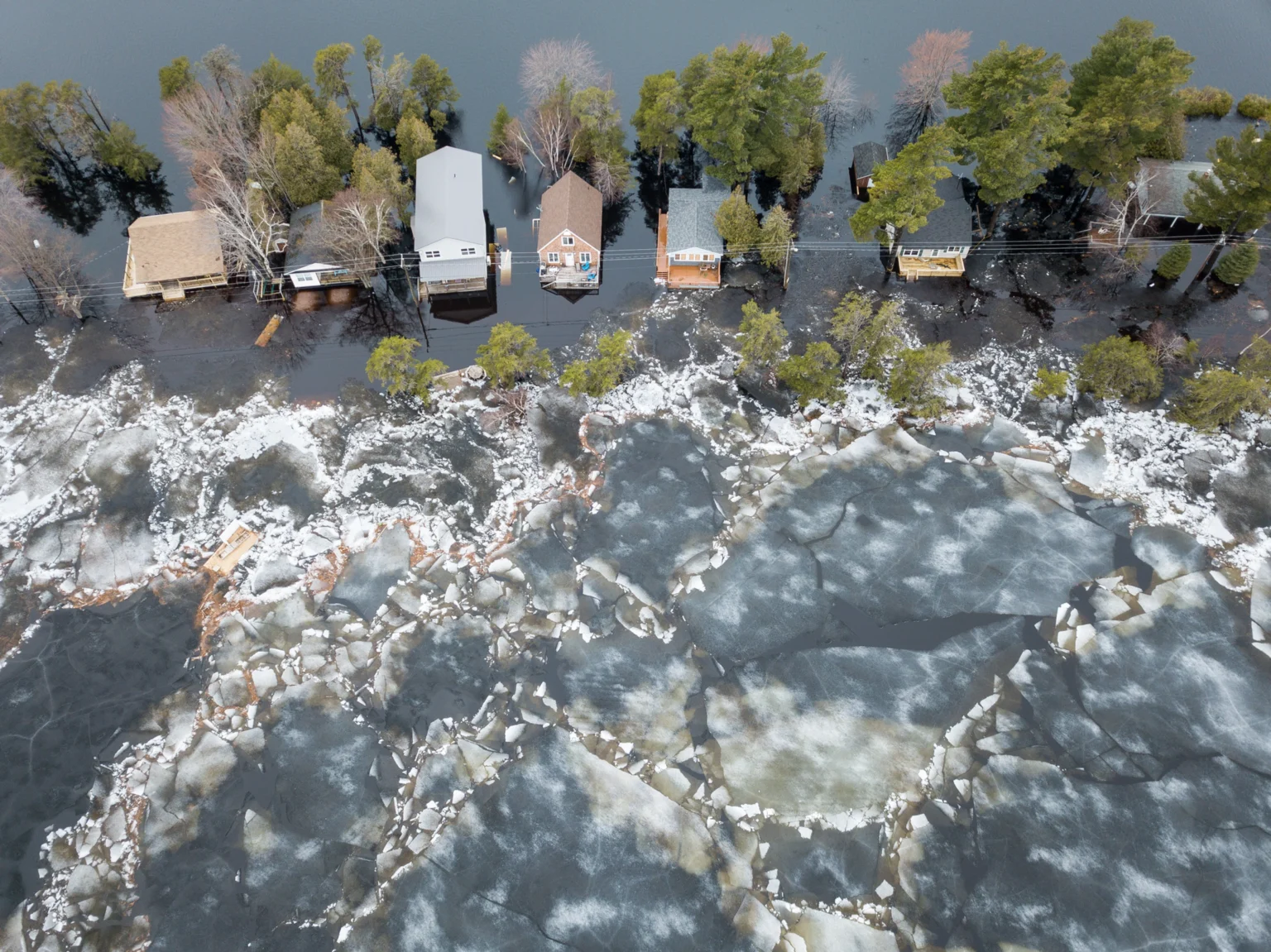

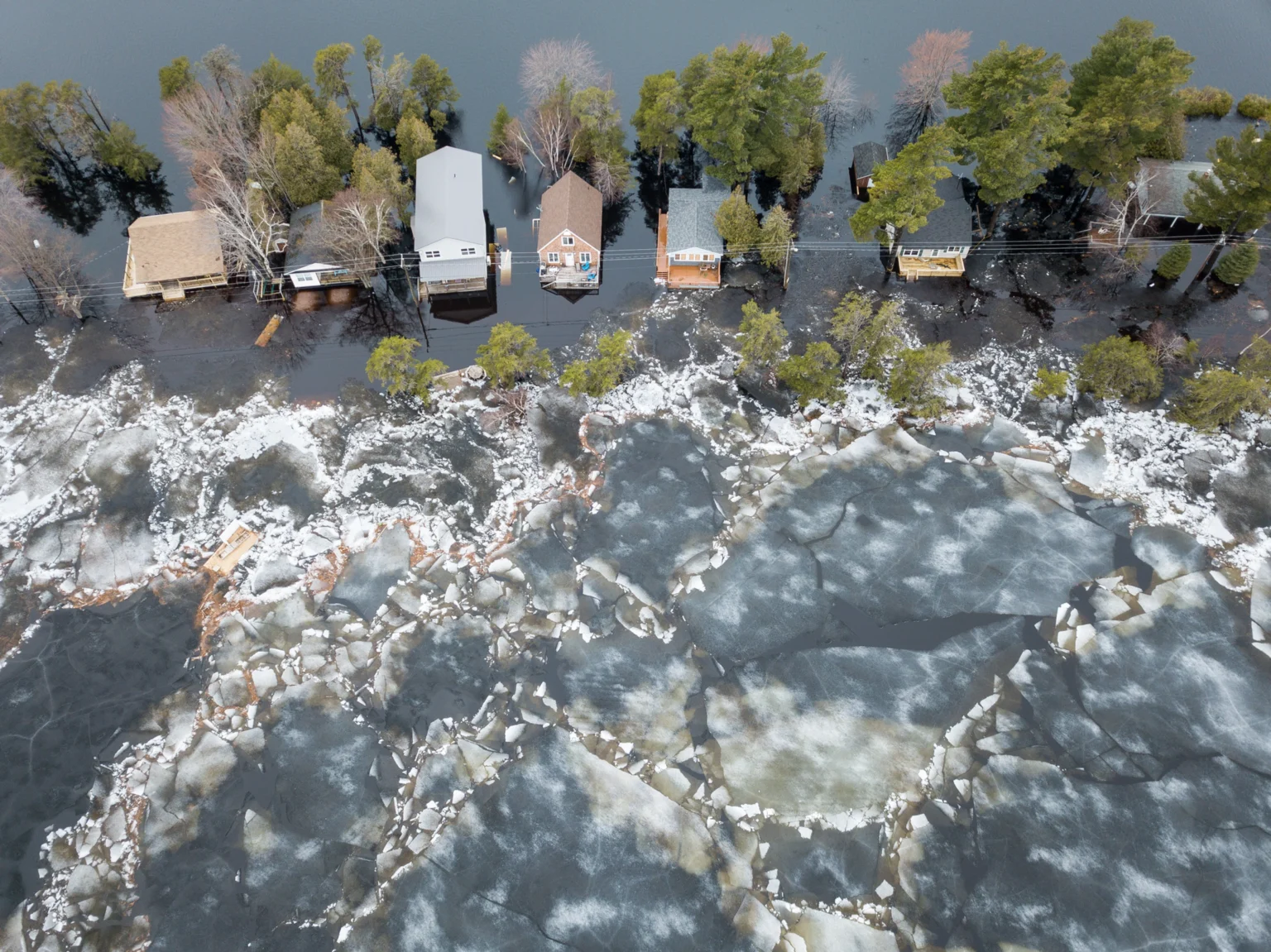

2023 - Climate Evidence Will Force a Resurgence in Sustainable Investing

2023 - Climate Evidence Will Force a Resurgence in Sustainable Investing

After a challenging year for ESG investing in 2022, marked by setbacks and declining interest, the focus now shifts to 2023. The recent...

Prof. Damodaran, see the "Value" in ESG

Prof. Damodaran, see the "Value" in ESG

Professor Aswath Damodaran suggests people working in the ESG space were either ‘useful idiots’ or ‘feckless knaves’. We argue that...

Two Blue Ticks Verify Our Sustainability Credentials

Two Blue Ticks Verify Our Sustainability Credentials

Our adherence to stringent ESG standards exemplifies our commitment to sustainability and transparent business practice.

India’s Fiscal Budget Thrust on Sustainability – Show Me The Money?

India’s Fiscal Budget Thrust on Sustainability – Show Me The Money?

We take an accounting of the sustainability linked hits and misses in this year's Fiscal Budget.

2022 – Year When ESG Aspiration Meet Implementation

2022 – Year When ESG Aspiration Meet Implementation

With pressures to make ESG reporting more meaningful, we take a look at the standards, quality and coverage to come, globally and in India.

Assessing companies for financial risk, sustainability and resilience

Assessing companies for financial risk, sustainability and resilience

Assessing companies for financial risk, sustainability and resilience to macro turbulence is key to our proprietary ESG investment process.

How Green is Green Energy?

How Green is Green Energy?

We look beyond the “clean” label in responsible investing to reveal stark choices for carbon intensity and footprint.

From ESG to EHG: Greenwashing Pitfalls in the March Towards Sustainability

From ESG to EHG: Greenwashing Pitfalls in the March Towards Sustainability

Investors navigating ESG greenwashing need to be aware of practices which we refer to as EHG: Eyewash, Hogwash, and Greenwash.

Progress on Indian Workplace Gender Diversity

Progress on Indian Workplace Gender Diversity

Workplace diversity contributes to better management outcomes. How has India progressed in female employee participation?

ESG Harnessing the Power of Equal Opportunity

ESG Harnessing the Power of Equal Opportunity

Gender diversity is crucial to profitability and value creation. As India ESG investors, we demand far better disclosures from companies.

ESG Indexes – A Stumbling Block for India Investors

ESG Indexes – A Stumbling Block for India Investors

ESG indexes are only as good as the underlying data used to construct them and are rightly under increasing investor scrutiny.